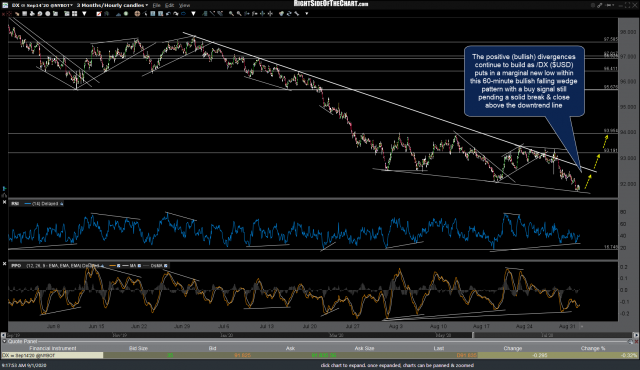

The next buy signal has been triggered on this breakout above the intersecting downtrend line + 93.191 resistance level on /DX (US Dollar futures) thereby opening the door for the next leg up to my next price target of 93.954. Should that occur it would be net bearish for gold as gold tends to trade inversely to the US Dollar. Previous (Sept 1st & Sept 4th) and updated 60-minute charts below.

Note: The charts below are in a gallery format that will not appear on the email notifications but may be viewed under this post on rsotc.com (short url). Click on the first chart to expand, then click on the arrow at the right to advance to the next chart. Expanded charts can be panned & zoomed for additional detail.

- DX 60m Sept 1st

- DX 60m Sept 4th

- DX 60m Sept 8th

/GC (gold) is backtesting the recently broken downtrend line from below with positive divergences at the most recent low. My preferred scenario (red) has /GC rejected off the trendline with another leg down although with bullish divergences in place at the recent lows, a solid break back above the trendline & the 1952ish resistance level would likely trigger a rally up to at least the 1997 resistance level (green). Previous & updated 60-minute charts below.

- GC 60m Sept 1st

- GC 60m Sept 4th

- GC 60m Sept 8th

/SI silver continues to defend the 26.220 support level with a sell signal to come on a solid break and/or 60-minute close below (preferred scenario) with a solid break above 27.308 would be near-term bullish. Previous & updated 60-minute charts below.

- SI 60m Sept 4th

- SI 60m Sept 8th

While I still favor the next-term bearish scenarios for gold & silver, one potential bullish catalyst for the precious metals, particularly gold, could be another big swoon down in the stock market as gold catches a flight-to-safety bid. However, another big leg down in the stock market doesn’t assure a rally in gold as quite often, especially with current market conditions, gold can come under pressure from forced selling due to margin call liquidations as was the case when the stock market & gold both fell sharply into the March lows earlier this year. A false/failed breakout in the US Dollar futures followed by another leg down would also be a net positive for gold.