Here’s a quick look at the 60-minute charts of the market-leading FAAMG stocks, most which are still above trend & have yet to trigger a sell signal (green check box). MSFT is one of only 2 of the 5 FAAMG stocks that is trading below the 60-minute trendline although not by much and a breakdown in any one or two of the FAAMGs is likely to prove to be a whipsaw (false breakdown) unless the rest of the lot follow suit.

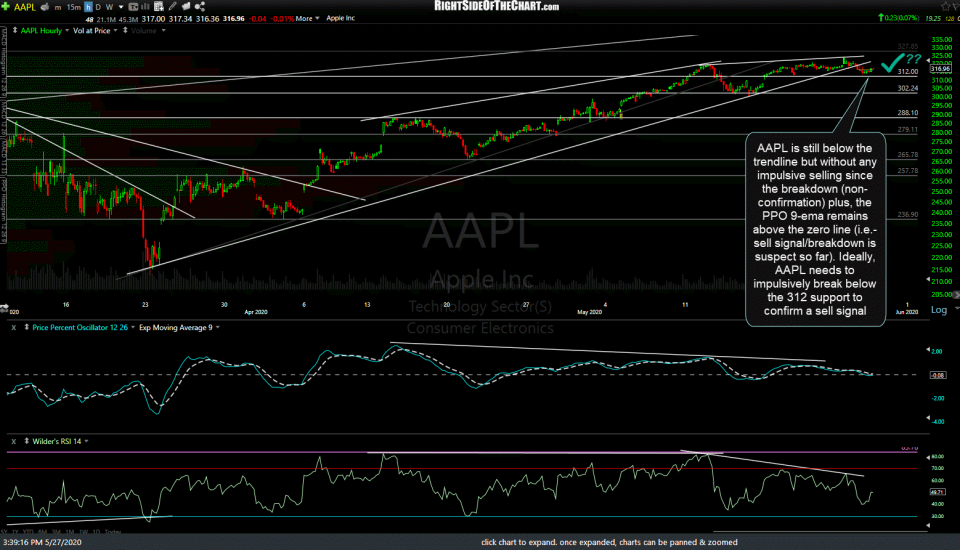

AAPL is still below the trendline but without any impulsive selling since the breakdown (non-confirmation) plus, the PPO 9-ema remains above the zero line (i.e.- sell signal/breakdown is suspect so far). Ideally, AAPL needs to impulsively break below the 312 support to confirm a sell signal.

AMZN is still trading comfortably above the key 2280 support level (bottom of the multi-week trading range).

GOOGL tested & has so far held above the primary uptrend line (no sell signal) with the PPO 9-ema still above the zero line.

FB still well above the primary uptrend line (no sell signal) with the PPO 9-ema still above the zero line. Bottom line: Close but no cigar for a sell signal on the FAAMGs as we head into the close today. To be continued tomorrow…