Member @dazi requested an update on gold & the precious metals mining stocks. My recent outlook for gold has been largest based off my analysis & bearish outlook for the EUR/USD (Euro/U.S. Dollar forex pair). Since the last update, EUR/USD reversed exactly off the bottom of my bounce target zone while not coincidentally, gold futures (/GC) reversed exactly off the lower most bounce/reversal targets that we also posted last week. Pretty bearish price action as the recent counter-trend bounce in both gold & the EUR/USD were very shallow & reversed (so far) at the lower-end of the expected range. Previous & updated EUR/USD charts below.

- EUR-USD daily Sept 19th

- EUR-USD daily 2 Sept 27th

- EUR-USD daily Sept 29th

- EUR-USD daily Oct 2nd

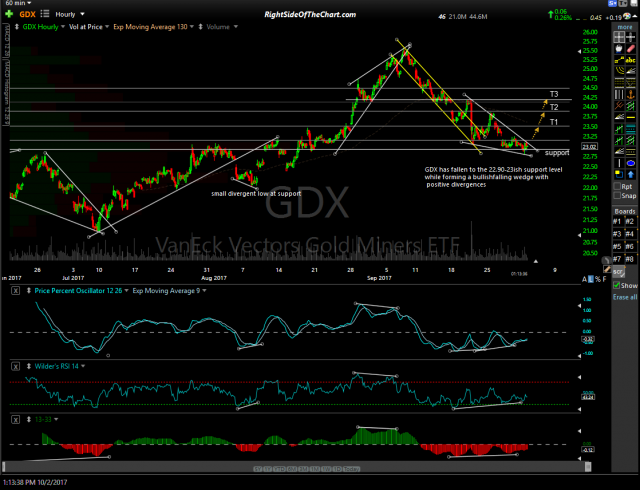

However, both gold futures as well as GDX have confirmed positive divergences on the 60-minute time frames, with GDX near the apex of a bullish falling pattern while also trading at the 22.90-23.00 support level. As such, the odds are good for another bounce in gold & GDX very soon, especially if the EUR/USD manages to hold above the 1.17 support level for a while. A buy signal for a swing trade on GDX would come on a break & 60-minute close above that falling wedge pattern along with a reversal in gold prices and EUR/USD holding above the 1.17 support level. Potentiual bounce targets for GDX are shown on the 60-minute chart below at 23.50, 23.90 & 24.15 with resistance at both the downtrend line & 23.20 level.

- GC 60-min Oct 2nd

- GDX 60-min Oct 2nd

Should EUR/USD break the 1.17 level with conviction & move much lower, and a long position gold would likely face headwinds due to the fact the US Dollar would be rising. Due to the fact that I can still make a decent case for more downside in the EUR/USD, espcially if that 1.17 support level gives way, GDX or gold are not official trade ideas at this time although I will continue to monitor gold & GDX closely & post any significant developments that I notice.