The positive divergence was confirmed via a bullish crossover on the QQQ 60-min chart & by all accounts, this bullish falling wedge appears ripe for a breakout. However, I still favor another thrust down to T3 at this time, even if it comes after a failed pop above the wedge pattern. With that being said, this is a pretty clean falling wedge pattern so it would be prudent to respect any impulsive breakout which is also confirmed by a breakout above the comparable downtrend line on the 60-minute chart of SPY.

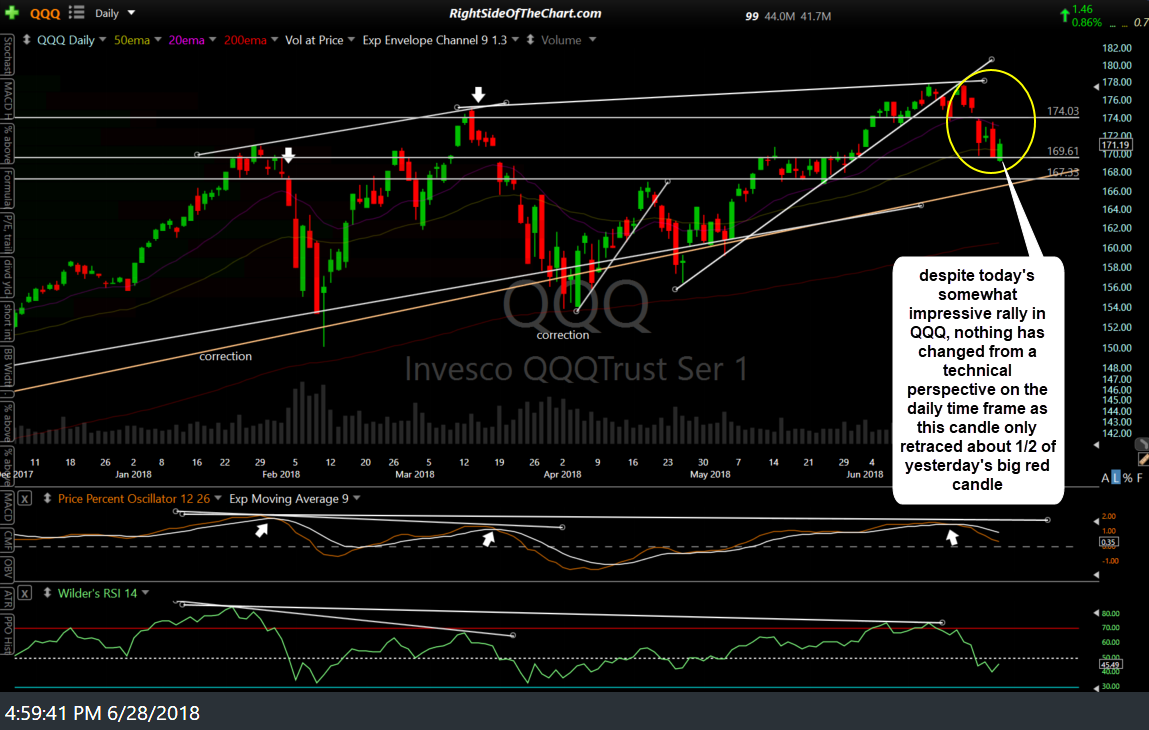

Zooming out to the bigger picture, despite today’s somewhat impressive rally in QQQ, nothing has changed from a technical perspective on the daily time frame as this candle only retraced about 1/2 of yesterday’s big red candle with QQQ still yet hit even the minimal 38.2% Fibonacci retracement level of the move down off the June 20th high.

As with QQQ, we have some technical cross-currents on SPY with the 60-min bullish divergences confirmed today yet the PPO signal line is still well below zero, keeping that near-term trend bearish since June 15th. Unlike QQQ which tagged its 60-minute downtrend line today & closed slightly below it, SPY closed comfortably below its near-term downtrend line today after failing at the 271.20ish resistance level. My preferred scenario has SPY making at least one more thrust down below today’s lows although an impulsive breakout above the downtrend line could change that.