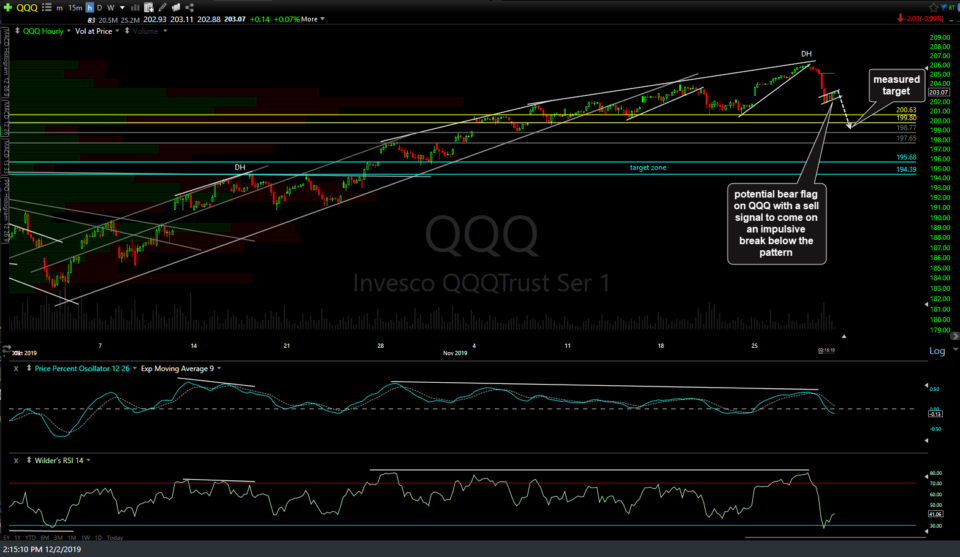

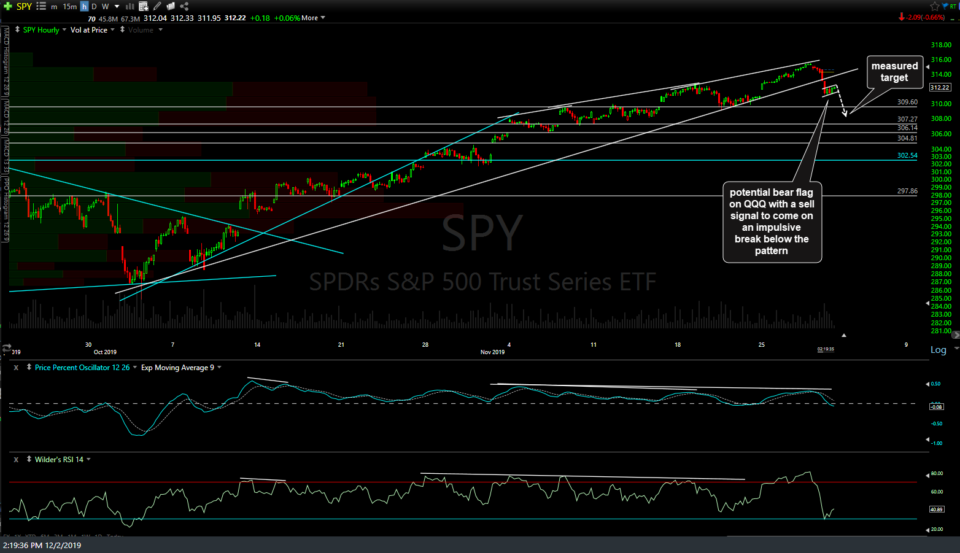

Both SPY & QQQ have drifted higher on diminishing volume following the impulsive leg down earlier today which is indicative of bear flag continuation patterns. While bear flag patterns are, as their name implies, potentially bearish chart formations & as with any technical pattern, they need to trigger a sell signal via a break down below the flag and ideally followed by impulsive selling similar to that of the flagpole or move down leading up to the flag formation.

- QQQ 60m Dec 2nd

- SPY 60m Dec 2nd

This market has had an extremely resilient bid beneath it in recent weeks which may continue as so far the dip buyers have stepped in since the lows earlier today although not very aggressively so far. Those looking to initiate or add to a short position on the index could short here with a relatively tight stop as the potential flag patterns will have been foiled if the indexes move much higher or wait for a solid break below the flags on both SPY & QQQ. The former would be a more aggressive entry with an increased chance of being stopped out for a loss (as the trend is still bullish despite today’s drop) while the latter would have a better chance of playing out albeit at a less favorable entry price (i.e.- a lower R/R vs. the first option). Those bullish & looking to buy today’s dip could do so here with a stop somewhat below today’s lows.

FWIW, my preference is a combination of the first two scenarios, shorting a half position of QQQ/NQ here & adding to the position if & only if SPY & QQQ break below the flags and/or today’s lows (depending on how any potential flag breakdowns look at the time). Should we get impulsive breaks below those flags, I will most likely let the position run for now lowering stops to entry & periodically lowering the stops tactically if/as the markets move lower.