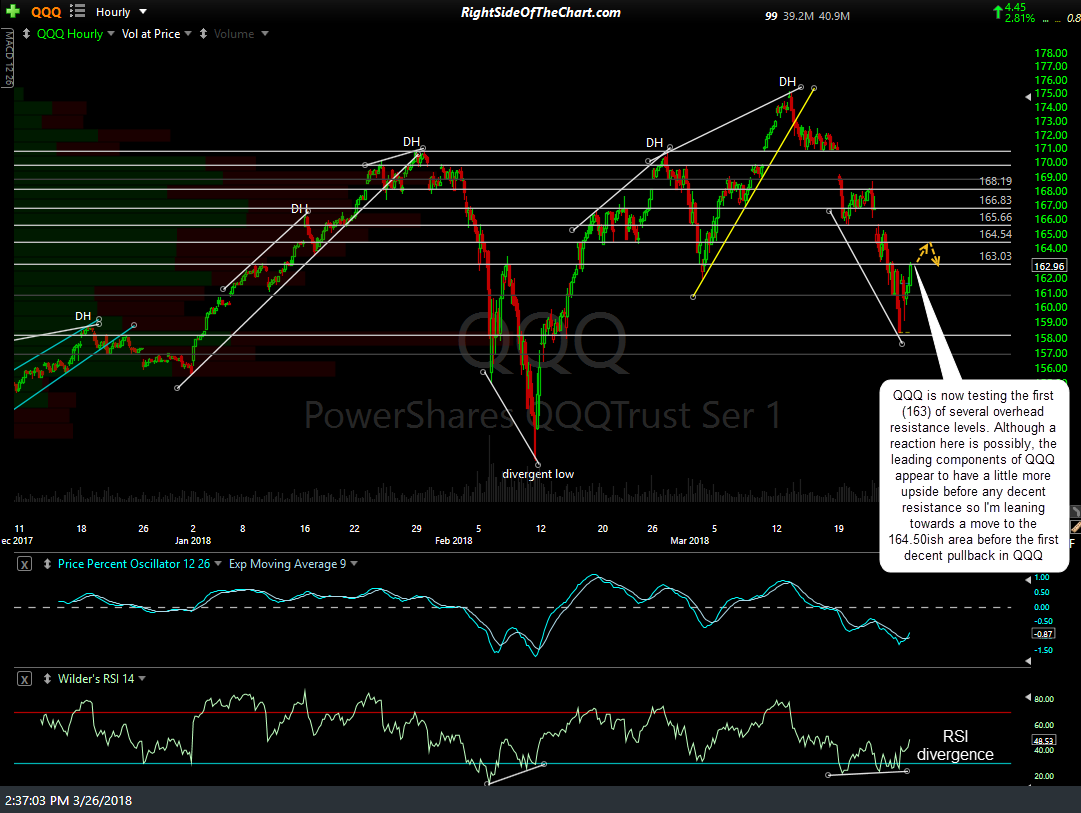

With the leading index (QQQ/Nasdaq 100) along with several key market leading stocks closing on support while near-term oversold on Friday, the resulting bounce has now taken QQQ back up to test the first (163ish area) of several overhead resistance levels. Although a reaction here is possible & at least a brief consolidation likely, the leading components of QQQ appear to have at least a little more upside before any decent resistance so I’m leaning towards a move to the 164.50ish area before the first decent pullback in QQQ.

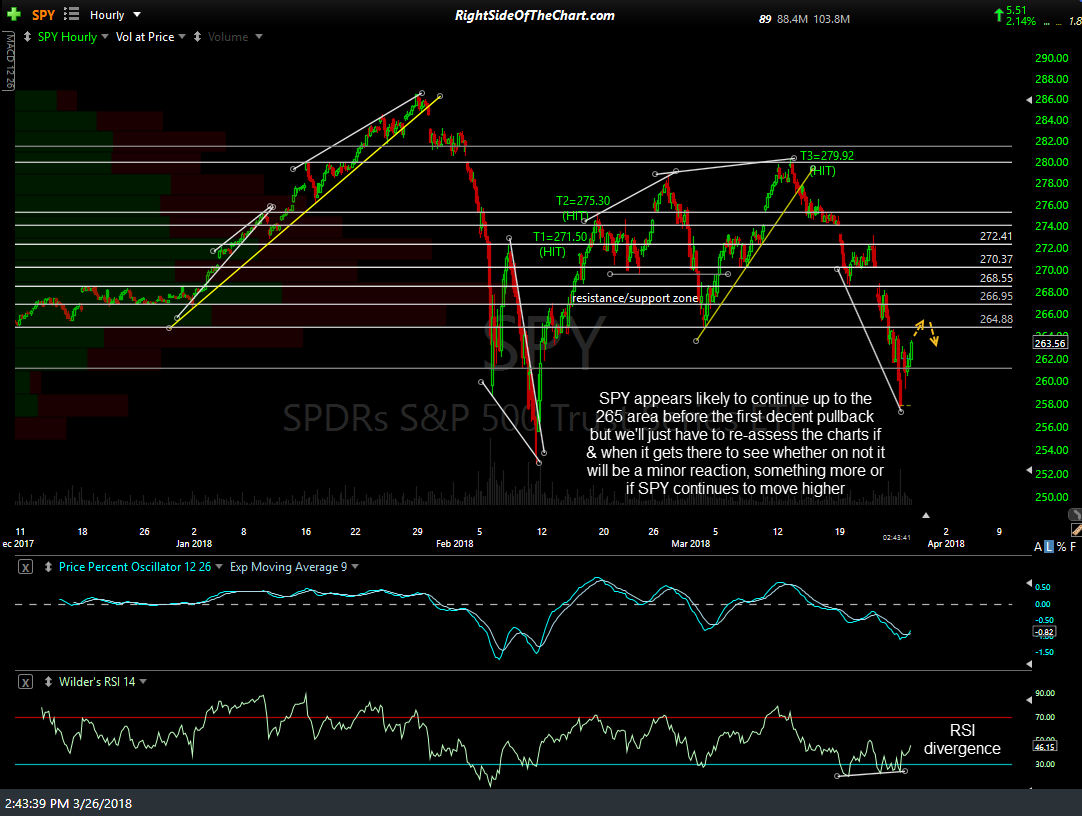

SPY also appears likely to continue up to at least the 265 area before the first decent pullback but we’ll just have to re-assess the charts if & when it gets there to see whether or not it will be a minor reaction, something more or if SPY appears likely to continue higher. If that analysis sounds a little wishy-washy, that is exactly what it is. Although I favor at least a little more upside from here, my convictions are not very high. The stock market was down sharply last week & whether we close the week above or below current levels, the odds of some fairly swift & strong rips & dips in the coming days are good. Although my very near-term bias is bullish, I beleive that it would be prudent to be extra-selective on opening new positions for now.