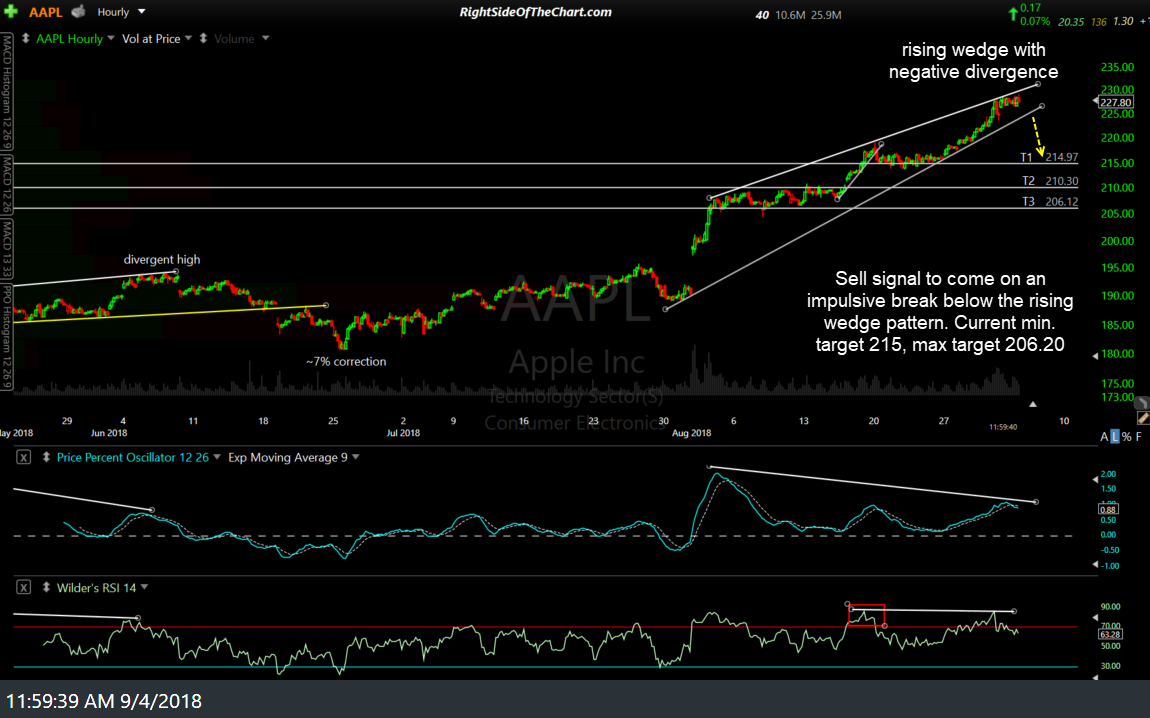

Looks like there’s potential for a drop of as much as 6-10% from current levels in AAPL (Apple Inc.) with a sell signal to come on an impulsive break below this 60-min bearish rising wedge pattern. Current minimum target 215, max target 206.20, assuming a break below the pattern occurs this week.

MSFT (Microsoft Inc.) also looks poised for a pullback of about 5-8% (T1–T3) with a sell signal to come on a solid break and/or 60-minute close below the 111.14ish minor support level.

I have revised the pullback targets on QQQ (Nasdaq 100 tracking ETF) since the video published earlier with a minimum preferred target of T3 around 174.75 at this time.

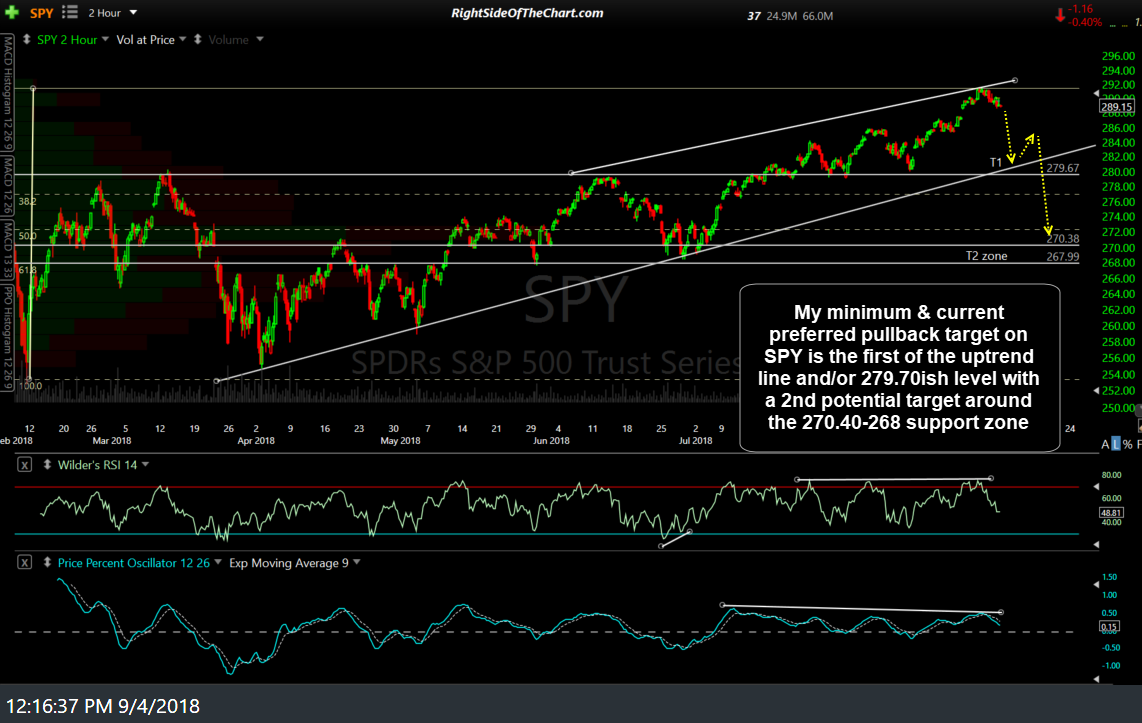

My minimum & current preferred pullback target on SPY (S&P 500 tracking ETF) is the first of the uptrend line and/or 279.70ish level with a 2nd potential target around the 270.40-268 support zone.