For those considering buying the dip, I have just two words: caveat emptor

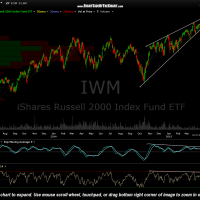

While this market has seen more than its share of stick saves over the last few years, with all the major US equity indices (small, mid & large caps) either recently breaking down below clear bearish rising wedge patterns or just on the cusp of doing so, it would be prudent for those positioned heavily long to at least make sure they have the appropriate stops or hedges in place. For those positioned short or considering shorting, just remember that if these wedge breakdowns do play-out as expected, stocks often drop much faster than the rise so make sure to have a trading plan in place vs. trying to figure out your targets & stops on the fly (never a good idea).

- QQQ daily April 17th

- SPY daily April 17th

- MDY daily April 17th

- IWM daily April 17th

Although a considerable drop in the US markets over the next couple of weeks looks likely, to use my own Yogism, the only thing that surprises me with this market over the last few years is when I’m not surprised. In other words, I wouldn’t be shocked to see the powers-that-be come in & ramp this market just when it looks like these wedge breakdowns are starting to gain some traction but I’d be pleasantly (and profitably) surprised if the technicals do play out this time around, as I expect they will.

To clarify, I remain bearish & favor these wedge breakdowns playing out as expected (i.e.- normal technical analysis, not the post-QE technical analysis which has been plagued with false sell signals that were often immediately followed by relentless rallies). However, whether bullish or bearish, one should expect volatility going forward and likely some very strong moves in either direction. Bulls & bearish alike should make sure to limit losses if wrong & not become married to any one bias.

note: At this point, the suggested stop for the QQQ swing short will be lowered to 108.11 from the previous/original suggested stop of 111. The entry on the current QQQ short was posted at 107.91 on March 18th so this new stop would essentially assure a breakeven (or very slight loss) on the trade.