With the stock futures basically picking up last night where they left off on Friday & trading mostly flattish since then & into the pre-market session, I wanted to wait to see how the markets traded after the open today before posting any updates. Essentially, we still have the (questionable) sell signal from Friday’s breakdown below the 60-minute rising wedge but I consider that breakdown questionable as 1) it was not followed with impulsive selling and 2) SPY is yet to trigger a comparable sell signal/breakdown.

Here’s the QQQ 60-minute chart showing the rising wedge breakdown & backtest with the next sell signal to come on a break below this minor support level.

/NQ (Nasdaq 100 futures) also had an (unimpulsive) breakdown & backtest of its comparable bearish rising wedge with the next sell signal to come on a break below /NQ 8690.

We adverted the last minute stop-raid on Friday by suspending the stop (which has been reinstated today) with the next sell signal on SPY still pending a break below the minor uptrend line.

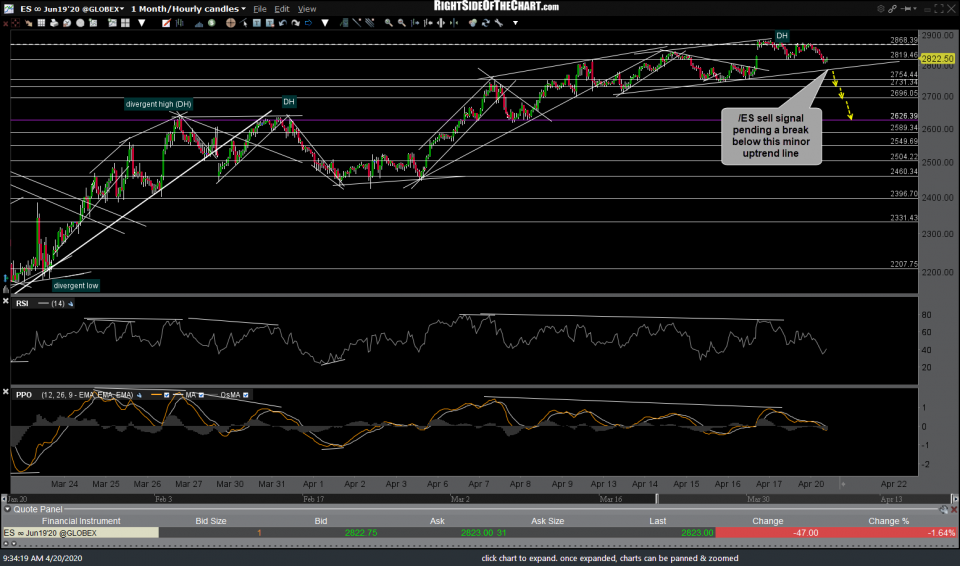

Likewise, the next sell signal on /ES is still pending a break below this minor 60-minute uptrend line.

Bottom line: The markets have pretty much picked up where they left off at the end of last week. I’m still monitoring the tech sector closely as I believe there has been a false sense of immunity from the impact of Coronavirus, with XLK (tech sector ETF) mounting an impressive but typically 31% (bear market) rally smack into its 61.8% Fibonacci retracement level on Friday and so far reversing off that level. I believe the focus will turn towards what impact Coronavirus has had on not only the recent earnings for the tech sector but more so, what the impact might be going forward. We may get an early preview of things to come as earnings season for “Big Tech” kicks off with IBM after the market close today followed by INTC (Intel) on Thursday evening.