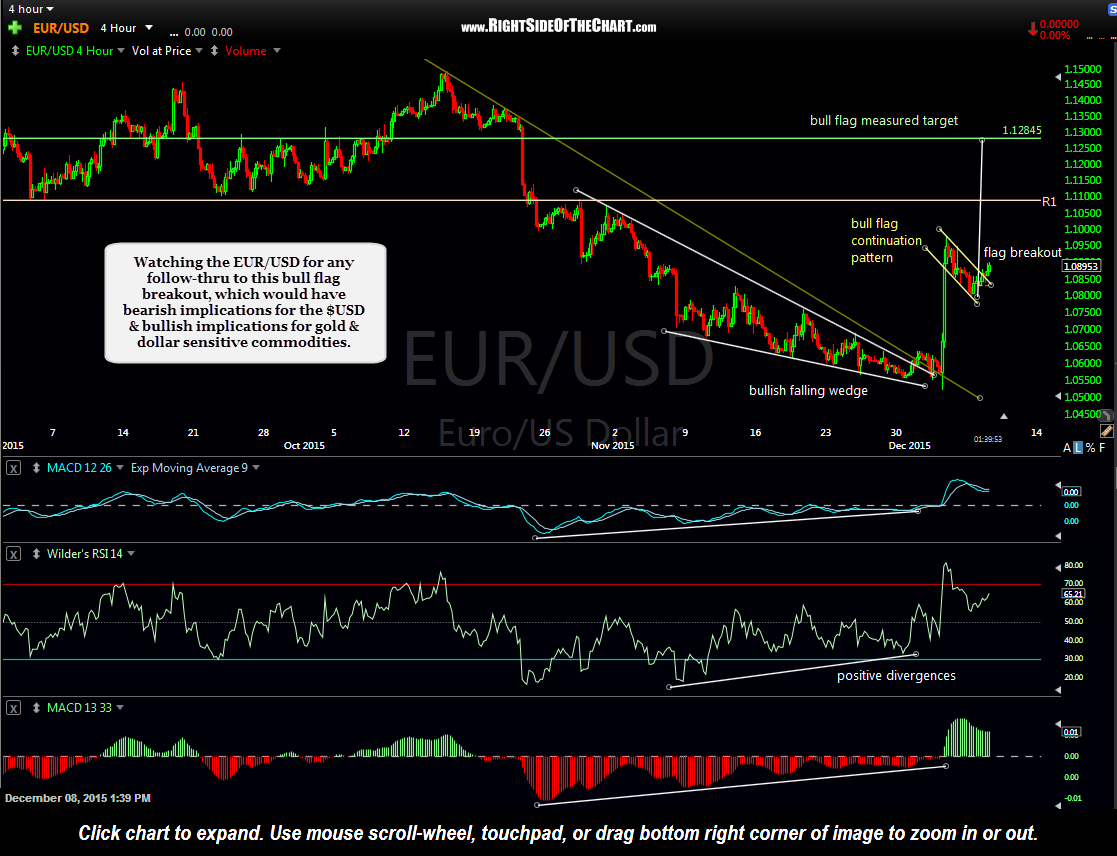

Watching the EUR/USD for any follow-thru to this bull flag breakout, which would have bearish implications for the $USD & bullish implications for gold & dollar sensitive commodities.

EUR-USD Bull Flag Breakout Could Spark Next Leg Higher In Gold Stocks

Share this! (member restricted content requires registration)

2 Comments