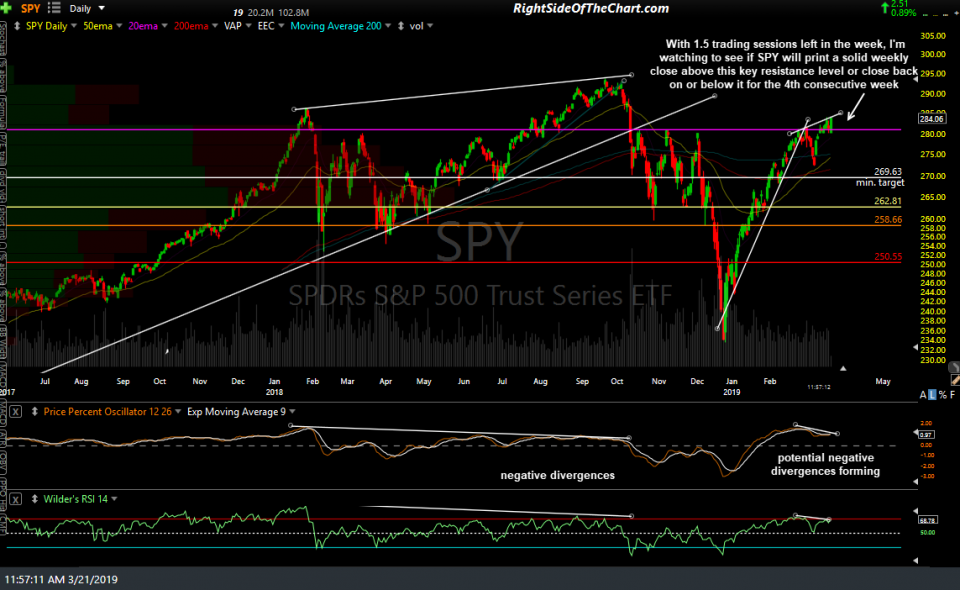

While this isn’t a comprehensive overview of the financial markets, a few charts that I’m watching this week are the broad market via SPY (S&P 500 tracking ETF), TLT (20-30 yr Treasury Bond ETF) and XLF (Financial Sector ETF). Starting with the former, with 1.5 trading sessions left in the week, I’m watching to see if SPY will print a solid weekly close above this key resistance level or close back on or below it for the 4th consecutive week. Intraweek moves, especially those surrounding yesterday’s FOMC announcement & press conference, should be taking with a grain of salt as the usual post-FOMC volatility often causes sharp & rips dips in both directions until the dust settles.

After falling as much as 27% off the end of the bull market top in Jan ’18, XLF is still trading 15% below that top as of today, XLF (finanical sector ETF) has been starting to roll over following the most recent divergent high + failure at the 61.8% Fibonacci retracement of the Jan ’18 – Dec ’18 drop. As such, the next leg down in the 2018-20?? bear market may very well be just getting underway in the financial sector, which is one of the top-weighted sectors in the S&P 500. (note: XLF peaked around Feb back in 2007, about 10 months before the market-leading tech sector, XLK).

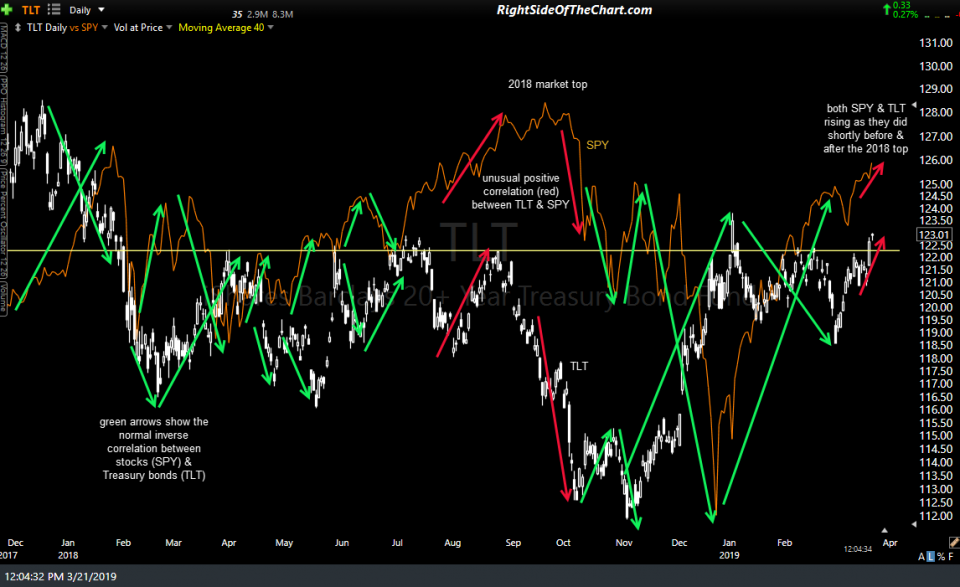

So far today, TLT is following through to yesterday’s breakout above the key 122.50ish resistance level. The second chart below highlights the usual inverse correlation (green arrows) between Treasury bonds (TLT) and the stock market (SPY), also highlighting the few rare instances where Treasury bonds were rallying in lock-step with equities, such as just before the Q4 ’18 stock market plunge as well as the past couple of weeks.

- TLT daily March 21st

- TLT vs SPY March 21st

Pardon my absence in the trading room today as I’m taking advantage of the post-FOMC ‘noise’ to take some time away from my desk & spend some time with family while my kids are on spring break & will be away from my desk for most of today while in & out tomorrow. If there are any significant developments by the close of trading today I will post an update/market wrap & I will reply to trading room questions & chart requests at my earliest convenience. Thank you for your patience.