The stock market was closed yesterday for the President’s Day holiday. While I’ll be away from my desk for a couple of hours this morning for an appointment, here are a few of the charts I’ll be watching today.

/NG (nat gas futures or UNG, nat gas ETN) is likely to spark a rally up to my 4.90ish target if it can solidly punch through this 3.85ish resistance while pullbacks to this key uptrend line continue to offer objective add-ons or re-entries. 120-minute chart below.

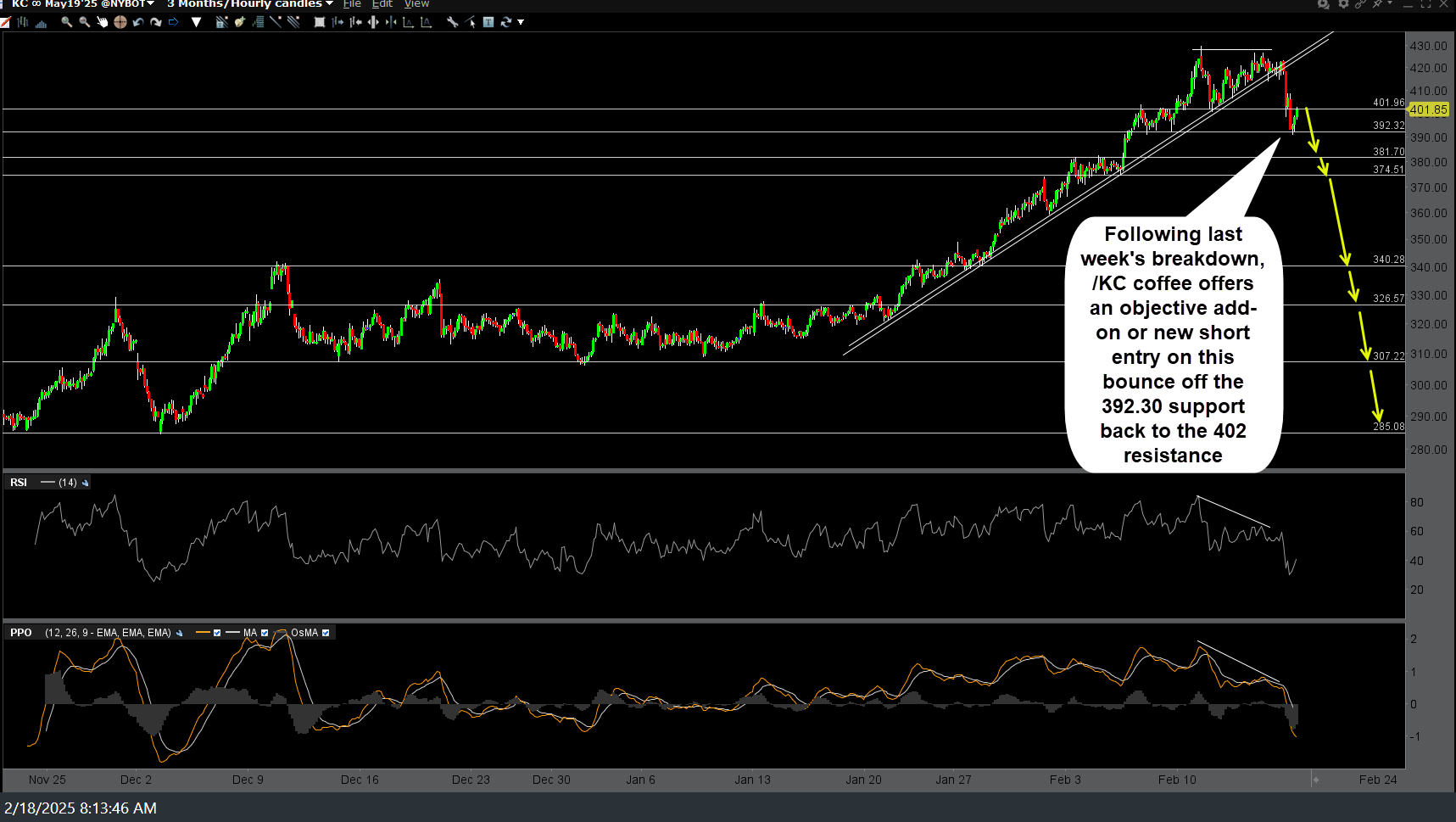

Following the trendline breakdown/sell signal I highlighted last week, /KC coffee offers an objective add-on or new short entry on this bounce off the 392.30 support back to the 402 resistance level (former support). 60-minute chart below (as mentioned recently, to the best of my knowledge there aren’t any coffee tracking ETFs or ETNs trading since JO was discontinued).

