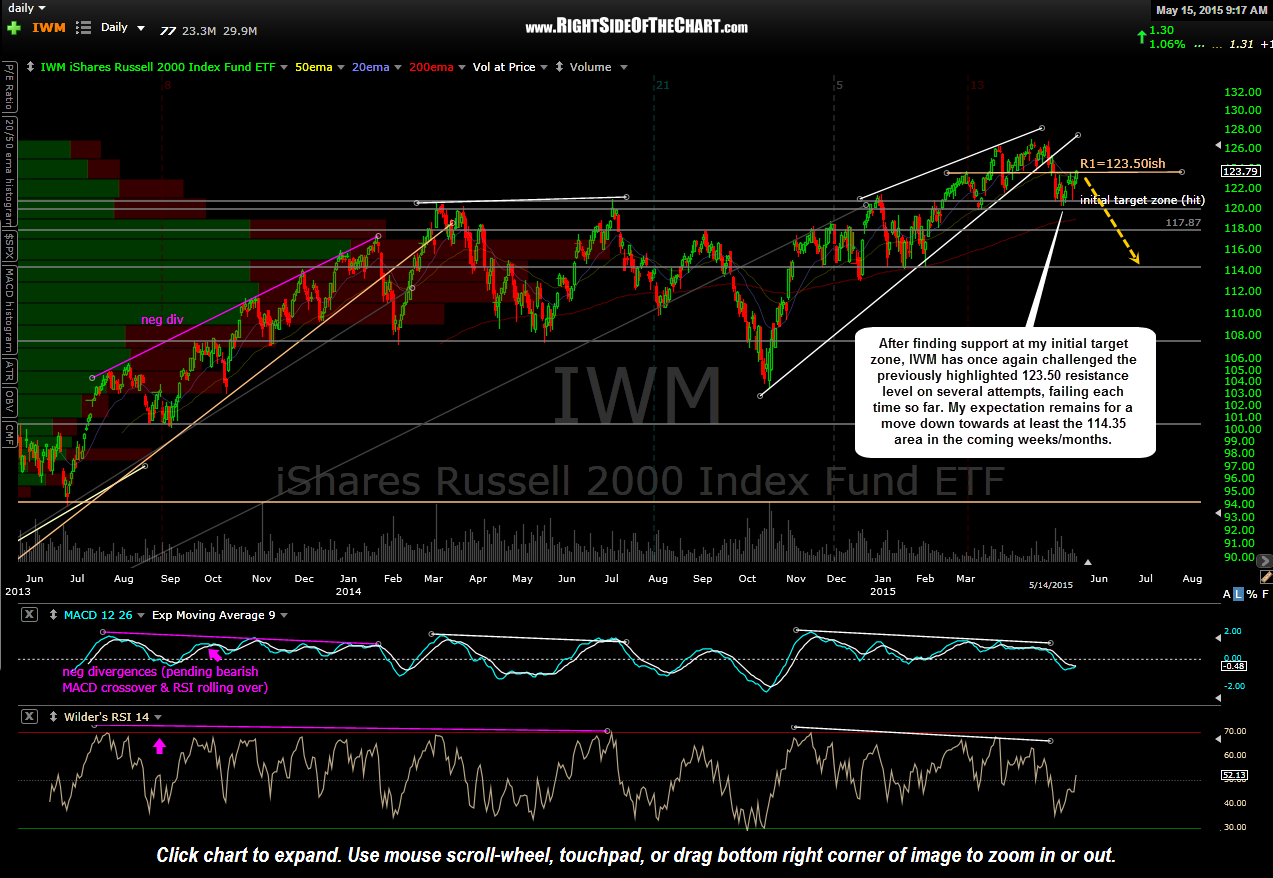

The recent sloppy price action in the broad markets has led to numerous whipsaw signals lately & although I still have some short exposure via QQQ & IWM, as stated last Thursday, I have not added & will not add to those positions until I see a compelling reason to do so. As far as when I’ll pull the plug on those index shorts, I’m willing to allow about another 2-3% upside in the broad markets. QQQ & especially IWM are still comfortably below their recent highs and although I don’t have any exposure to SPY, I’m watching for (and almost expecting) the next whipsaw signal to be for the bulls with a breakout above the 212.40ish level. Even a break above this resistance level that has been capping all advances in the SPY since Feb would still have the SPY within a bearish rising wedge pattern with double negative divergences in place. Bottom-line: Although a breakout in the SPY would appear bullish on face value, the odds that it will fail are quite elevated IMO.

