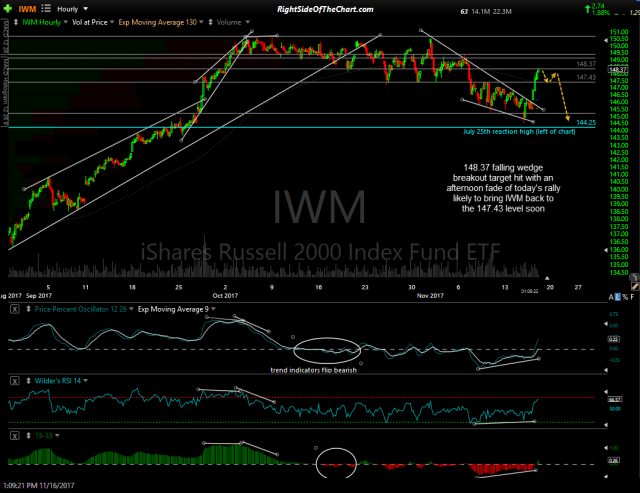

IWM has now hit the 148.37 falling wedge breakout target hit with an afternoon fade of today’s rally likely to bring it back to the 147.43 level soon. (scenario shown on last chart). All charts below are 60-minute time frames.

- IWM 60-min Nov 15th

- IWM 60-min Nov 16th

- IWM 60-min 2 Nov 16th

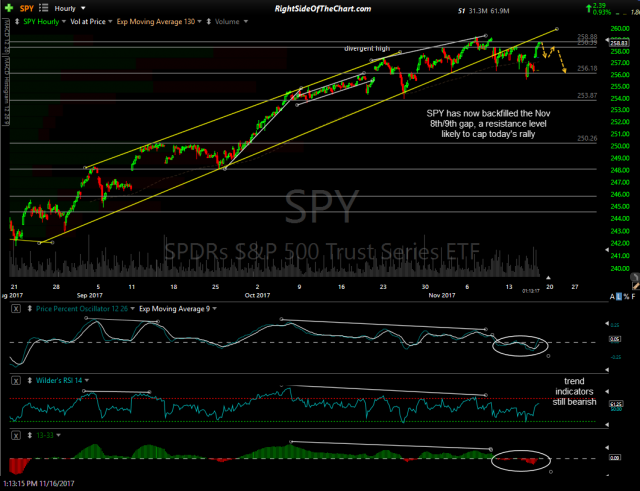

In tandem with IWM hitting resistance, SPY has now backfilled the Nov 8th/9th gap, a resistance level likely to cap today’s rally in the large caps as well. While QQQ doesn’t have any overhead resistance as it is trading at a new high, this most recent high on QQQ is an extension of the negative divergences that have been building since the previous divergent high on Nov 8th. Breakouts to new highs with negative divergence in place have an increased rate of failing.

- SPY 60-min Nov 16th

- QQQ 60-min 2 Nov 16th