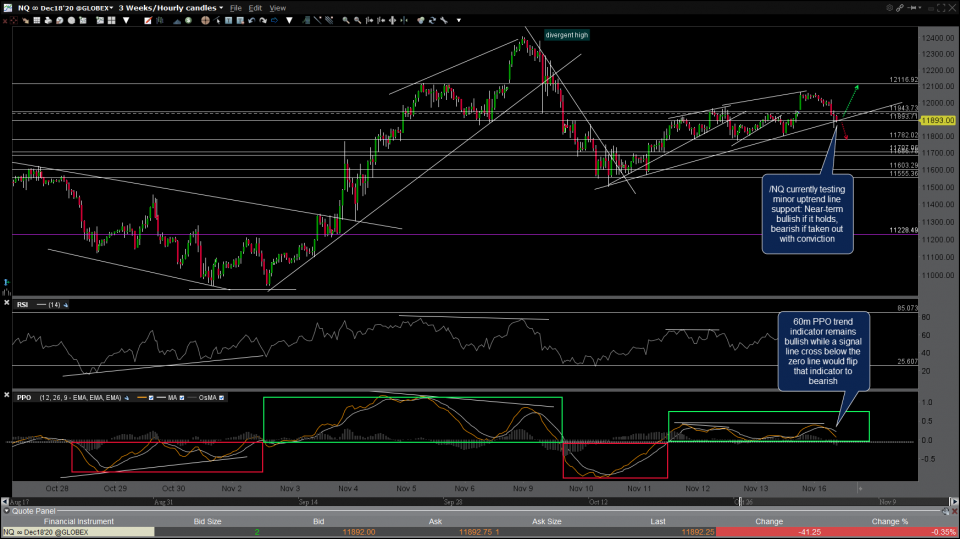

/NQ (Nasdaq 100 futures) is currently testing minor uptrend line support: Near-term bullish with the next target around 12117 if it holds, bearish if taken out with conviction. The PPO trend indicator remains bullish (PPO 9-ema above zero) while a signal line cross back down below the zero line would flip that indicator to bearish. 60-minute chart below.

/ES (S&P 500) is also testing minor uptrend line support on the 60-minute time frame: Bullish & new highs likely if successfully defended, bearish if taken out with conviction.

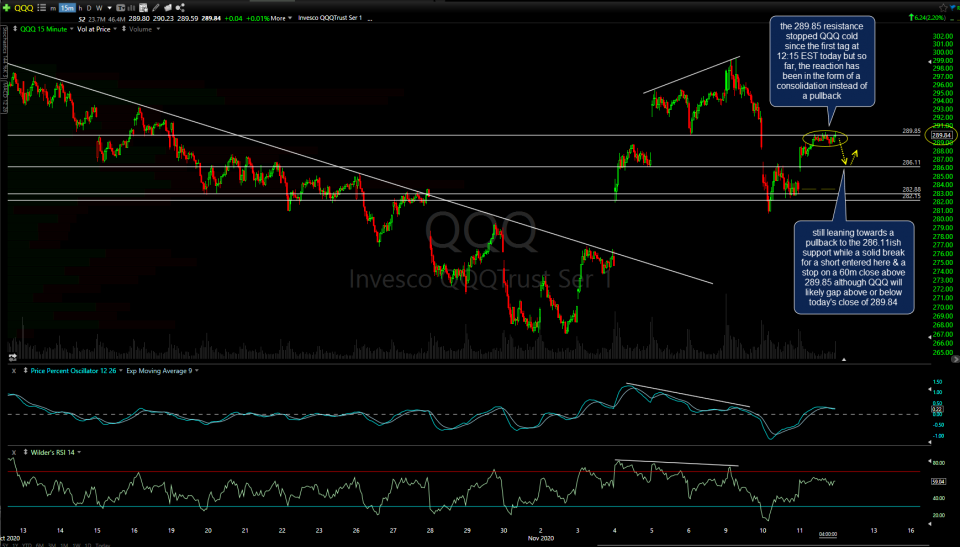

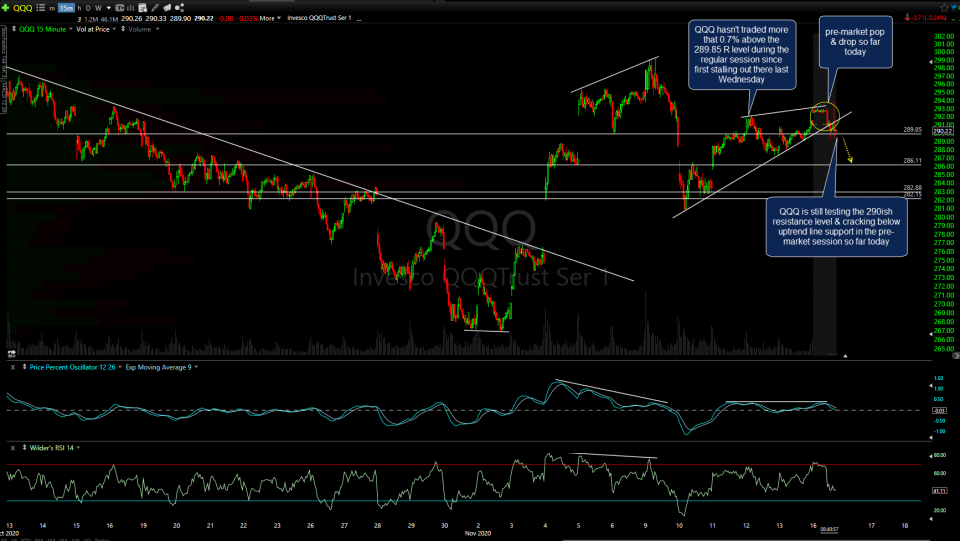

QQQ is still testing the 290ish resistance level that was first highlighted on the 15-minute time frame last Wednesday (first chart below) & cracking below uptrend line support in the pre-market session so far today. However, the stock futures are still holding above 60-minute trendline support (more significant/higher weighting) for now.

So far in the early pre-market session today, QQQ had a pre-market pop & drop while the Q’s haven’t traded more than 0.7% above the 289.85 resistance level during the regular session since first stalling out there last Wednesday. Should the stock futures break those 60-minute trendlines with conviction, the minimum target for QQQ remains just above 286.10 but as I like to say, support is support until & unless broken. As such, we could be looking at new highs in the $SPX soon unless both /ES & /NQ solidly break below those trendlines with the 60-minute trend indicators flipping from bullish to bearish. Updates to come later after the regular session is underway.