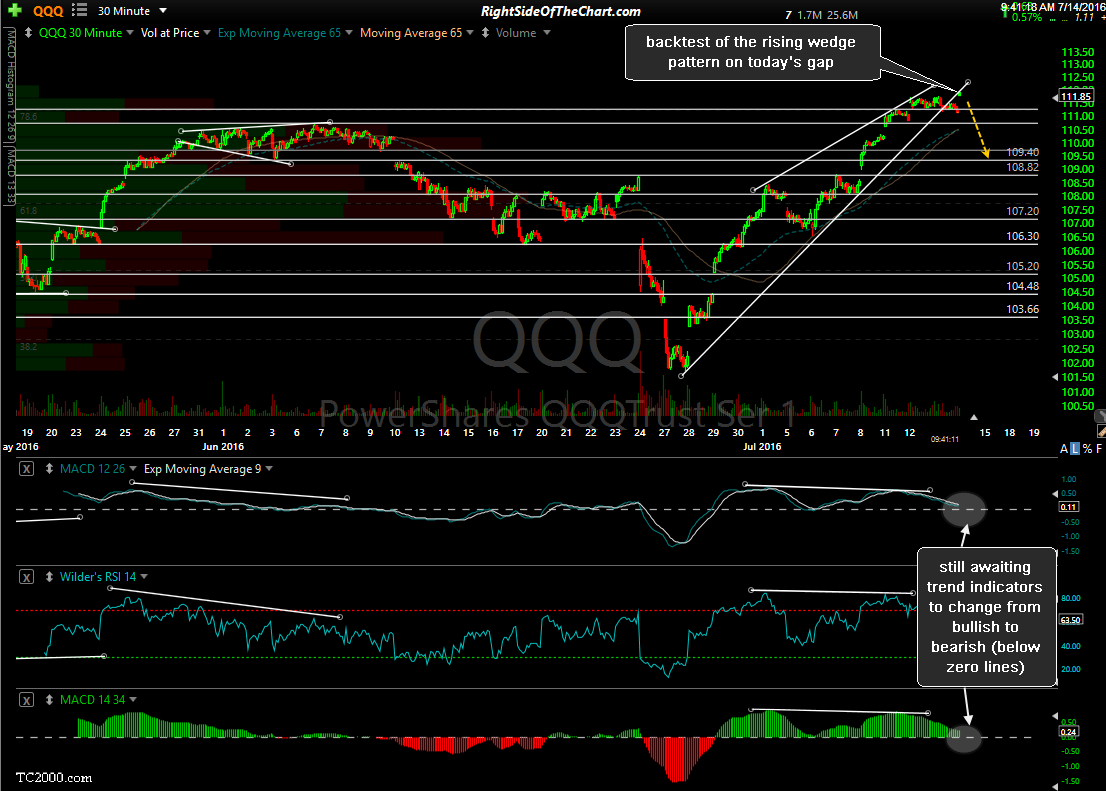

After breaking below the 30-minute rising wedge yesterday, QQQ is currently backtesting the wedge pattern from below following today’s gap. With both the QQQ as well as the SPY, we are still awaiting bearish crosses below the zero level on the MACD signal line as well as the 14/34 ema histogram trend indicators.

SPY found support at the alternative wedge uptrend line that was posted yesterday (in the comment section below the previous update on these wedges) which now becomes the primary uptrend line as yesterday’s reaction off that TL has validated it as the third reaction. Therefore, we still don’t have any sell signals on the broad markets yet until & unless the SPY breaks below the bottom of this revised wedge pattern, QQQ reverses soon after this backtest and both the MACD & 14/34 trend indicators move from bullish to bearish. It is also worth noting that the SPY is also backtesting the former primary uptrend line (now colored blue) in tandem with the QQQ backtest.