Following yesterday’s post on the short entry for UNG/natural gas, /NG (natural gas futures) reversed where I posted covering it in the comment section below that post yesterday (1st 60m chart below), rallied, & now has negative divergence which could play out for a reversal anytime although the next objective long exit or short entry would be on a thrust up to just below the 7.348 resistance. Previous & updated 60-minute charts below.

There’s quite a bit more I’d like to cover & will do my best to do so later today if I’m feeling better. One of the most important things to watch today is what I refer to as the Bain Of Powell, which is the negative feedback loop of any real or perceived pivoting of a ‘less hawkish’ Fed (such as today’s reaction to the only slightly cooler & expected*, see DJP chart below), which results in commodities rallying, which in turn fans the flames of inflation, which then forces the Fed to remain hawkish.

With energy being one of the largest weightings in the CPI, just how much the Fed can pivot will largely depend on where crude & natural gas prices go from here. The rally off the divergent low & pullback to the primary uptrend line in UNG/nat gas has been explosive so far, & will most likely contribute to a hot CPI reading next month if this rally has some legs. Daily chart below.

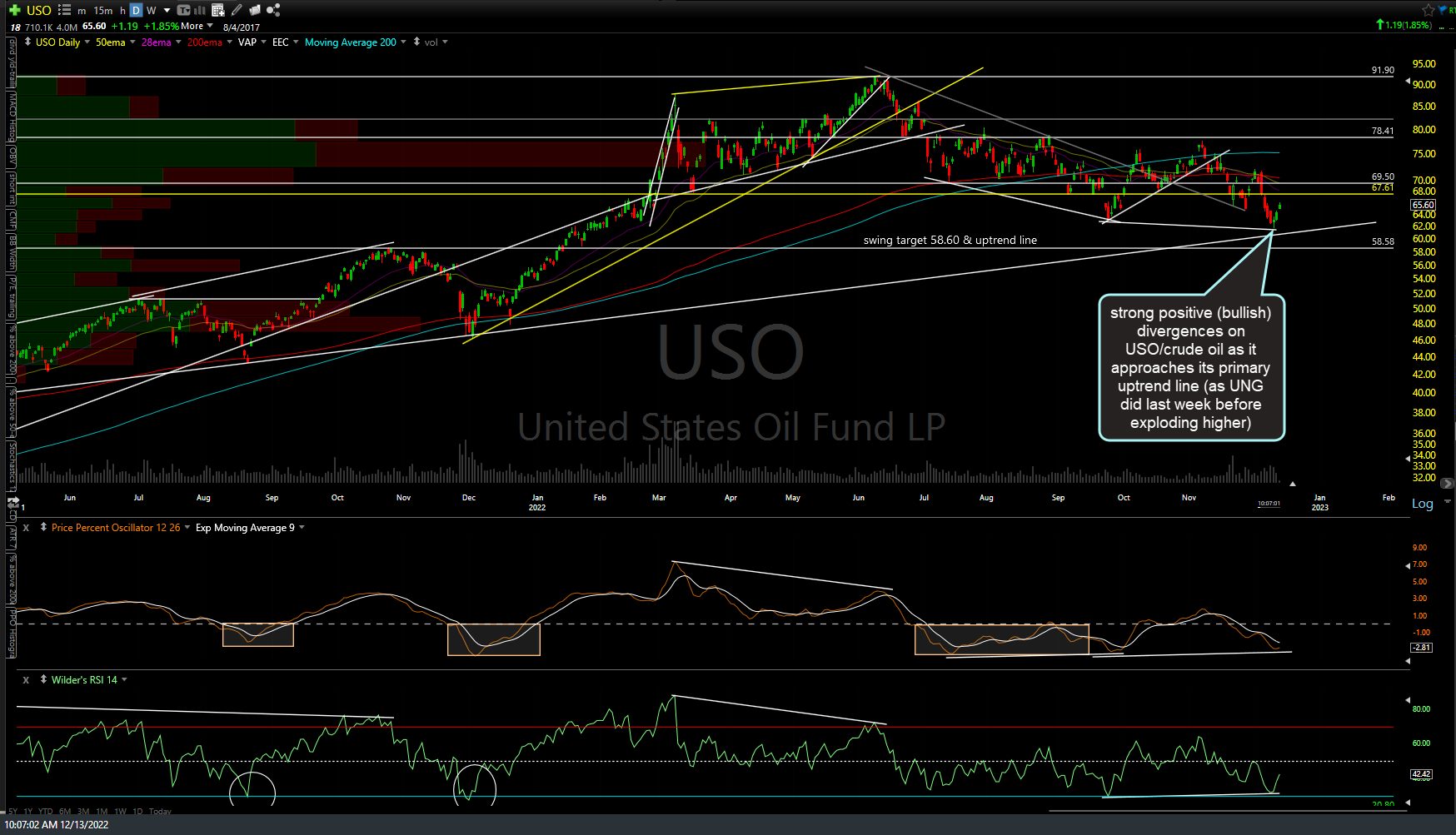

We also have strong positive (bullish) divergences on USO/crude oil as it approaches its primary uptrend line (as UNG did last week before exploding higher). Daily chart below.

The negative feedback loop continues, with commodities rallying hard on what the street assumes will be a Fed pivot towards ‘less-hawisk’, a vicious cycle that will continue to provide a headwind for the stock market that is likely to continue to play out for many months, if not years to come.