Here’s an overview of the major US stock index tracking ETFs as we head into the final half-hour of trading (all shown on the 60-minute time frames).

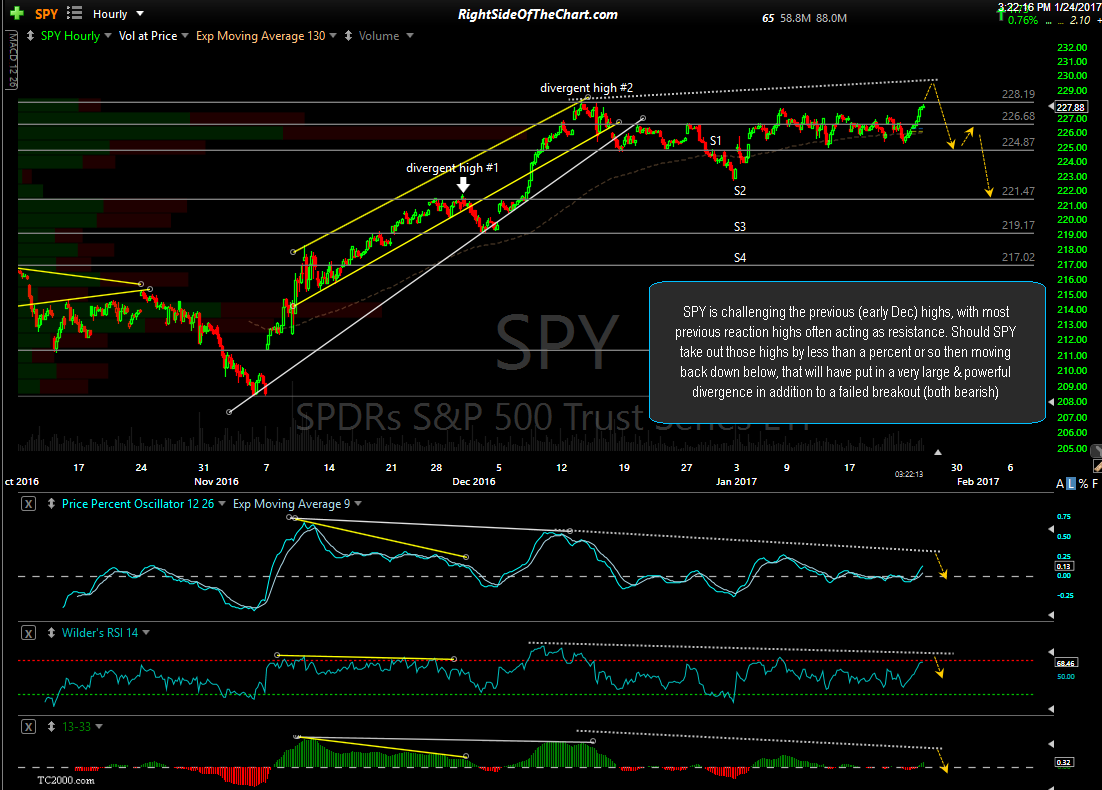

SPY (S&P 500 Tracking ETF) is challenging the previous (early Dec) highs, with most previous reaction highs often acting as resistance. Should SPY take out those highs by less than a percent or so then moving back down below, that will have put in a very large & powerful divergence in addition to a failed breakout (both bearish).

Following this very brief whipsaw breakdown below the minor uptrend line, QQQ reversed to make a marginal new, yet still divergent high. Still awaiting confirmation of the bearish divergences via a bearish crossover on the PPO as well as the 13/33-ema histogram (a trend indicator, bullish when green/above zero, bearish when red/below).