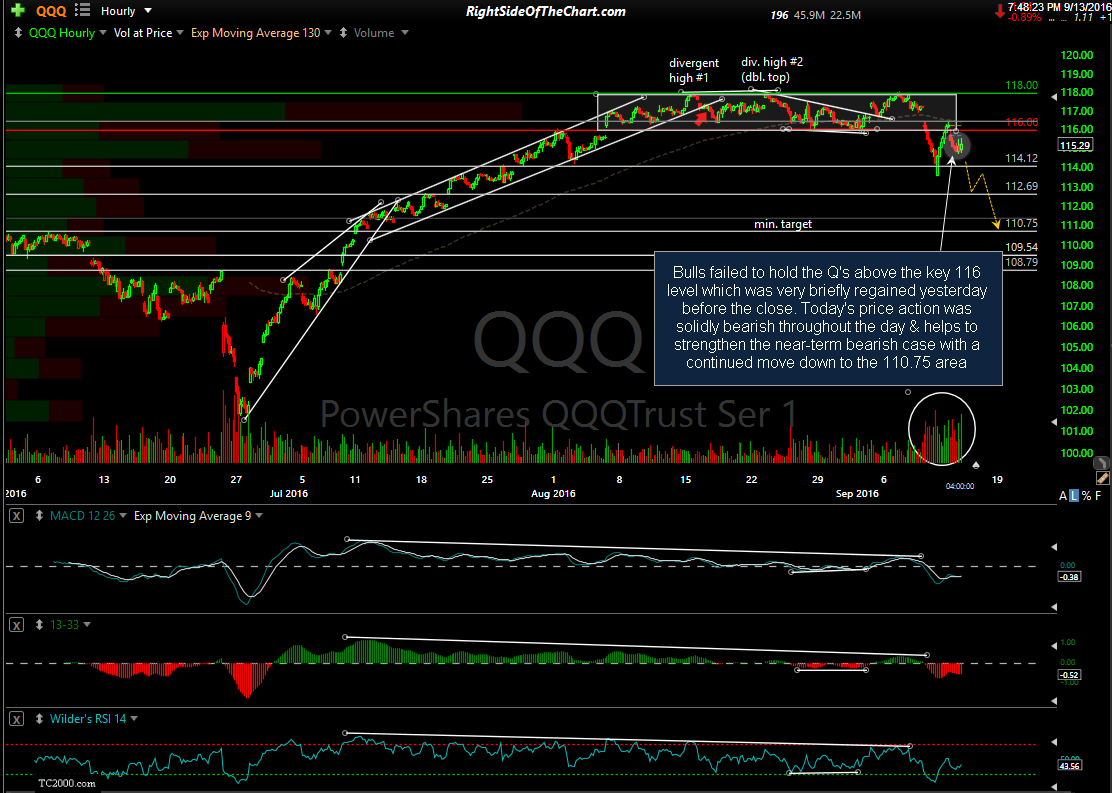

The bulls failed to hold the Q’s above the key 116 level which was very briefly regained yesterday before the close. Today’s price action was solidly bearish throughout the day & helps to strengthen the near-term bearish case with a continued move down to the 110.75 area. Only a 60-minute close back above the top of Friday’s gap will inflict serious damage to the near-term bearish case at this point.

