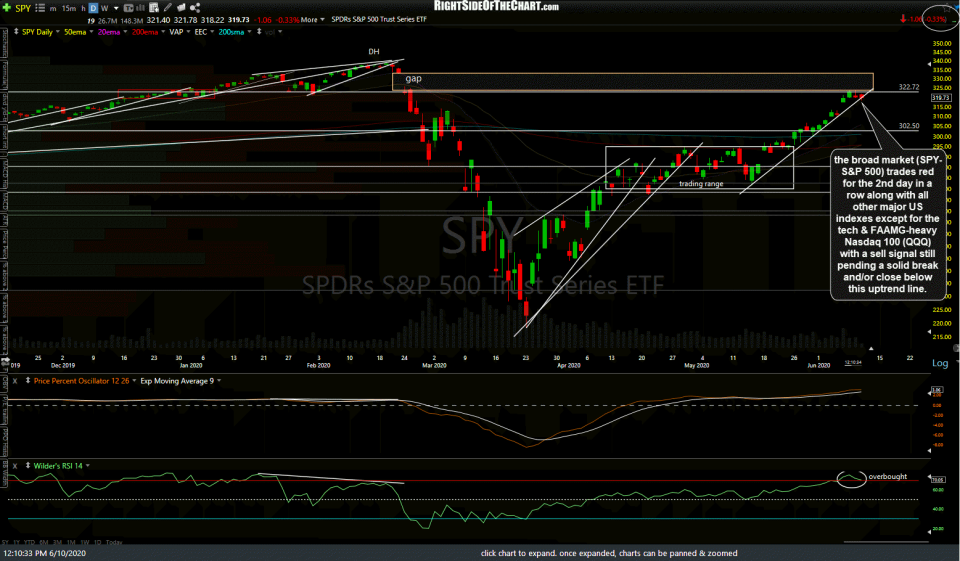

As I like to say, one (or even two) days does not make a trend so I’m passing this along as something to monitor going forward. The broad market (SPY- S&P 500) is currently trading red for the second day in a row along with all other major US indexes except for the tech & FAAMG-heavy Nasdaq 100 (QQQ) with a sell signal still pending a solid break and/or close below this uptrend line. As of 12:30 am EST, only 125 of the stocks within the S&P 500 are trading positive vs. 380 of the 505 stocks trading red. As with yesterday, of the 11 sectors within the S&P 500, only the technology sector is posting significant gains (1.4%) today with 9 of the 11 sectors trading red & XLV only +0.12%. Translation: Big tech/FAAMGs are doing nearly all of the heavy lifting again today while most stocks & sectors are under distribution.

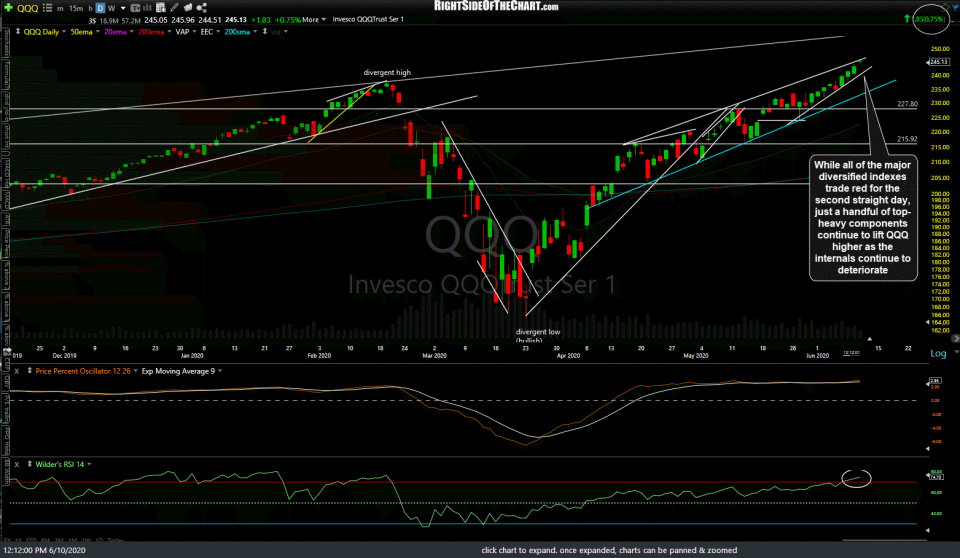

While all of the major diversified indexes trade red for the second straight day, just a handful of top-heavy components continue to lift QQQ higher as the internals continue to deteriorate.

