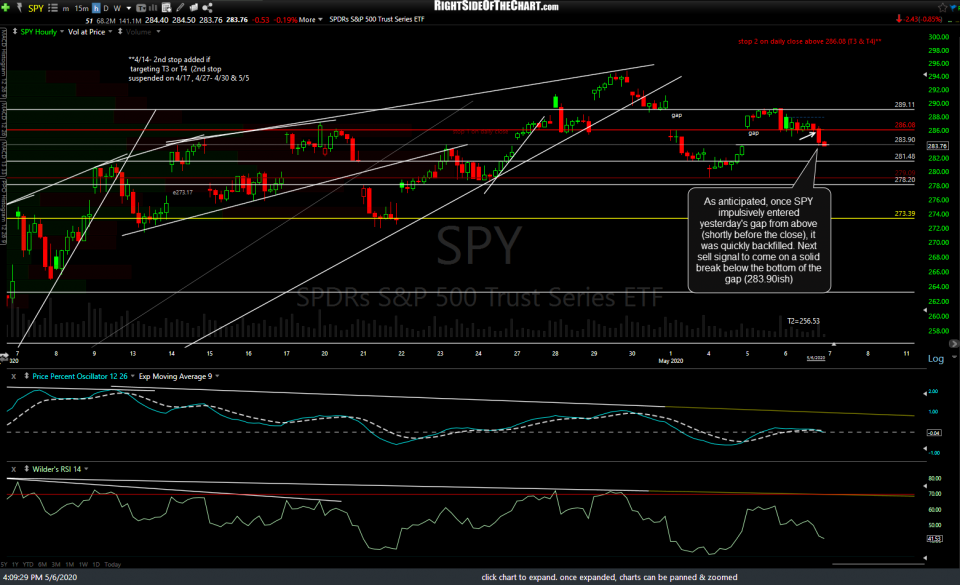

In lieu of a video, here’s a quick look at the 60-minute charts of the S&P 500 & Nasdaq 100 tracking ETFs & futures. As anticipated, once SPY impulsively entered yesterday’s gap from above (shortly before the close), it was quickly backfilled. Next sell signal to come on a solid break below the bottom of the gap (283.90ish).

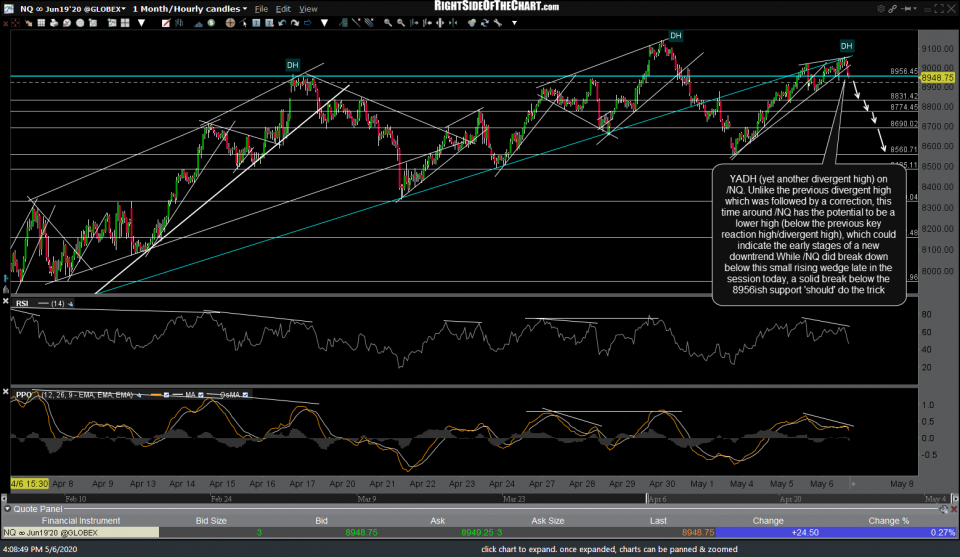

Today’s marginal new high in QQQ extended the negative divergences that were already in place, setting the stage for what could be an even larger drop if/when those divergences play out for a trend reversal soon. Next sell signal to come on a solid break below the top of this dual gap support level.

/ES (S&P 500 E-mini futures) effectively put in a divergent high (a nearly-equal high with lower highs on the indicators) with yet another failure at the key 2882.75 resistance level followed by a sell signal with the breakdown, backtest & impulsive drop below the minor uptrend line.

YADH (yet another divergent high) on /NQ (Nasdaq 100 futures). Unlike the previous divergent high which was followed by a correction, this time around, /NQ has the potential to be a lower high (below the previous key reaction high/divergent high), which could indicate the early stages of a new downtrend. While /NQ did break down below this small rising wedge late in the session today, a solid break below the 8956ish support ‘should’ do the trick.