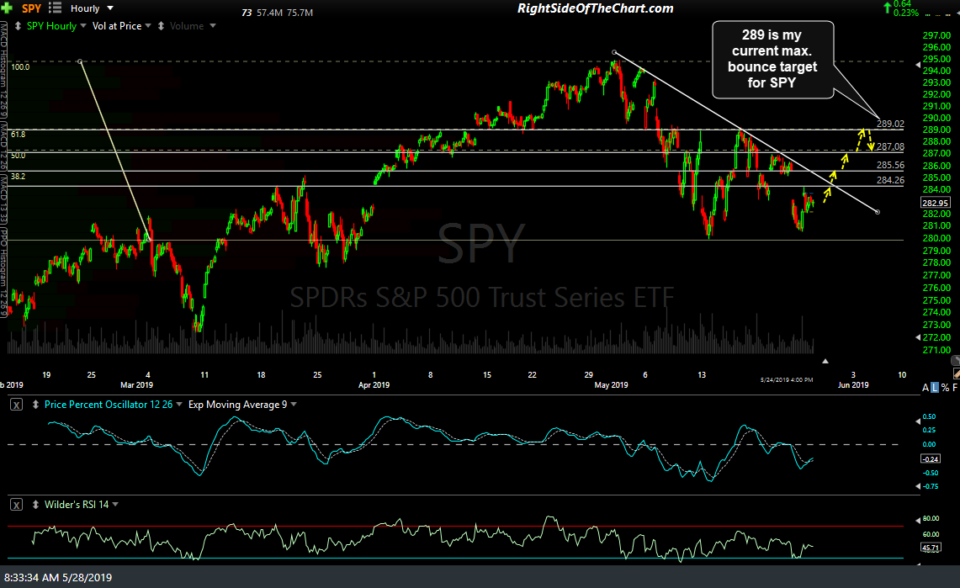

Each of the marked overhead resistance levels on the following 60-minute charts of QQQ, SPY & IWM are my potential bounce targets, with the top levels (QQQ 186, SPY 289 & IWM 156.20) my upper-most bounce targets, all of which are price resistance but also align with the key 61.8% Fibonacci retracement level on all three. (the 3 charts in a gallery format below may not appear on the subscriber-email notifications but may be viewed on the site).

- QQQ 60-min May 28th

- SPY 60-min May 28th

- IWM 60-min May 28th

My expectation is that we could be looking at a sharp rally (2-3%) kicking off today & if so, I think there is a good chance that:

- Any rally this week is likely to prove to be just a counter-trend rally with a larger downtrend with more downside in the coming weeks & possibly months

- Should my expectations for a rally this week start today, my minimum bounce targets (the levels second from the top) and quite possibly my maximum bounce targets above will likely be hit by the end of the week

- Should a bounce fail to materialize this week with the major indices impulsive taking out last week’s lows, that could open the door to another wave of selling although I would prefer to assess any break below last week’s lows as/if it happens to try and gauge whether or not that might just prove to be a final flush-out/stop-clearing move down before a tradable rally kicks off

- Should the market start to rally this week but fall shy of my minimum bounce targets (QQQ 182.32, SPY 287 & IWM 154.73) while then going on to undercut the recently lows, that would be indicative of very poor supply/demand dynamics in the market at this time & portend a much larger correction than we’ve seen so far up to this point.

Due to the fact that the major stock indexes are currently poised to open roughly flat to slightly higher with 30-minutes to go before the open today, that leaves the stock market in the same precarious technical posture that it closed at last week, just slightly above the key QQQ 178 & SPY 282ish support levels. As things could & likely will go either way once the market opens for trading today & the big institutional players step onto the field to play, I am only passing these along as unofficial trade ideas at this time.

Should the case for a tradable rally firm up this week, I have several long-side trade ideas under consideration as official trade ideas with several potential short trade candidates, should things go the other way. As of now, I’d like to see how things go in the first hour or so of trading before doing much in the way of new positioning. Stay flexible & best of luck on your trades!