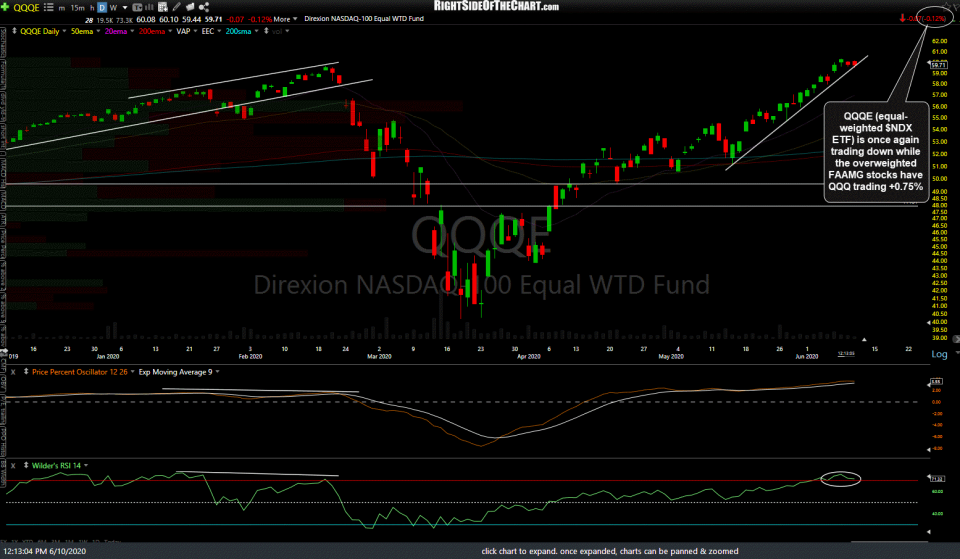

QQQE (equal-weighted $NDX ETF) is once again trading down while the overweighted FAAMG stocks plus a handful of other large tech companies have QQQ trading +0.75%.

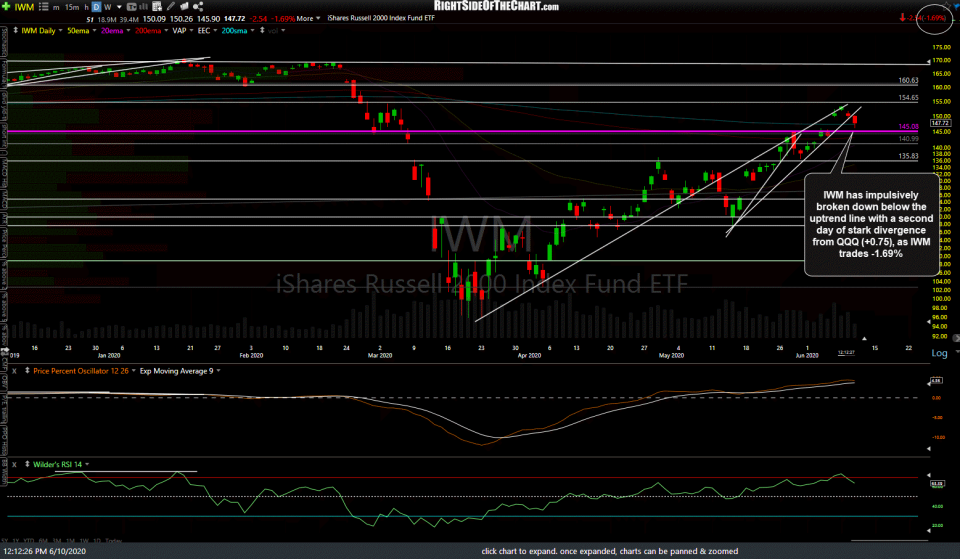

IWM (Russell 2000 Small-cap Index ETF) has impulsively broken down below the uptrend line with a second day of stark divergence from QQQ (+0.75), as IWM trades -1.69%.

While the deterioration in market internals over the past couple of days could prove to be an aberration, deteriorating market breadth with fewer & fewer stocks doing most of the heavy lifting is commonly observed leading up to significant tops in the market. Just a with divergences and overbought conditions (which we have on all the major indexes at this time) are not sell signals, solid breaks of well-defined support levels on the major indexes are. As of today, we have a breakdown/sell signal on IWM although the small-caps are likely to only drop ‘so far’ without the large-caps breaking down & falling as well. As such, I remain on watch for a solid break below the uptrend line on SPY as well as any decent sell signals on QQQ, XLK (tech sector ETF), and the majority of the FAAMG stocks (FB, AAPL, AMZN, MSFT, & GOOG/GOOGL).