Wash. Rinse. Repeat. YADH (Yet Another Divergent High) in /CL (crude futures) with the next sell signal pending a break this minor uptrend line. USO (1x long) & DWT (3x short) are two popular ETF proxies for shorting crude. 60-minute chart:

/KC (coffee futures) trying to break out above the minor downtrend line but the key 1.00 level is the more significant level to watch right now IMO. JO (coffee ETN) is still on watch for a breakout but the highest probability entry will come on a break above 1.00 on coffee futures.

Still awating a break below last Thursday’s lows on /ES-SPY & /NQ-QQQ for a probability sell signal on the US stock indexes. 60-min charts of /ES & /NQ below:

- ES 60-min March 1st

- NQ 60-min March 1st

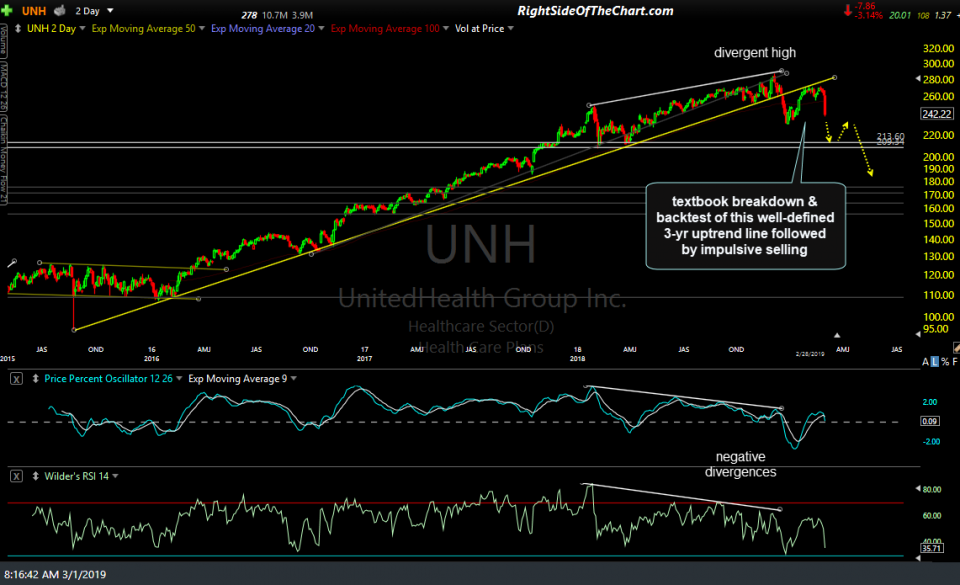

While reviewing the charts of the top 20 or so components of the S&P 500 on Wednesday night, UNH stood out as the most compelling trade setup, long or short. I had considered adding it as an active short trade yesterday morning but with the S&P 500 & Nasdaq 100 still yet to take out last Thursday’s lows coupled with the resilient trend in the broad market & most importantly, the fact that UNH has fallen to long-term (10-year) trendline support, I’m going to give this one the benefit of the doubt & wait for either an impulsive intra-week break or a solid weekly close below that long-term bull market trendline.

The recent price action on the daily chart looks like something straight out of the T.A. textbooks: UNH put in a divergent high in early December after numerous tests of an extremely well-defined 3-year uptrend line (multiple tests in close proximity often indicate weakness in the stock vs. one test & back off to the races). Shortly after the divergent high, the stock broke down below the trendline followed by very impulsive selling (which helps to confirm the breakdown). Following the 19% drop off the divergent high, the stock experienced a typical oversold bounce/initial kickback rally which took it back to make a perfect backtest of the trendline from below, once again followed by impulsive selling. UNH is on watch as a potential official short swing trade.