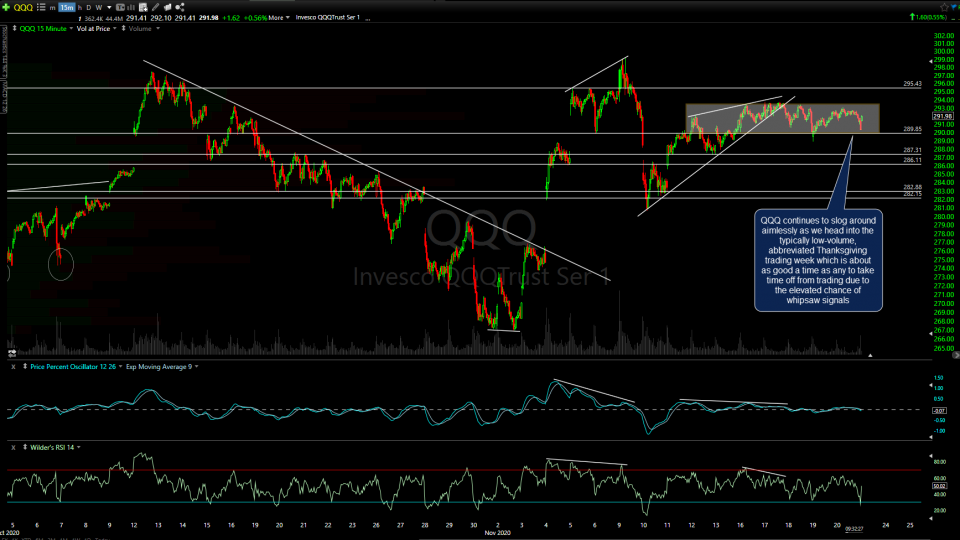

QQQ continues to slog around aimlessly as we head into the typically low-volume, abbreviated Thanksgiving trading week which is about as good a time as any to take time off from trading due to the elevated chance of whipsaw signals. 15-minute chart below.

/NQ (Nasdaq 100) is pinching towards the apex of this 60m triangle pattern with an upside break likely to spark a rally up towards 12117 or a downside break a drop towards 11782. However, the odds for whipsaws/false breakouts during the low-volume abbreviated holiday trading week are elevated. 60-minute chart below.

/ES (S&P 500) has been grinding around sideways all month within smaller trading ranges inside of the larger trading range. A break above the current (yellow) range would likely spark a rally to the top of the previous range while a downside break should take /ES to at least the 3520 support. However, with the abbreviate & low-volume holiday trading week, whipsaws & more sideways grinding is likely until at least next week. 60-minute chart below.

/GC (gold) continues to grind around between the 1852 support & the blue downtrend line on this 120-minute chart: A solid break below would be bearish while bullish on a solid upside break.

/KC coffee is starting to form a relatively steep uptrend line on this 120-minute chart with the 1.1585 support just below.

While the broad market continues to slog around sideways, many of the trade ideas highlighted in recent videos, such as these, continue to outperform as they aren’t heavily indexed.

With trading volumes typically low & whipsaws fairly common during the abbreviated Thanksgiving trading week, I’ll be in & out of the office over the next few sessions as I typically refrain from trading. If I come across anything that stands out I’ll pass it along. Otherwise, I’ll do a post-market wrap later today as well as follow up on any questions, comments, or chart requests.