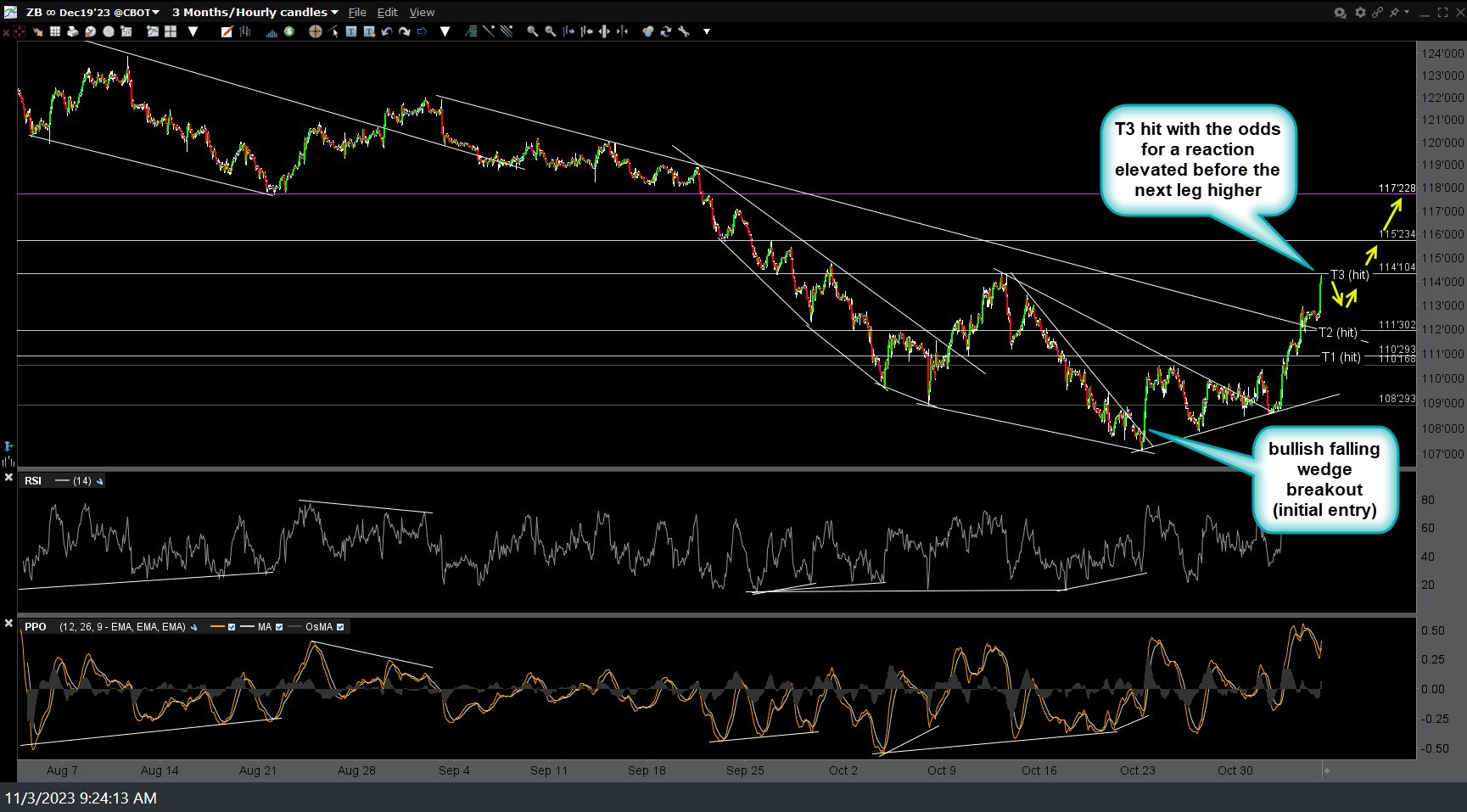

/ZB (30-yr Treasury bond futures) has just hit T3 (114’104) with the odds for a reaction elevated before the next leg higher. Original (when the setup was posted on Oct 19th, right around the start of this rally & at multi-year lows on the 30-yr) followed by the updated 60-minute charts below.

Likewise, the TLT (20-30 yr Treasury bond ETF) swing trade has also just hit it’s 2nd price target (88.52) with the odds for a reaction before the next leg higher elevated at this time, although I remain very bullish on Treasuries, reaction or no reaction here. Previous (Oct 19th) & updated 60-minute charts below.

…And now for my dilemma, and a big one at that.

Treasury bonds (long/bullish) is one of my largest swing/trend positions at this time as my convictions are high that the 10-30 yr Treasury bonds will continue to rally with yields moving lower. As I’ve stated for months, particular several months back when the market-cheerleaders on TV where signing the bull song for the stock market back in July/August, claiming that Treasury yields had peaked, I was warning of another thrust up to multi-year highs in yields & that, if so, the stock market would start to become “hyper-sensitive” to Treasuries yields, even moving tick-by-tick if/as yields were to break out to new highs (which they did & the stock market most certainly did as well).

That brings me to today: My primary scenario still has the stock market most likely starting another major leg down soon however, the problem with that is my bullish call on Treasury bonds (i.e.- yields continuing to fall in the coming weeks & possibly months) would (and most certainly has been… just look at when yields peaked, i.e.- when our /ZB/TLT trade was entered at the lows) and what the stock market has done since then.

In other words, the stock market remains hyper-sensitive to yields and that cuts both ways. Therefore, for the stock market to take another major leg down, my call for more upside in bonds (downside in rates) either needs to be wrong (and I feel stronger on my bullish call for bonds than my bearish call for stocks at this time) …or… we need to see a disconnect between the recent strong positive correlation between Treasury bond prices & the stock market.

While I do think the latter has a decent chance of occurring, especially as we continue to see evidence building that the jobs market is finally starting to roll over (including this morning’s report), the million dollar question is “How long will it take market participants to realize that it might be too late for the long awaiting pullback in rates to prevent what still appears to be an inevitable & (relatively) imminent recession that will impact corporate earnings, regardless of a pullback in yields?”

My guess is ‘sooner than later’ & I will spend the rest of the day digging into the charts to identify the sectors & stocks that are poised to rally on the recent abatement in yields as well as those that appear to offer objective short entries (or re-entries, such as the SOXX short that I recently posted reversing from short to long for the expected counter-trend rally). More to come soon but for now, if we get more than just a minor reaction (i.e.- we get a decent pullback) in Treasuries off these targets/resistance levels, then that should be good for a pullback trade in equities as well.

If & when the positive correlation between stocks & bonds reverses to a negative (or no) correlation, that will most likely be due to a migration from the “buy stocks because rates are falling” to “buy bonds because stocks are falling”, i.e.- a flight to safety bid for Treasuries from institutional investors. That disconnect won’t happen in a single day but more so as a trend developing so I’ll be watching to see if stocks begin to rally “less” in response to Treasuries rallying and of course, continue to see how key stocks & sectors react/trade based on their own unique technicals.