Watching the market trade the last couple of days leading up to an FOMC meeting is like watching paint dry. So far this week, the broad market (S&P 500) has put in two candles so small you almost need a microscope to see them, moving slightly higher by a mere 1/4th of 1% so far this week. As a type this, we have exactly 24 hours to go before the FOMC rate announcement & subsequent statement is released tomorrow so I’m expecting more of the same until then.

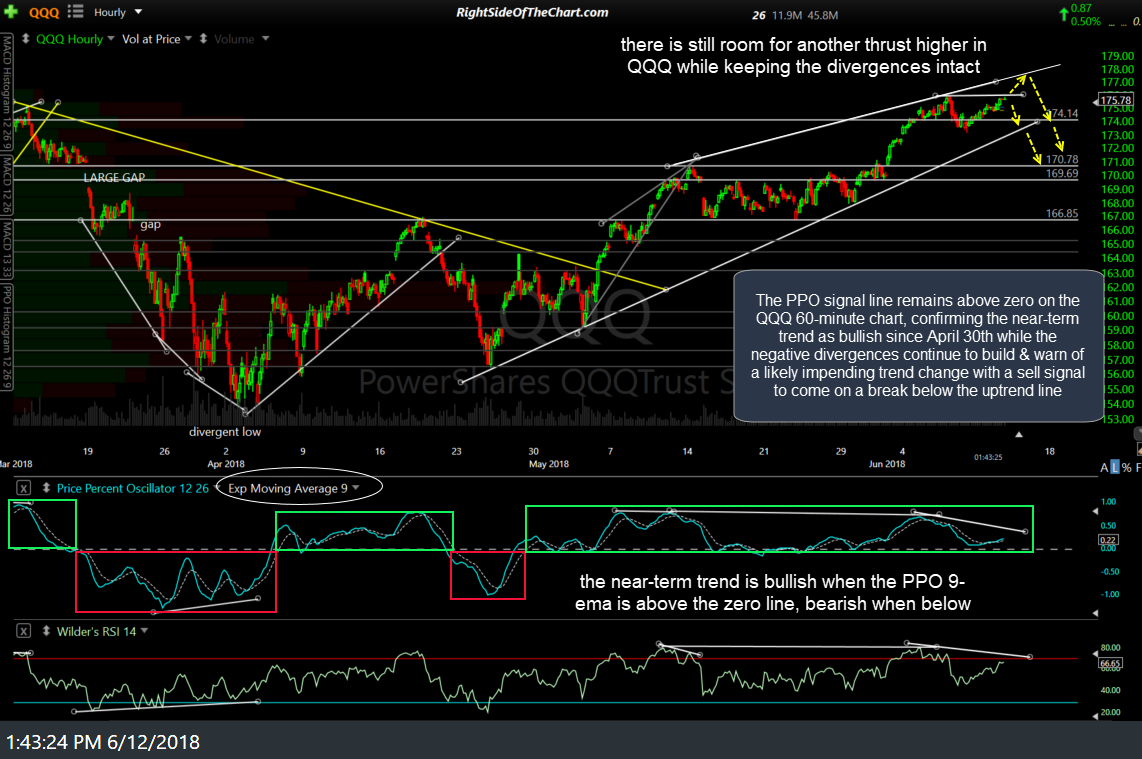

With that being said, here are the updated 60-minute charts of SPY & QQQ along with my observations. As of now, the PPO signal line remains above zero on both the SPY & QQQ 60-minute charts, confirming their near-term trends as bullish the negative divergences continue to build & warn of a likely impending trend change with a sell signal to come on a break below the uptrend line on QQQ.

SPY has crossed slightly below its respective uptrend line today but far from impulsive, plus, whipsaw signals are usually quite common during the low-volume grinds leading up to FOMC meetings.

Bottom line: Later this week we should have a better idea of whether these divergences are likely to play out for a correction or if they will be burned through, with the market moving higher in the wake of the FOMC announcement.

As I don’t plan to do any trading over the next day or so, I will only be periodically checking in on the trading room & will provide charts opinions & answer any questions at my earliest convenience.