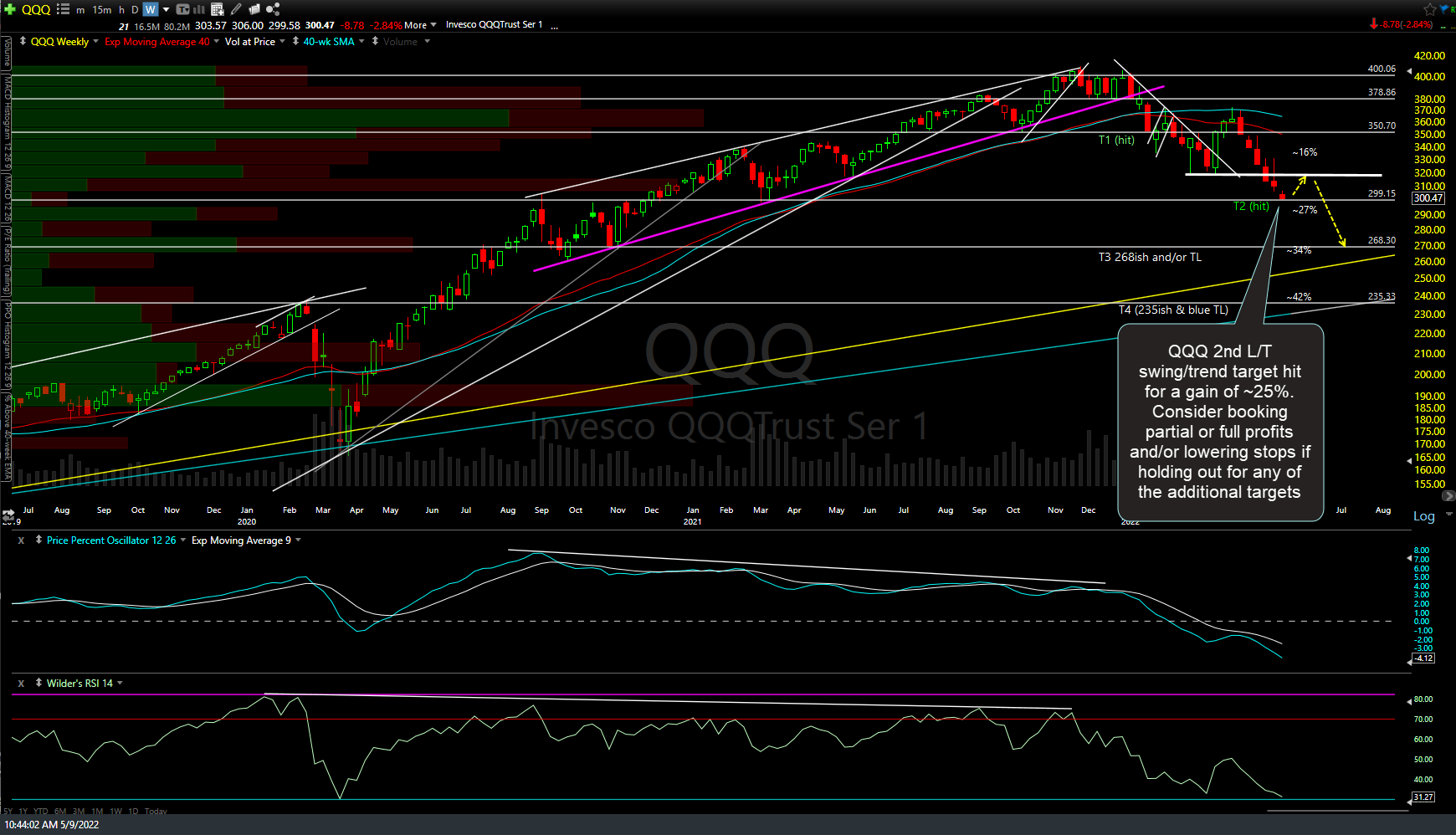

QQQ has just hit the second long-term swing/trend target of 299-300 (LOD so far 299.58) for a gain of approximately 25% from the multiple short entries posted around the all-time highs back in Nov-Dec 2021. Consider booking partial or full profits and/or lowering stops if holding out for any of the additional targets.

While I still think QQQ will go on to hit the next target(s), the odds for a reaction are always elevated upon the initial tag of each price target. As such, active traders could opt to game a tradable bounce while longer-term swing & trend traders might opt to just lower stops to protect profits & sit tight for now.

I’m a bit torn between whether or not we get a tradable bounce today or not as the positive divergences are still intact from the 5-minute charts out to the daily charts but it will be quite bearish if those divergences are taken out. As such, active/flexible traders should remain nimble & adjust positioning accordingly. The 5-minute charts of /NQ & /ES below show some downtrend lines/falling wedges that could spark a near-term rally if taken out.

Also, keep in mind that the markets are at that potential breaking point where we may very well get a waterfall or crash-type selloff. Again, stick to your trading plan but make sure to adjust/adapt if & when the charts indicate.