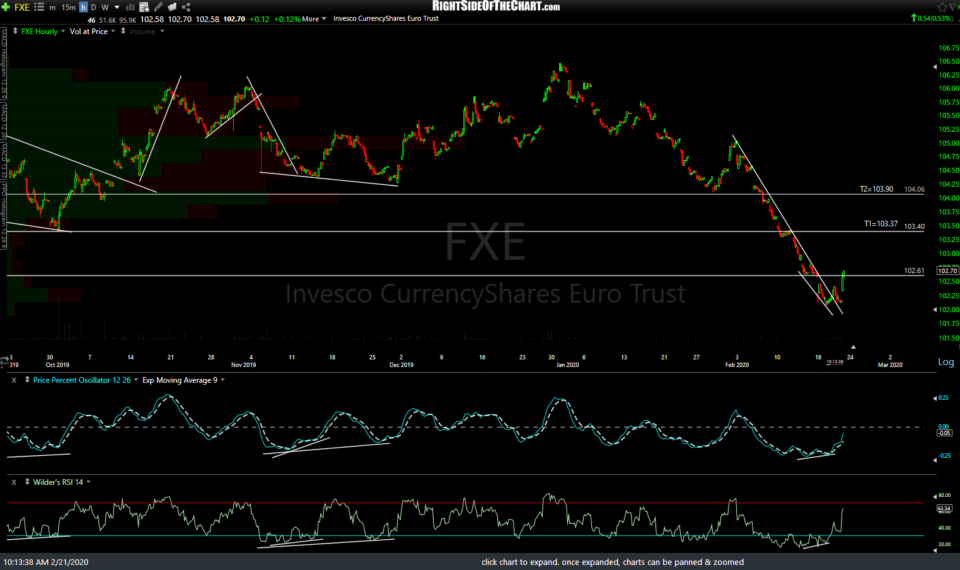

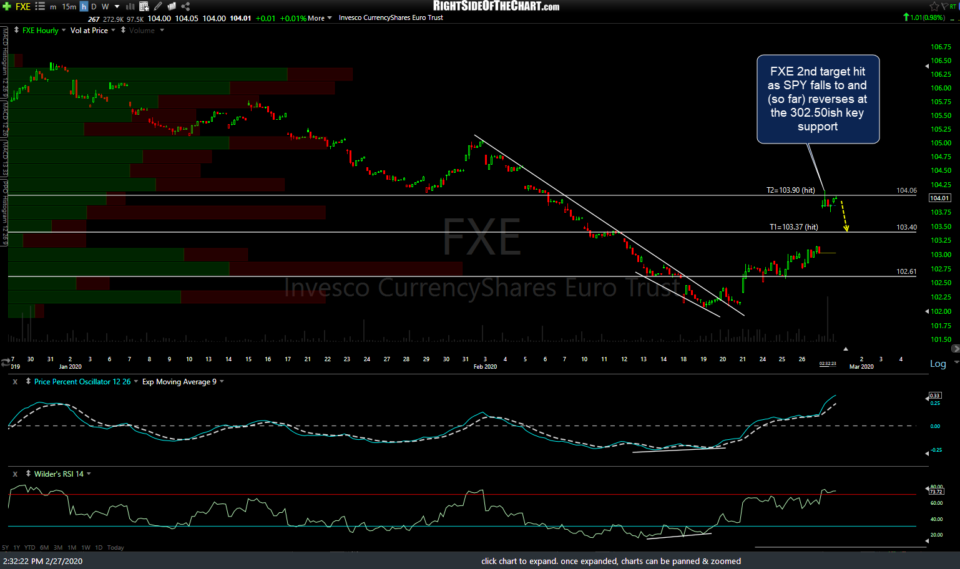

Both /E7 (Euro futures) and FXE (Euro ETN) have hit their 2nd & final initial* swing targets at the same time that SPY hit & (so far) reversed off the key 302.50ish support level highlighted in the video earlier today. As a reversal off this resistance level is likely, especially if the US stock market rallies from later today or earlier next week, considering booking profits, raising stops or reversing to a short for a pullback trade. Original 60-minute charts followed by the updated charts of /E7 & FXE below. click on charts to expand

- E7 60m Feb 21st

- E7 60m 2 Feb 21st.png

- E7 60m 2 Feb 27th

- FXE 60m Feb 21st.png

- FXE 60m 3 Feb 27th

Essentially, the way it works is this: As the largest component of the US Dollar index, the Euro basically moves inversely to the Dollar. The US stock market & US Dollar tend to have a positive correlation so most likely, the scenarios laid out here (Euro corrects, Dollar & stock market rally) or this support on the stock market & resistance on the Euro get taken out with both continuing to the next support & resistance levels. I favor the former but with just over an hour left in this week’s trading session, we’re going to have to wait until Monday to see which scenario plays out & with volatility as high as it is, my guess is we’ll be looking at a big gap up or down on Monday so probably best to keep position sizes light over the weekend, whichever way you are positioned (or go home flat & wait to see how we open next week).