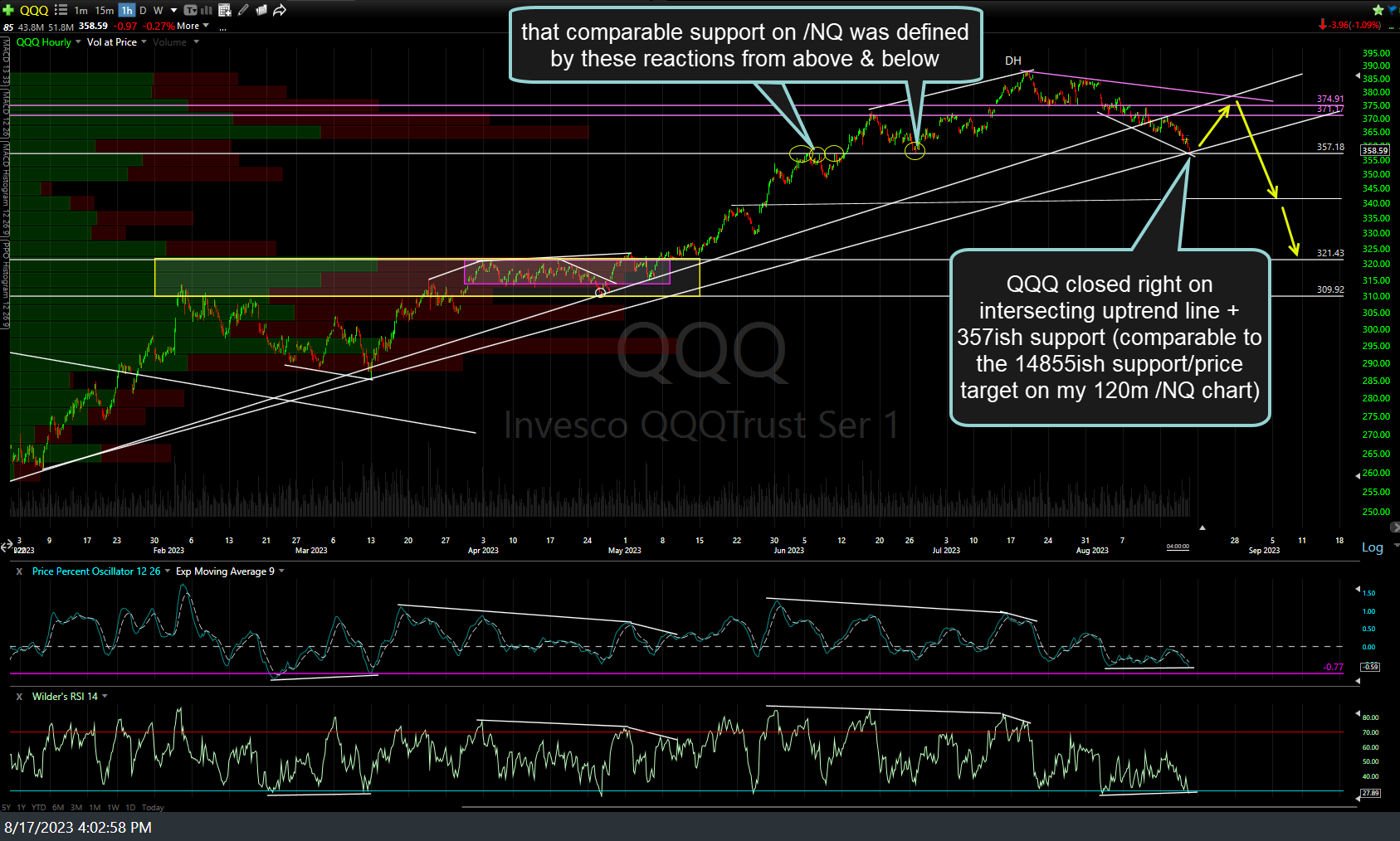

/NQ (Nasdaq 100 futures) closed a hair (~1/2%) below the 14855ish support, which is effectively on that support/initial swing target, with QQQ closing right on its comparable support level without any violation below today. Therefore, no change in my near-term outlook as of today’s close as the technical posture remains the same as earlier today. 120-minute chart of /NQ followed by the 60-minute chart of QQQ below.

One clearly bearish development which chips away at the case for the $NDX to hold & rally off this support is the fact that after hitting & consolidating on the 176ish support level (first price target) for the past week or so, AAPL (Apple Inc.) made a solid break & close below that key level today. That is clearly bearish for the largest component of the S&P 500 & Nasdaq 100 until & unless AAPL can regain that level soon (if so, that would mean today’s breakdown was a whipsaw & likely be followed by a short-covering rally). Daily chart below.

Bottom line: Some of the most important technical developments to watch for tomorrow and/or into next week would be:

- Whether or not AAPL can clearly rally back above the 176ish former support, now resistance level (bullish if so, bearish if not)

- Whether or not both SPY & QQQ can rally back above their recently broken 50-day EMAs (bullish if so, bearish if not)

- Whether or not the $NDX can successfully hold above & begin to rally of the support level it fell to & closed at today (bullish if…)

- Whether or not the 10-year Treasury yield ($TNX) takes out the previous multi-year high from last October and continues to run (bearish for the stock market) or if the current divergences begin to play out for a reversal, especially if $TNX breaks solidly below that primary uptrend line off the March 2020 COVID lows that I’ve been highlighting in recent videos (bullish for the stock market… unless that drop in yields is due to institutions flocking into Treasuries as a flight-to-safety trade due to a continued selloff in equities, especially if the selling intensifies.