Upon further review of the charts, I have added an additional price target to the SOXX (semiconductor ETF) Active Short Swing Trade at 188.68 which now becomes T2 with the former T2 at 182.70 resequenced as T3. As the case for an even larger correction continues to firm up with the futures down sharply meaning that QQQ & SPY failed at my minimum bounce targets on Friday’s bounce, I may add/extend the final price target on both the SOXX & QQQ trades but for now, let’s see how the market trades in the regular session today once the big players step onto the field between 9:30-4pm. Thursday’s previous & updated 60-minute SOXX chart below highlighting the expected endpoint for the counter-trend bounce in SOXX (and objective add-on or new short entry point).

- SOXX 120-min May 9th

- SOXX 60-min May 13th

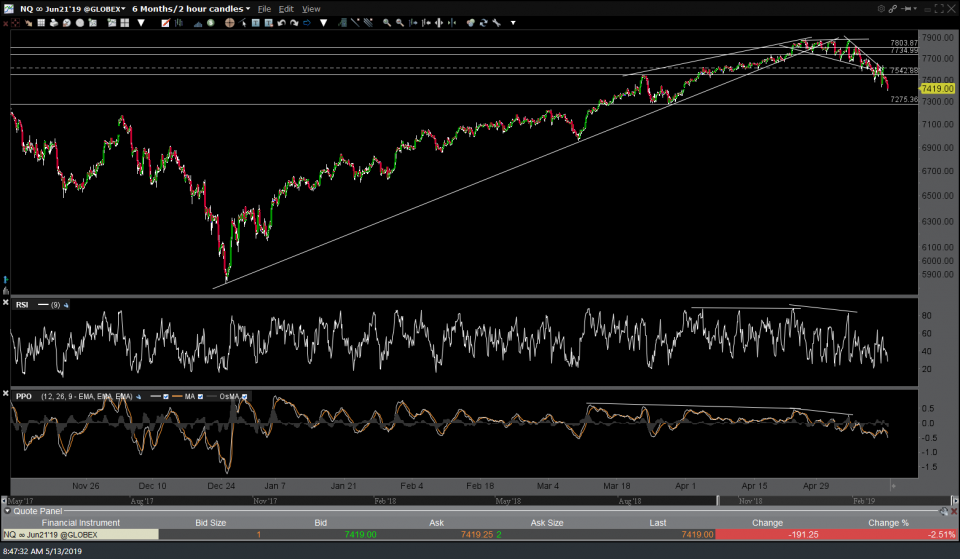

Here’s a quick look at the /ES (S&P 500) and /NQ (Nasdaq 100) 60-minute futures charts with /NQ smack inbetween the 7275 support/next price target and the first target/7543 former support, now resistance level while /ES makes another test of the 2830 support. Until & unless /ES takes that support level out impulsive, the odds for a sharp rally after the opening bell today is decent while a solid break below could usher in another wave of selling that takes /NQ down to that 7275 target. FWIW, I’m slightly leaning towards the former but will post another update after the regular session is underway.

- NQ 60-min May 13th

- ES 60-min May 13th

Although not reflected on this Friday end-of-day chart, QQQ is trading just below the 180.77 T2 level in the pre-market sessions, providing an opportunity to book partial or full profits which would be a good idea for those whose original trading plan was/is to do so.