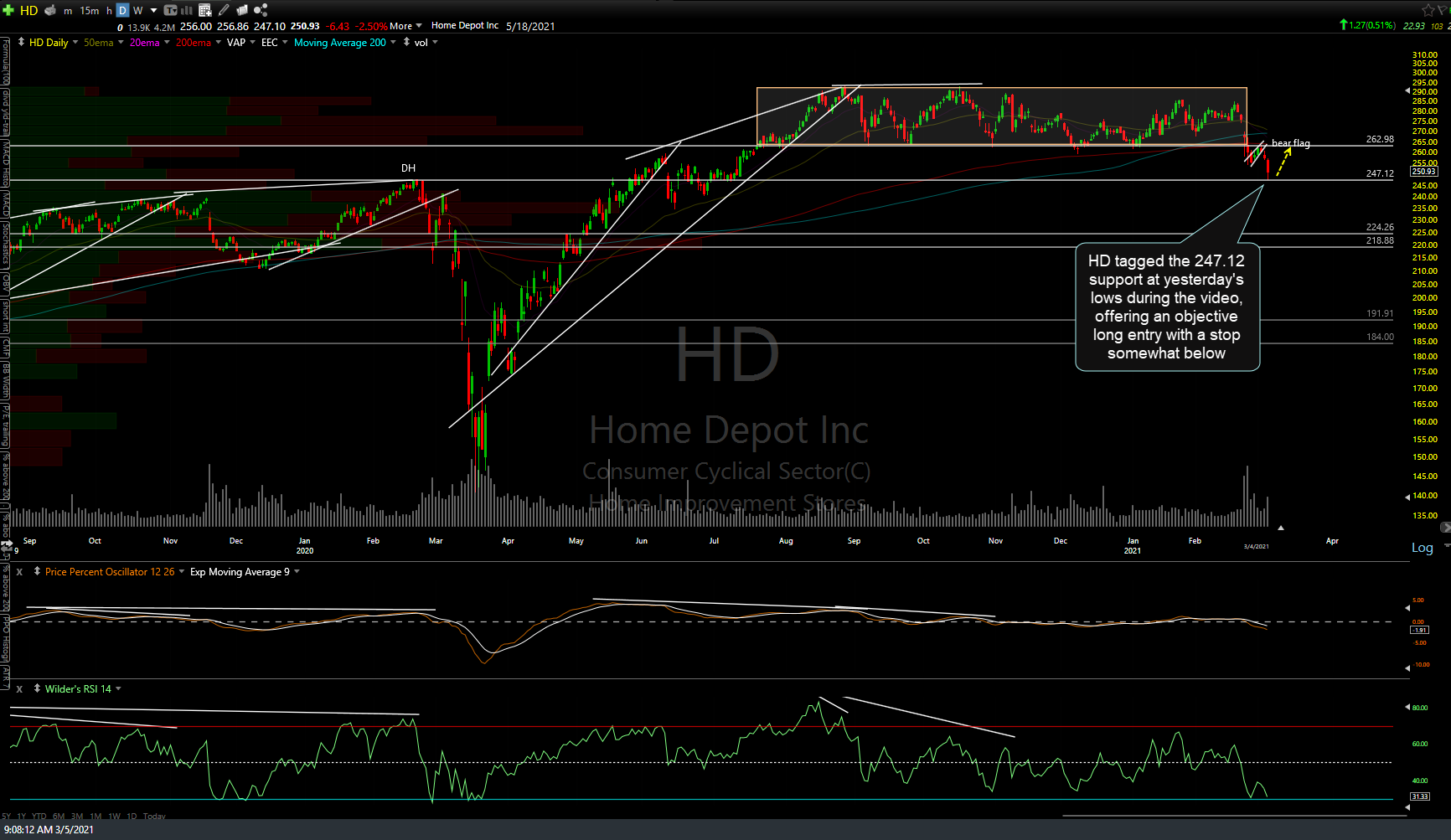

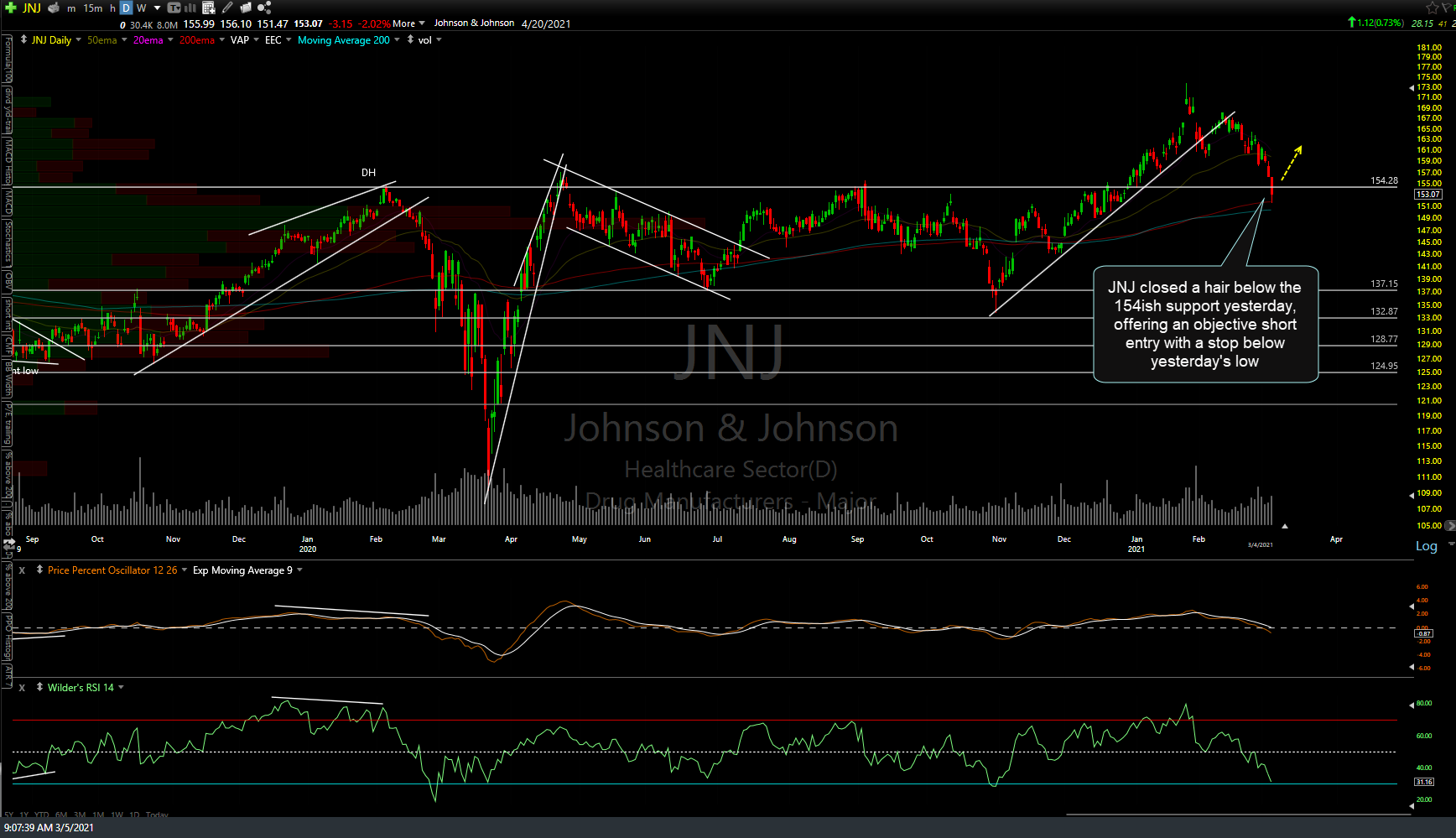

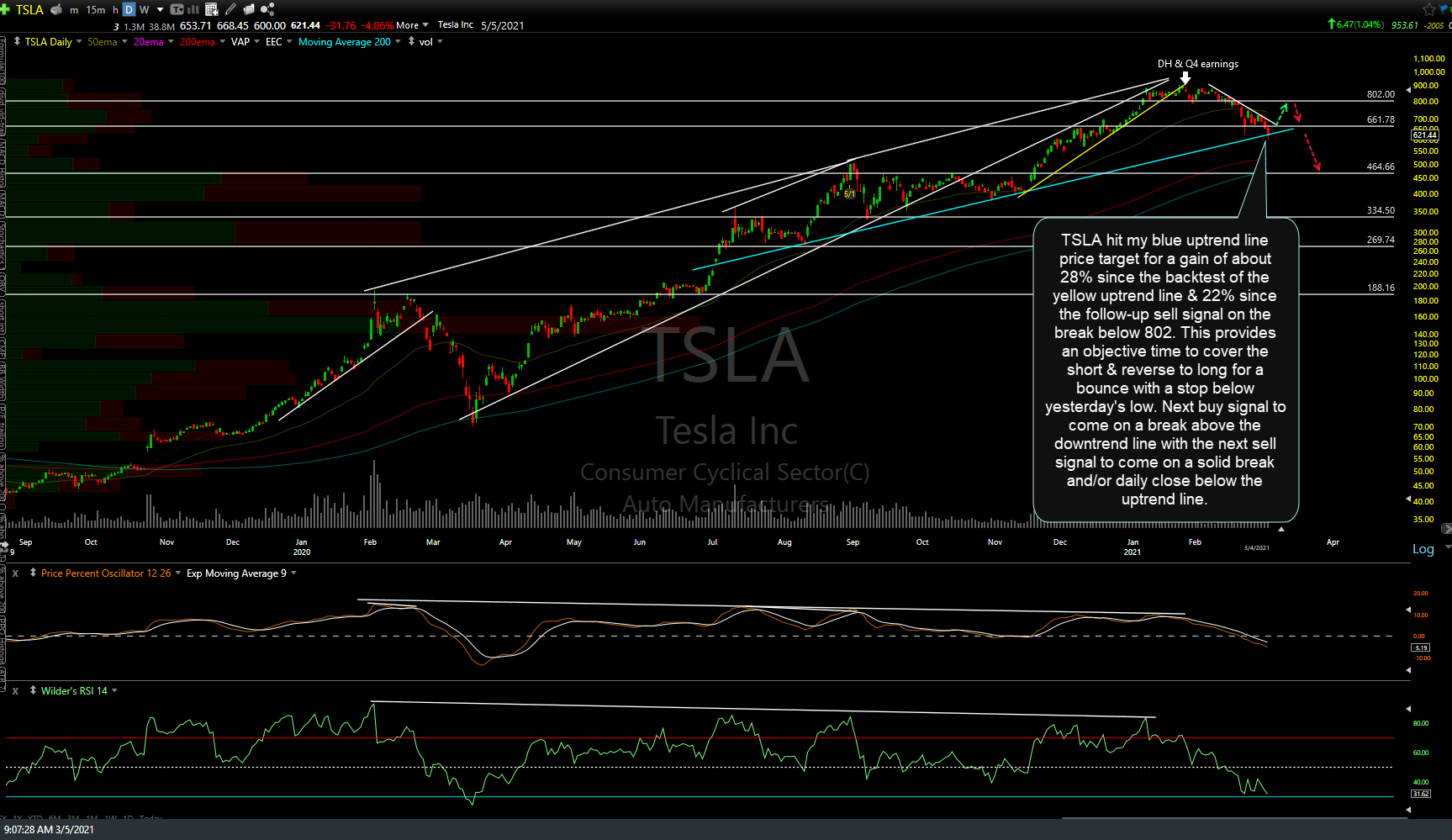

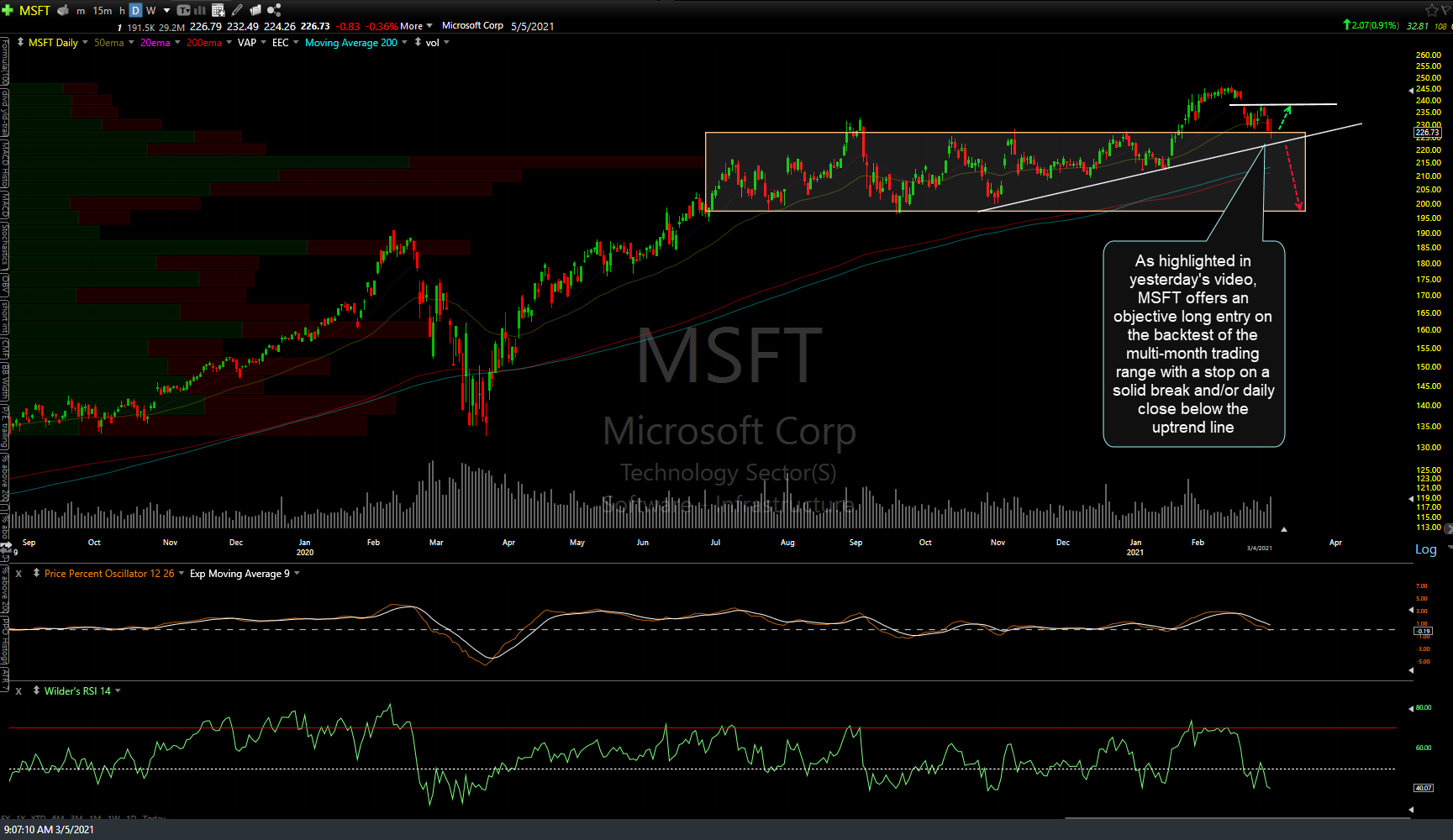

Here are some of the top components of the S&P 500 that were highlighted as objective long entries on pullbacks to key support levels in yesterday’s video. As per the comments in that video, solid breaks & especially a solid daily close below these support levels would be bearish & quite likely open the door to another wave of selling. As such, my preference would be to keep