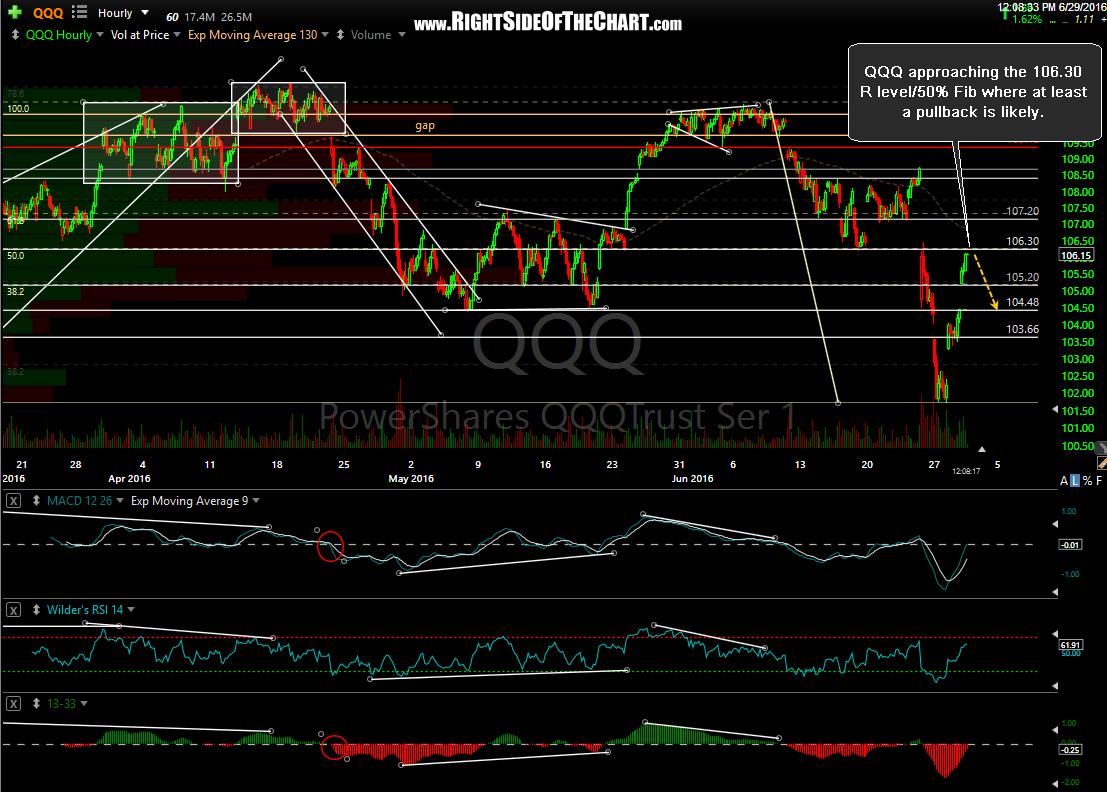

QQQ is now approaching the 106.30 R level/50% Fibonacci retracement level where at least a pullback is likely (with additional resistance levels just overhead at 106.50 & 107.10).

After composing the video below, I have decided to modify my trading plan & add back a substantial amount of short exposure on QQQ here (just added while the Q’s are now at 106.30) with the intention to remove all of that particular lot if QQQ prints a 60-minute closing candle above 106.50.