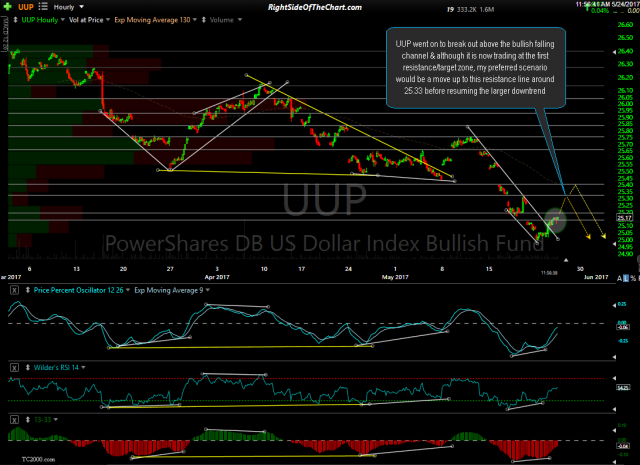

GLD (Gold ETF) went on to break down below the 60-minute bearish rising wedge pattern posted yesterday with UUP (U.S. Dollar ETN) also breaking out above the bullish descending price channel. Hard to say where this pullback would end but I favor the reversal to come anywhere from the top to the bottom of the target zone but leaning towards a reversal near the top of the zone. Previous & updated 60-minute charts:

- GLD 60-minute May 23rd

- GLD 60-minute May 24th

- UUP 60-min May 23rd

- UUP 60-minute May 24th

On a related note, this scenario (a little more upside in gold followed by a resumption of the larger uptrend) also meshes with my most recent scenario for the stock market, namely QQQ, in which my expectation posted yesterday leaning towards one last thrust up to a marginal new high to extend the current divergences that were already in place. However, that gets a little tricky now as QQQ came within a mere 5 cents of the previous reaction high (May 16th) shortly after the open today, effectively (but not technically) making a double-top high which would also be a divergent high as the indicators were/are still well below their April 25th peaks.

Bottom line is just as I stated yesterday, I can see the possibility of a little more upside in the markets before a meaningful drop but so little that the R/R is clearly skewed to being short vs. long at this time as any upside appears very limited. As there has been a fairly strong inverse correlation between the risk-on (e.g.- QQQ, tech stocks, small caps) and the risk-off (gold, treasury bonds, etc..) assets recently, one could expect gold to begin the next rally around the time that the stock market begins the next sell-off.

As of now, I can see a little more upside in QQQ & still lean slightly towards that scenario as typically when prices get this close to making a new high, the powers-that-be (market makers, HFT & algo trading programs, etc..) will pop the market above that level to run the stops on shorts & suck in some longs chasing the breakout to new highs before reversing from long to short. However, I would not be surprised in the least to see both equities & gold reverse trend at any time now.

My GDX stop was hit shortly after yesterday’s update on GDX, GLD & UUP & I don’t currently have any position in the metals or miners. At this point, I’ll just leave the suggested stop on the GDX trade as originally posted (any move below 22.11) but as always, that’s just a suggested stop level for those that are targeting the final price target of 23.98 & did not book any profits when T1 was hit or after the bearish rising wedge in GLD was highlighted yesterday. At this time I have no desire to short GDX & my preference is to wait for the next objective long entry which I think will come within the next few trading sessions or by the end of next week by the latest.