As interesting as it was to watch the big intraday swings in U.S. stocks & especially with gold & the mining stocks, there just weren’t many significant technical developments worth noting although I do think that this week certainly has the potential to change that. As mentioned on Friday, the major U.S. stock indices continue to struggle with their primary downtrend lines, which are unarguably significant technical levels.

- $SPX daily June 5th

- $NDX daily June 5th

Worth nothing is the fact that if these downtrend lines are taken out very soon (this week), with the markets going on to take out their April 19/20 reaction highs, they will most likely do so while putting in a divergent high, greatly increasing the chances that those breakouts will fail unless the market can continue to rally & burn through those divergences.

The real fireworks on Friday were in the gold mining stocks, which exploded higher on a surprisingly weak employment report, which immediately reduced the chance of a rate hike & spurred a sharp selloff in the dollar & rally gold. While certainly bullish on face value, Friday’s strong rally in gold & GDX could prove to be a one-day wonder, from a combination of short covering coupled with the expected reaction off the first target level on gold.

- $GOLD daily June 5th

- GDX daily June 5th

While I’m still leaning towards a continued move down in both gold & GDX, I’d like to see how the metal & miners follow through this week before firming up my opinion. Looking at the explosive nature of Friday’s move in GDX, the possibility that the recent correction in the miners was simply a bull flag continuation pattern within a larger uptrend can’t be ruled out, at least not yet.

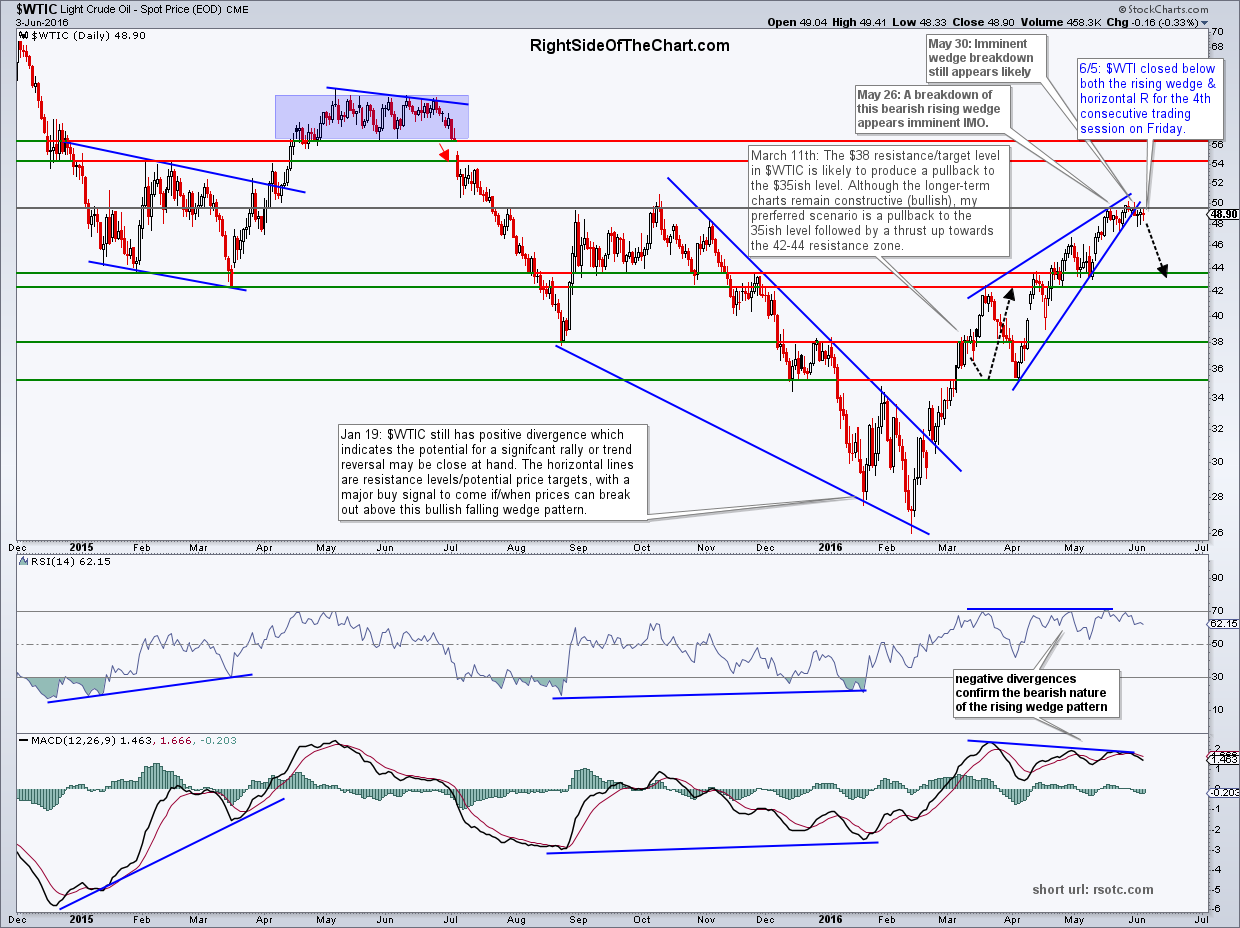

Not much to say in crude oil other than the fact that $WTIC printed the forth consecutive close below the bearish rising wedge pattern & horizontal resistance following the breakdown last week. My expectation remains for a continued move down in crude oil although the lack of impulsive selling following the wedge breakdown doesn’t help to confirm the breakdown so with everything else, I’d like to keep things light for now & watch the price action in crude next week before making any changes to my positioning.