The EUR/USD has broken out above the bullish falling wedge pattern that has been highlighted in recent videos, such as this one. Should this breakout stick, as the charts indicate is likely, that would help to support the intermediate & longer-term bullish outlook for gold & the mining stocks as the EUR/USD rising means that the US Dollar is falling against the Euro which is, by far, the largest component in the US Dollar index (and a falling Dollar is bullish for gold).

Likewise, GLD (gold ETF) and GDX are also rallying in response to the weaker Dollar as the Fed continues to placate the market with dovish comments & actions following the Q4 temper tantrum the stock market threw to make it crystal-clear that a hawkish Fed just wasn’t acceptable as both the equity market & economy have clearly become addicted & completely dependent on easy money. As such, the Fed gave the addict more of what it wanted today, essentially promising no more rate hikes for the remainder of the year.

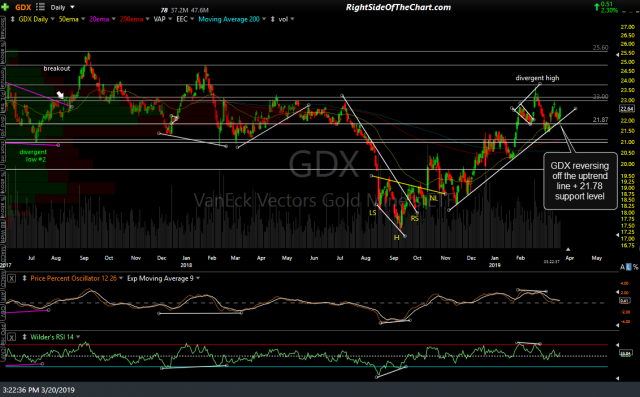

- GDX daily March 20th

- GLD daily March 20th

The big question regarding the stock market is whether keeping the easy money spigot flowing will be enough to reverse what has been a fairly clear & somewhat sharp turn-down in many economic indicators in recent months. Artificially low interest rates coupled with unprecedented amounts of liquidity (money created out of thin air) a la the various rounds of QE since the Great Recession have carried the stock market to nose-bleed valuations & far beyond the average lifespan & returns of previous bull markets but the big question is ‘how much longer can the Fed delay the inevitable?’ as for every economic expansion/bull market there is a recession/bear market that follows. That always has been the case & always will be, which is about the only guarantee that you’ll get in the stock market. Regardless of what the stock market does, the longer-term bullish outlook for gold remains bullish & will continue to firm up if the US Dollar builds on today’s losses in the coming days/weeks.