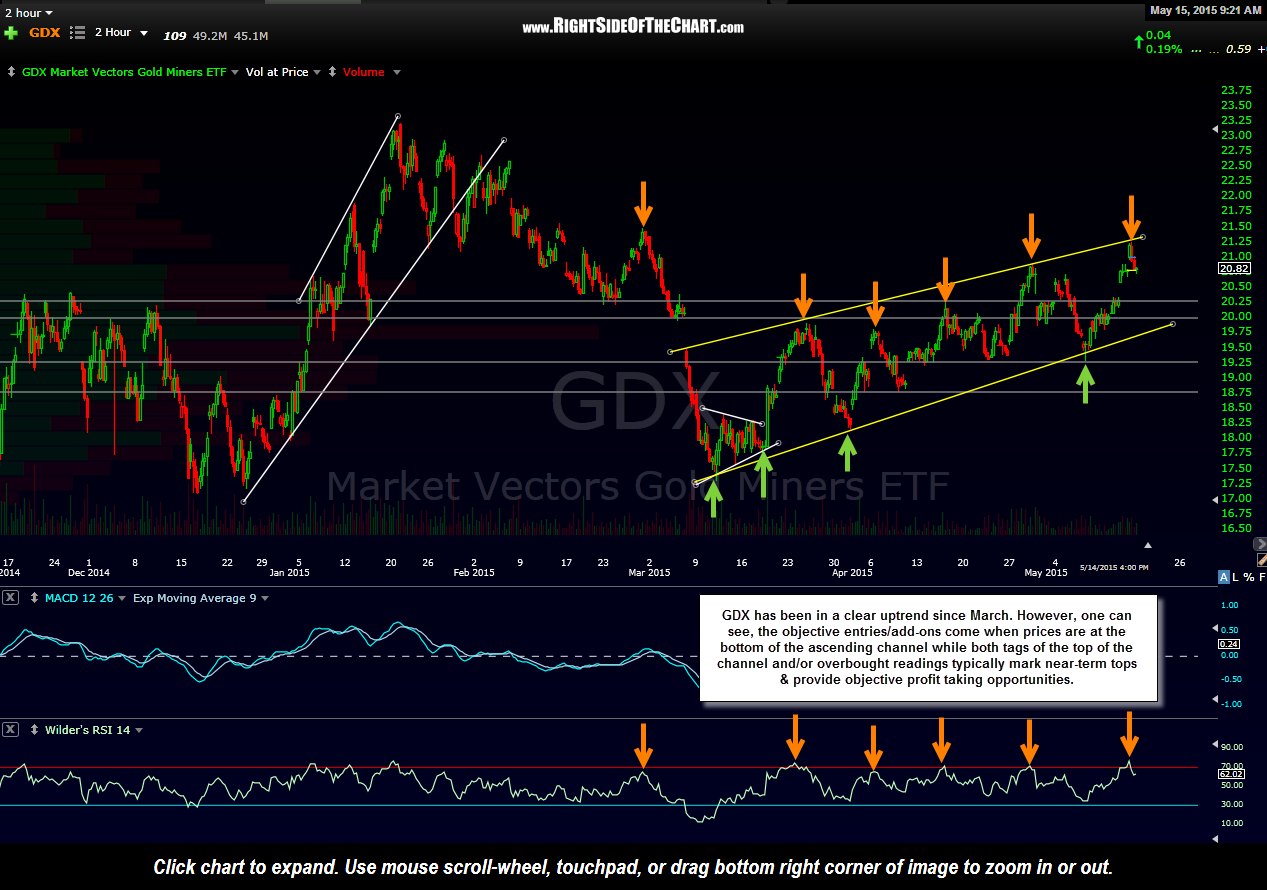

GDX has been in a clear uptrend since March. However, one can see, the objective entries/add-ons come when prices are at the bottom of the ascending channel while both tags of the top of the channel and/or overbought readings typically mark near-term tops & provide objective profit taking opportunities. Also keep in mind that if my reversal in the $USD (UUP rally) call pans out, that will likely create additional headwinds for gold & the mining stocks, which not only just tagged the top of this ascending price channel but also registered an overbought reading when they did so (i.e.- downside in the miners is likely in the coming days).