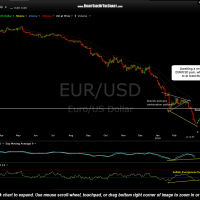

So far, starting with calling for a reversal in the EUR/USD (euro/dollar pair) a couple of weeks ago, then moving to the charts of the FXE (by request of those who prefer trading the Euro with the FXE) virtually every turn has been called with near impunity so far. Will that streak continue? Now that my 108.05 target has been hit, looking for a pullback before one more thrust higher to the 109.86 area.

- EUR-USD daily March 10th

- EUR-USD 60 minute March 16th

- EUR-USD daily March 16th

- EUR-USD 60 minute March 17th

- EUR-USD 120 minute March 17th

- EUR-USD 60 minute March 18th

- EUR-USD daily March 18th

- FXE 60 minute March 18th

- FXE 60 minute 2 March 18th

- FXE 60 minute March 19th

- FXE 60 minute March 20th

- FXE 60 minute March 26th

(to view the trading history of the EUR/USD & FXE, click on the first chart to expand, then click anywhere on the right-hand side of each chart to advance to the next chart).

The previously posted EUR/USD & FXE charts above give a visual picture of how well currencies have traded off the technicals lately and as previously discussed, whether or not one cares to trade currencies, integrating the $USD and other major currencies into your analysis can give additional insight as to where dollar sensitive assets such as US equities, precious metals and commodities are likely headed. With the recent extremely one-sided trade of long dollars/short euros quickly becoming unwound, leading to a lot of forced selling of dollars/shorting covering of euros, it is possible that the FXE just punches on thru the 108.05 resistance but again, I continue to favor a pullback here (which, of course, would correlate into a bounce in the $USD), before a resumption on the uptrend in the euro, with FXE moving up towards the 109.86 target area before any meaningful & lasting pullback in the euro (bounce in the $USD).