We have an impulsive breakdown (large red candle) below the 60-minute bear flag on QQQ in the pre-market session so far today, thereby triggering the next sell signal & opening the door to a drop to at least the 199.80 support level.

Likewise, /NQ has impulsively broken down below the 60m bear flag pattern, increasing the odds of another wave of selling today.

/ES has taken out the secondary uptrend line & is currently testing the 3012 support with the next sell signal to come on a break below 3097 (yellow line).

After flagging, /RTY (small-cap futures) has broken down below the 1606 support, opening the door for another thrust down to the 1580-1584 support/target zone.

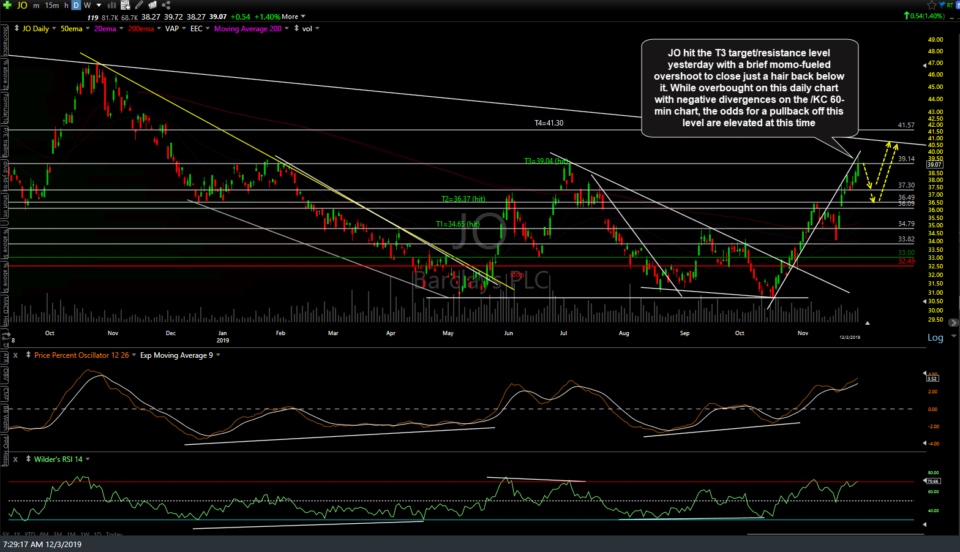

JO (coffee ETN) hit the T3 target/resistance level yesterday followed by a brief momentum-fueled overshoot to close just a hair below that key level. While overbought on the daily chart (first chart below) with negative divergences on the /KC coffee futures 60-minute chart (second), the odds for a pullback off this level are elevated at this time. Consider either booking full or partial profits and/or raising stops if holding out for the next targets (downtrend line & then 41.50ish level).

- JO daily Dec 3rd

- KC 60m Dec 3rd