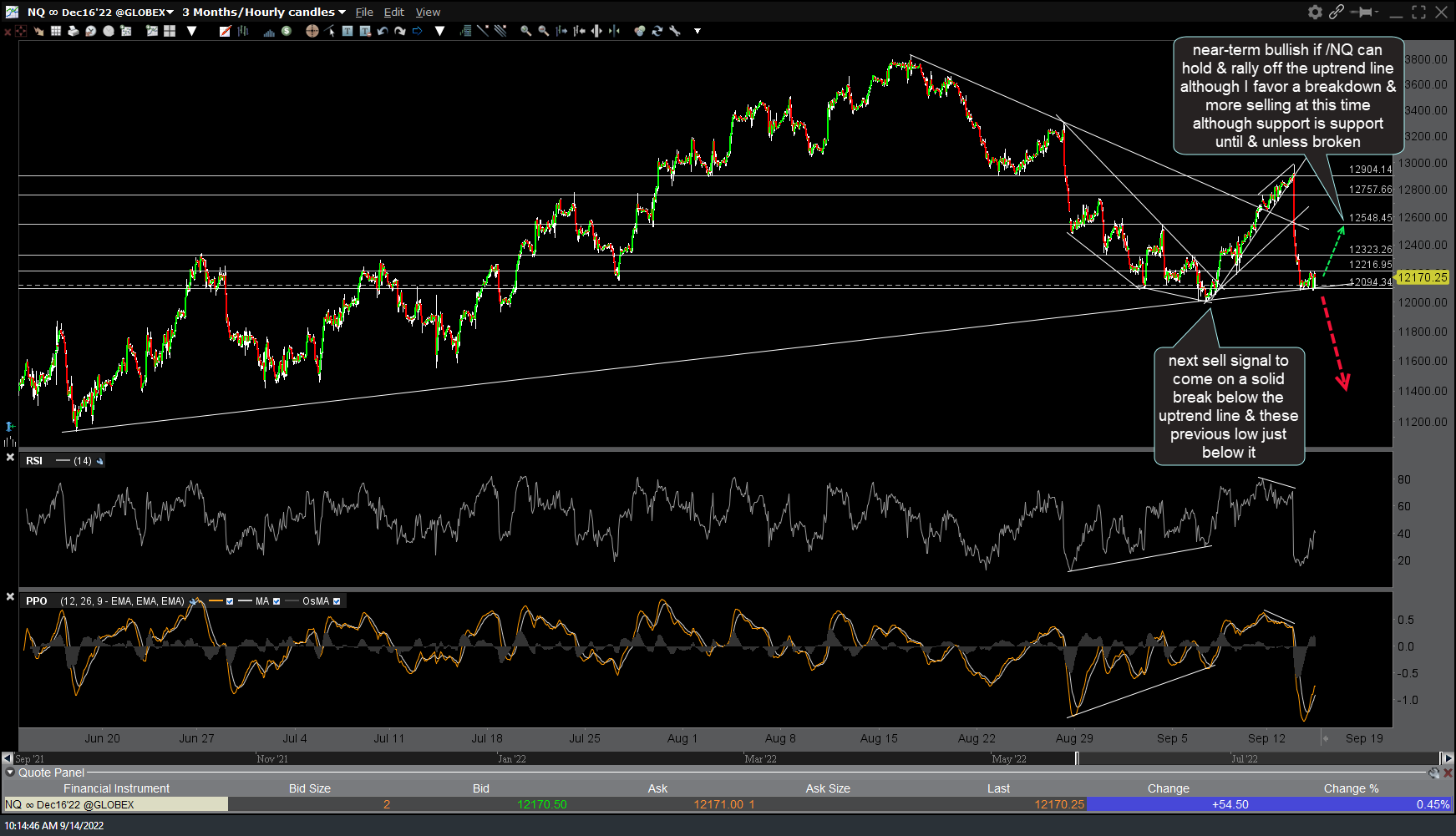

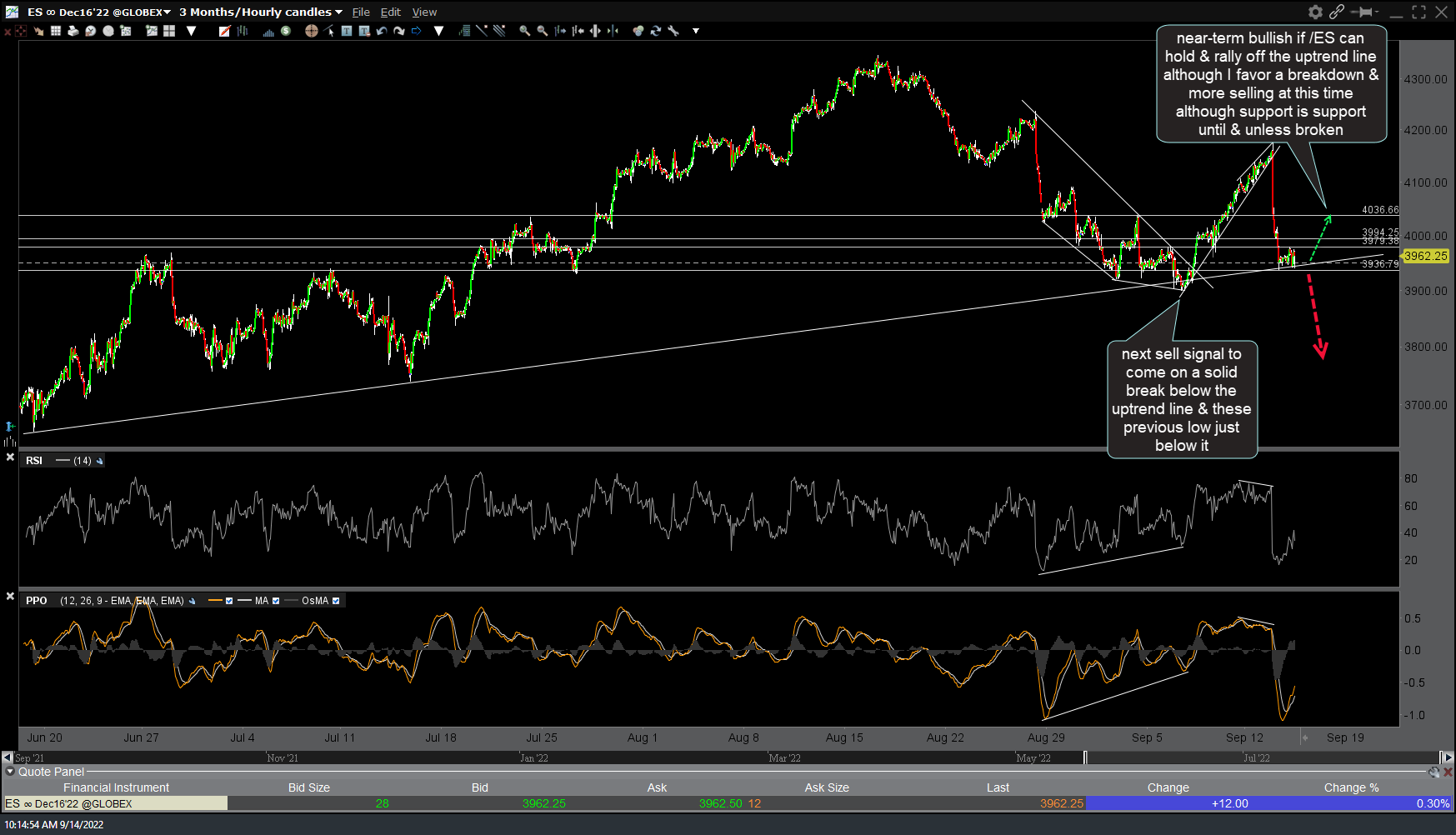

It would be near-term bullish if both /NQ & /ES can hold & rally off these uptrend lines they have been testing since yesterday. Although I favor a breakdown & more selling at this time, as I like to say: support is support until & unless broken. 60-minute charts below.