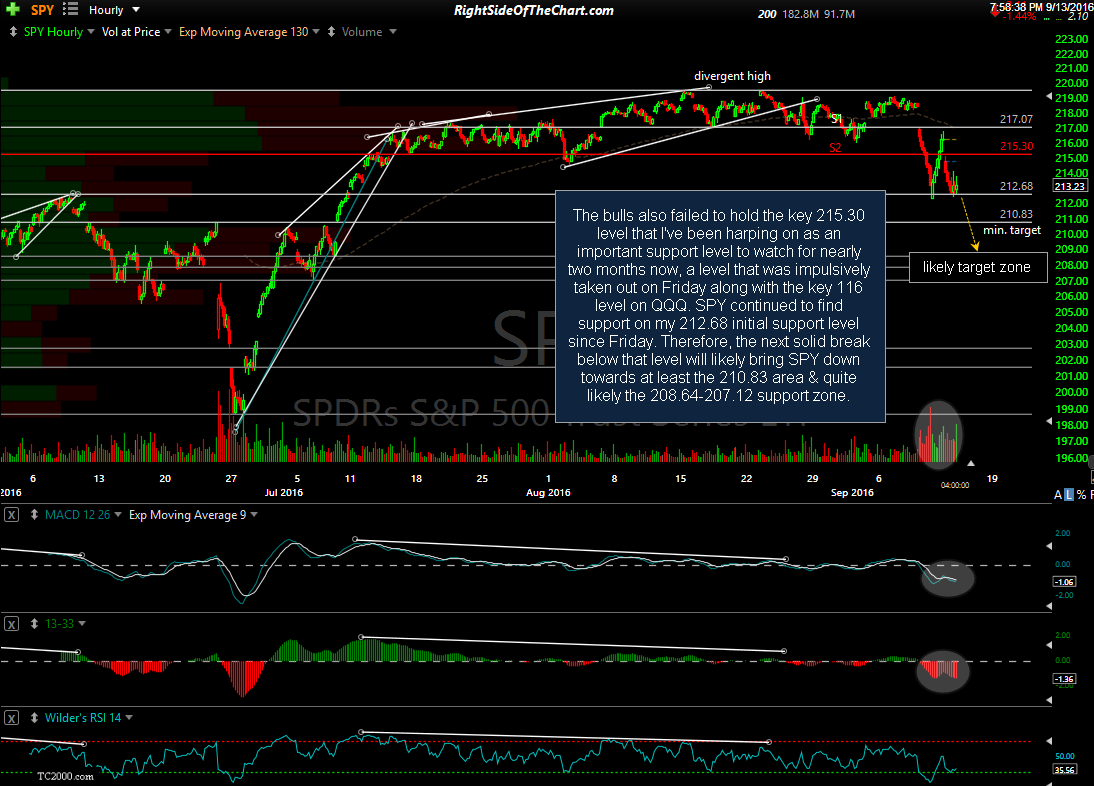

Likewise, the bulls also failed to hold the key 215.30 level that I’ve been harping on as an important support level to watch for nearly two months now, a level that was impulsively taken out on Friday along with the key 116 level on QQQ. SPY continued to find support on my 212.68 initial support level since Friday. Therefore, the next solid break below that level will likely bring SPY down towards at least the 210.83 area & quite likely the 208.64-207.12 support zone.

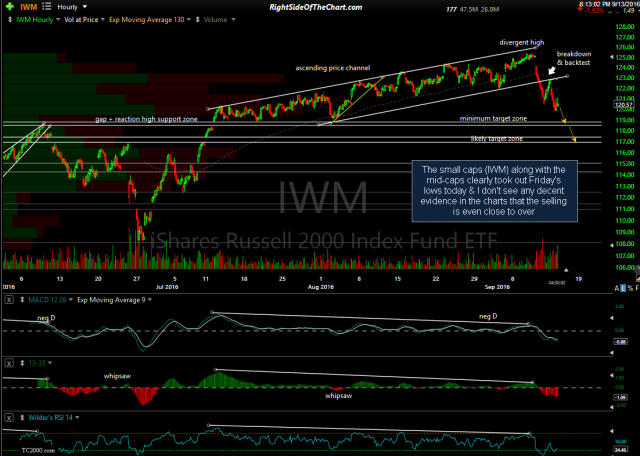

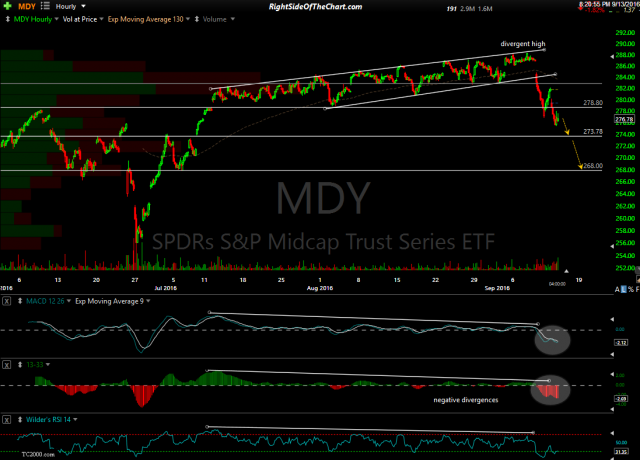

Both the small caps (IWM) along with the mid-caps (MDY) clearly took out Friday’s lows today & I don’t see any decent evidence in the charts that the selling is even close to over. With the small & mid-caps leading the way down, it is safe to say that the markets have recently flipped from the post-Brexit “Risk-on” trade to a “Risk-off” trade as of recently.

- IWM 60-minute Sept 13th

- MDY 60-minute Sept 13th