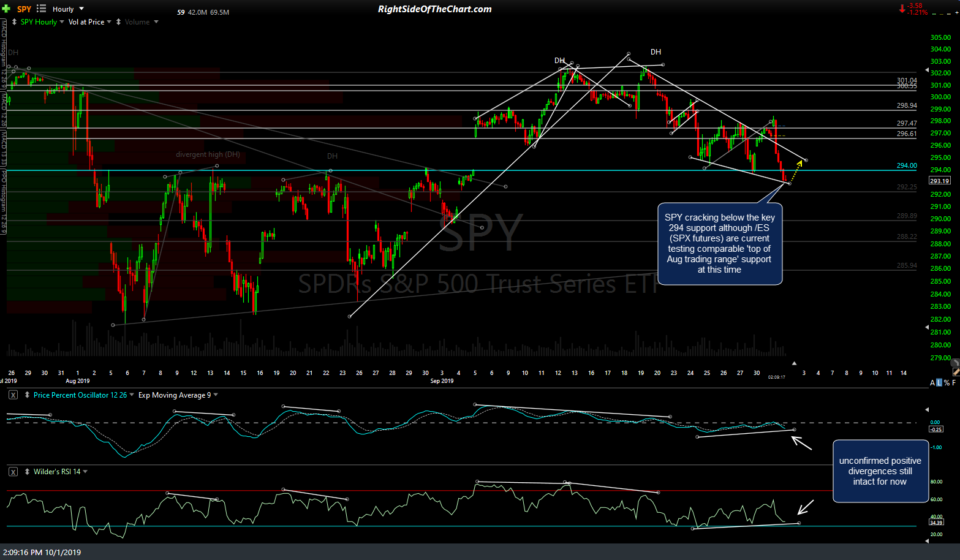

With SPY trading slightly below 294.00 (top of Aug trading range), /ES (S&P 500 E-mini futures contract) is currently testing the bottom of the 2939-2946 top of Aug range “support zone” with the potential positive (bullish) divergences still intact although very close to being negated or ‘taken out’, should /ES continue much lower. 60-minute charts below.

- ES 60m 3 Oct 1st

- SPY 60m 3 Oct 1st

Today’s sell-off since the reversal at 10:00 am EST hasn’t been very impulsive although the selling has been quite persistent, with very little to any buying, at least so far, at the support levels on both the S&P 500 & Nasdaq 100 where buyers “should have” stepped in. As of now, the major stock indexes remain above ($SPX) or within ($NDX) their August trading ranges while trading on on near the Dec 24th uptrend lines. While the indexes could start to move impulsively below those supports any time/day now, it would be prudent to hold off on adding any short exposure at this time as the odds for a rally off these supports are still decent.

With the risk-off assets (gold, silver & T-bonds) still trading below the previously highlighted resistance/target levels, I’m still leaning towards at least a minor rally off the top of the $SPX August trading range but wouldn’t at all be surprised to see things go the other way, with a late-session dump into the close. As such, I remain mildly long the indexes & mildly short the risk-off assets in my active trading account & still net short the indexes in my longer-term accounts although I’m ready to either close or flip those active trading positions on short notice, depending on how things go as we head into the final two hours of trading.