tight stops below yesterday’s lows on any of these taking as either pure-play long-side swing trades or hedges against index shorts as discussed in the video.

HD tagged the 247.12 support at yesterday’s lows during the video, offering an objective long entry with a stop somewhat below.

WMT closed a hair below the 128 support yesterday & still offers an objective long entry with a stop below yesterday’s low.

JNJ closed a hair below the 154ish support yesterday, offering an objective short entry with a stop below yesterday’s low.

TSLA hit my blue uptrend line price target for a gain of about 28% since the backtest of the yellow uptrend line & 22% since the follow-up sell signal on the break below 802. This provides an objective time to cover the short & reverse to long for a bounce with a stop below yesterday’s low. Next buy signal to come on a break above the downtrend line with the next sell signal to come on a solid break and/or daily close below the uptrend line.

As highlighted in yesterday’s video, MSFT offers an objective long entry on the backtest of the multi-month trading range with a stop on a solid break and/or daily close below the uptrend line.

AMZN kissed the 2943.50ish support yesterday, offering an objective long entry with stop not too far below.

Updates on the major stock indices as well as these potential trade ideas to follow after the regular-session has been underway for a while. Once again, these stock offer objective long entries at support but they also offer objective short entries if these support levels are solidly taken out, ideally on impulsive breaks below yesterday’s lows.