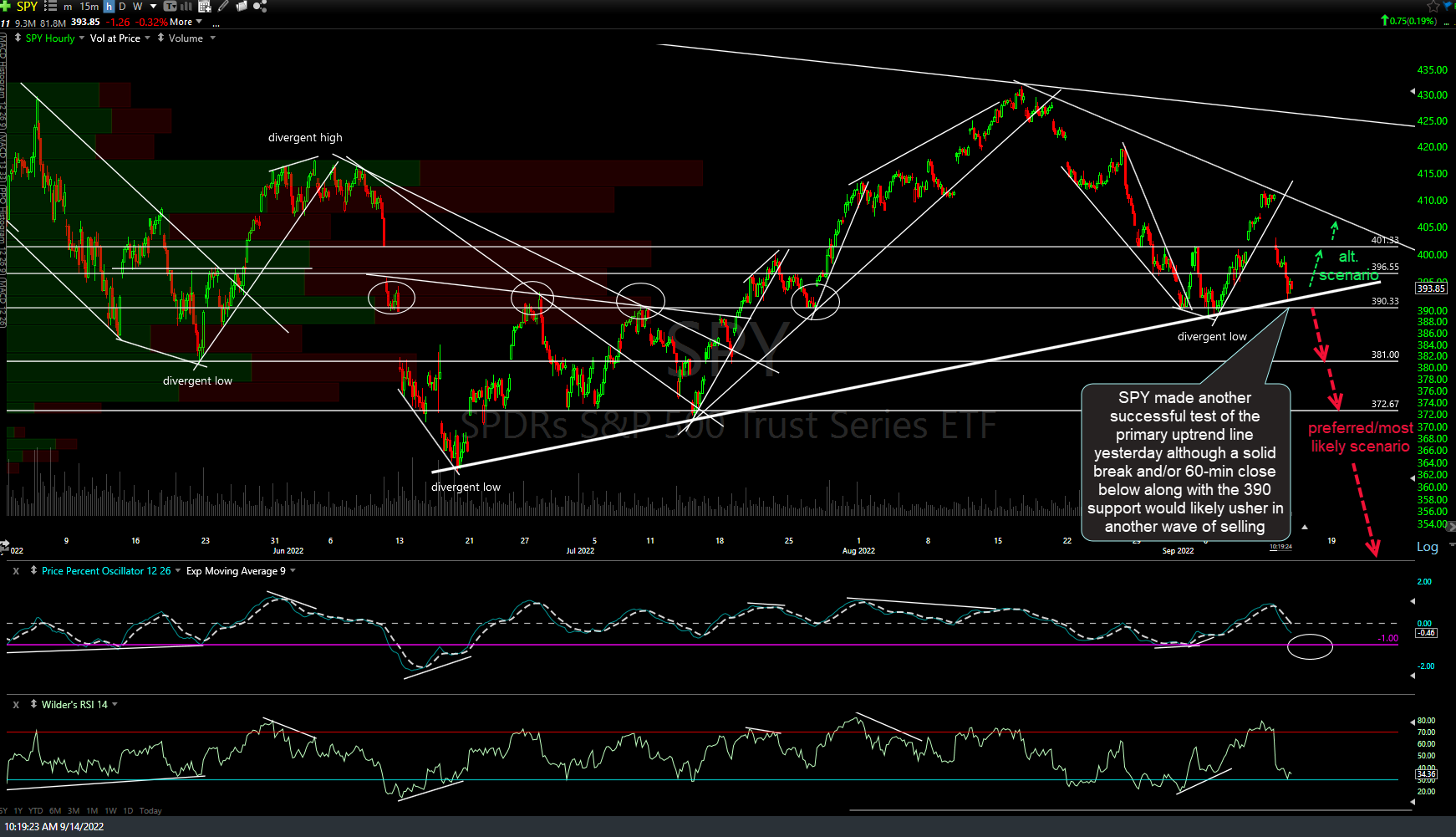

SPY made another successful test of the primary uptrend line yesterday which keeps the uptrend line off the mid-June lows intact for now while a solid break and/or 60-minute close below along with the 390 support (and especially a daily close) would likely usher in another wave of selling. 60-minute chart below.

