/NQ continues to backtest the uptrend line off the early Oct lows (as well as the 8278.50ish R level) since breaking below it last night. Still awaiting a solid break below 8200 for a near-term sell signal on the market.

The next chart is a zoomed-in view of the /NQ 60m chart showing multiple 60-minute candlestick backtests of the uptrend line + 8278.50ish resistance level so far since the trendline break last night.

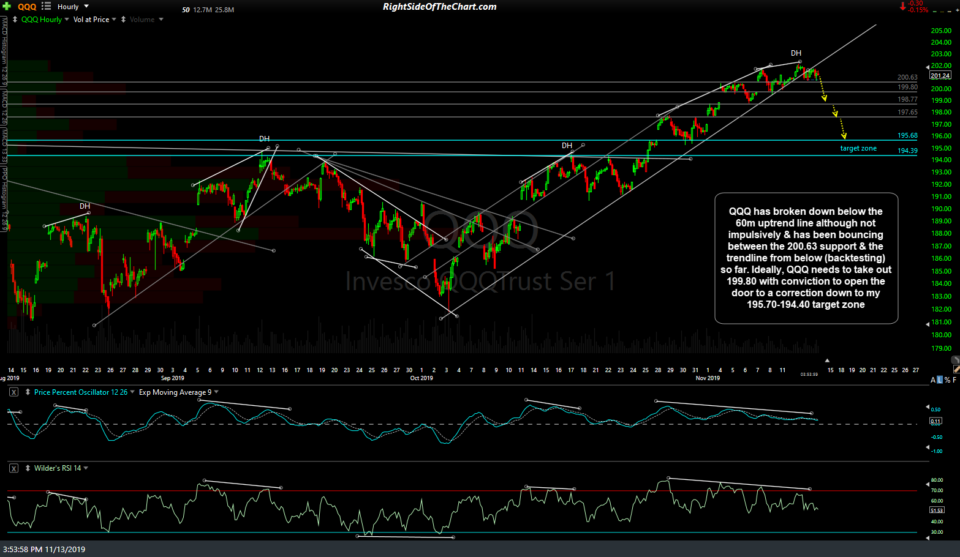

Likewise, QQQ has broken down below the 60m uptrend line although not impulsively & has been bouncing between the 200.63 support & the trendline from below (backtesting) so far. Ideally, QQQ needs to take out 199.80 with conviction to open the door to a correction down to my 195.70-194.40 target zone.

Should we get the more significant sell signals with solid breakdowns below /NQ 8200 & QQQ 199.80 soon (also look for impulsive rejections off the backtests of these trendlines), that would likely spark additional upside in the risk-off assets which should provide for at least a short-term tradable rally. /GC (gold futures) appears poised for a run up to at least the 1480ish level if it can break above 1468 with conviction, especially if the stock market pulls back soon. GLD is the ETF for gold.

/ZB (30-yr Treasury bond futures) and TLT (20-30 yr T-bond ETF) appear poised for at least a minor rally if they can take out the recent highs with conviction, especially if we get a pullback in the stock market soon.