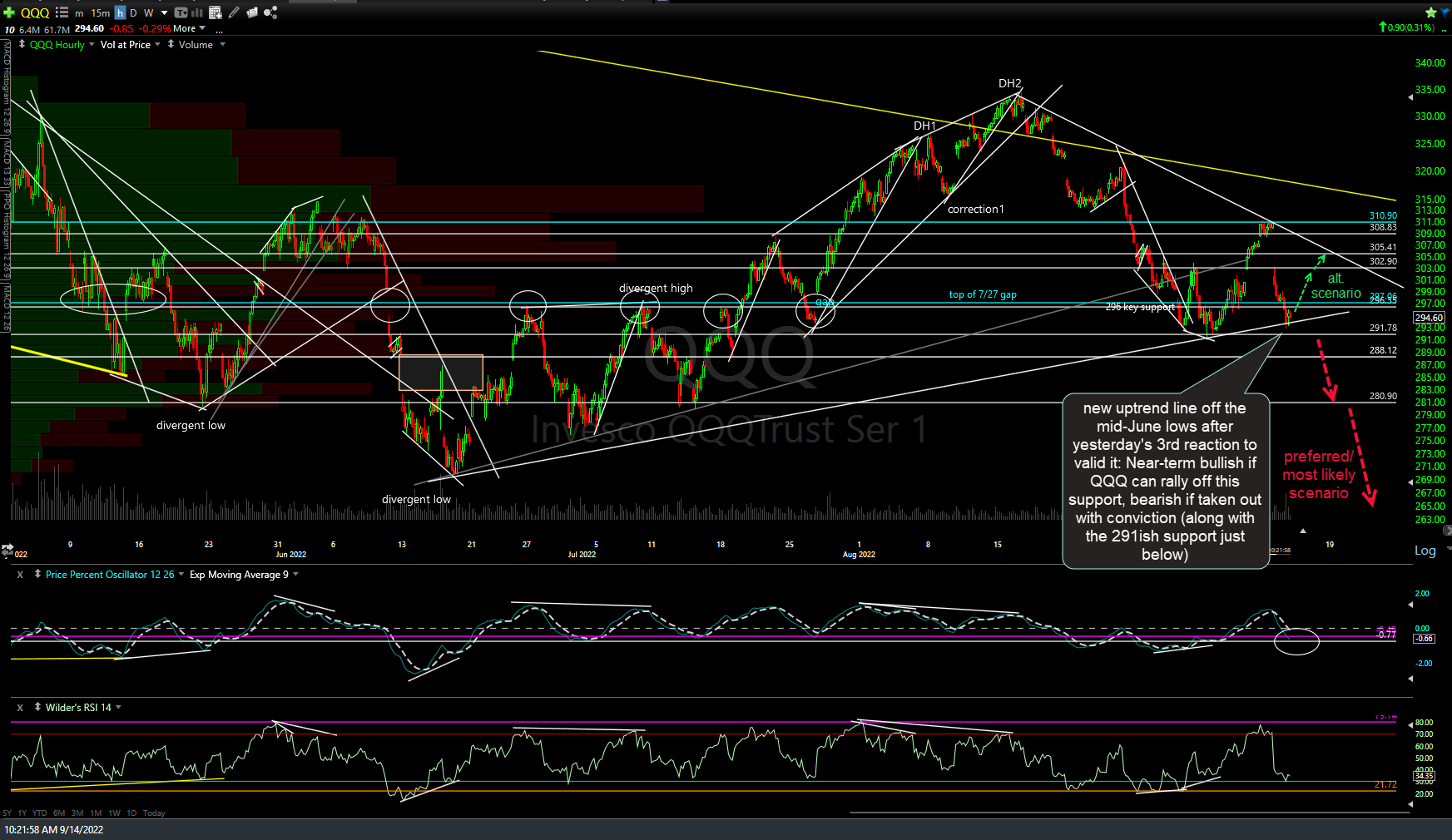

I’ve added a new uptrend line off the mid-June lows on QQQ after yesterday’s 3rd reaction to valid it: Near-term bullish if QQQ can rally off this support, bearish if taken out with conviction (along with the 291ish support just below). 60-minute chart below.

Bottom line: The major stock indexes are sitting just above key support. As such, it would not be objective to initiate or add short positions at this time. Best to wait for the aforementioned sell signals while those bullish could certainly make a case to go long here with stops somewhat below the recent lows.