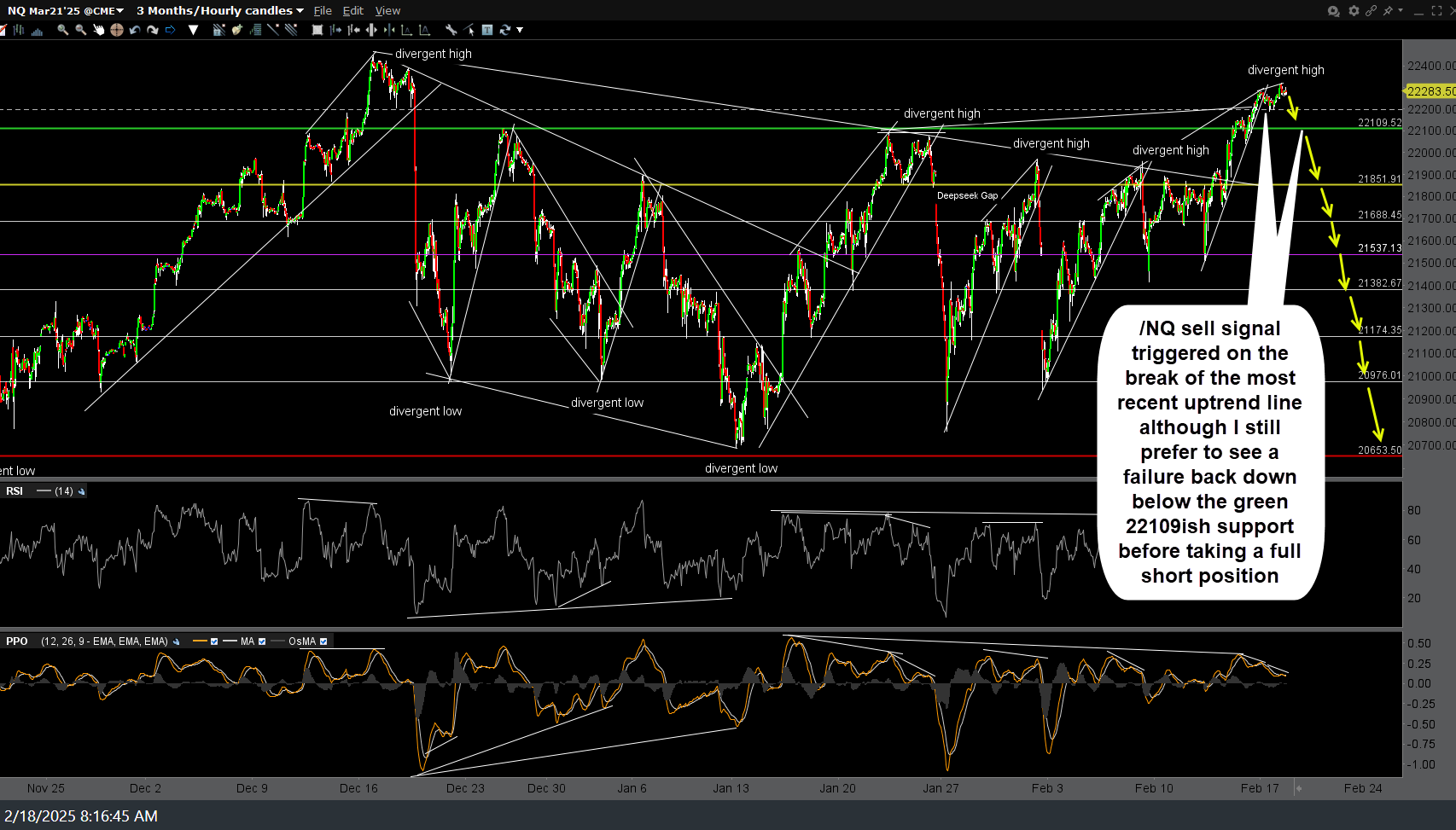

/NQ sell signal triggered on the break of the most recent uptrend line although I still prefer to see a failure back down below the green 22109ish support before taking a full short position. 60-minute chart below.

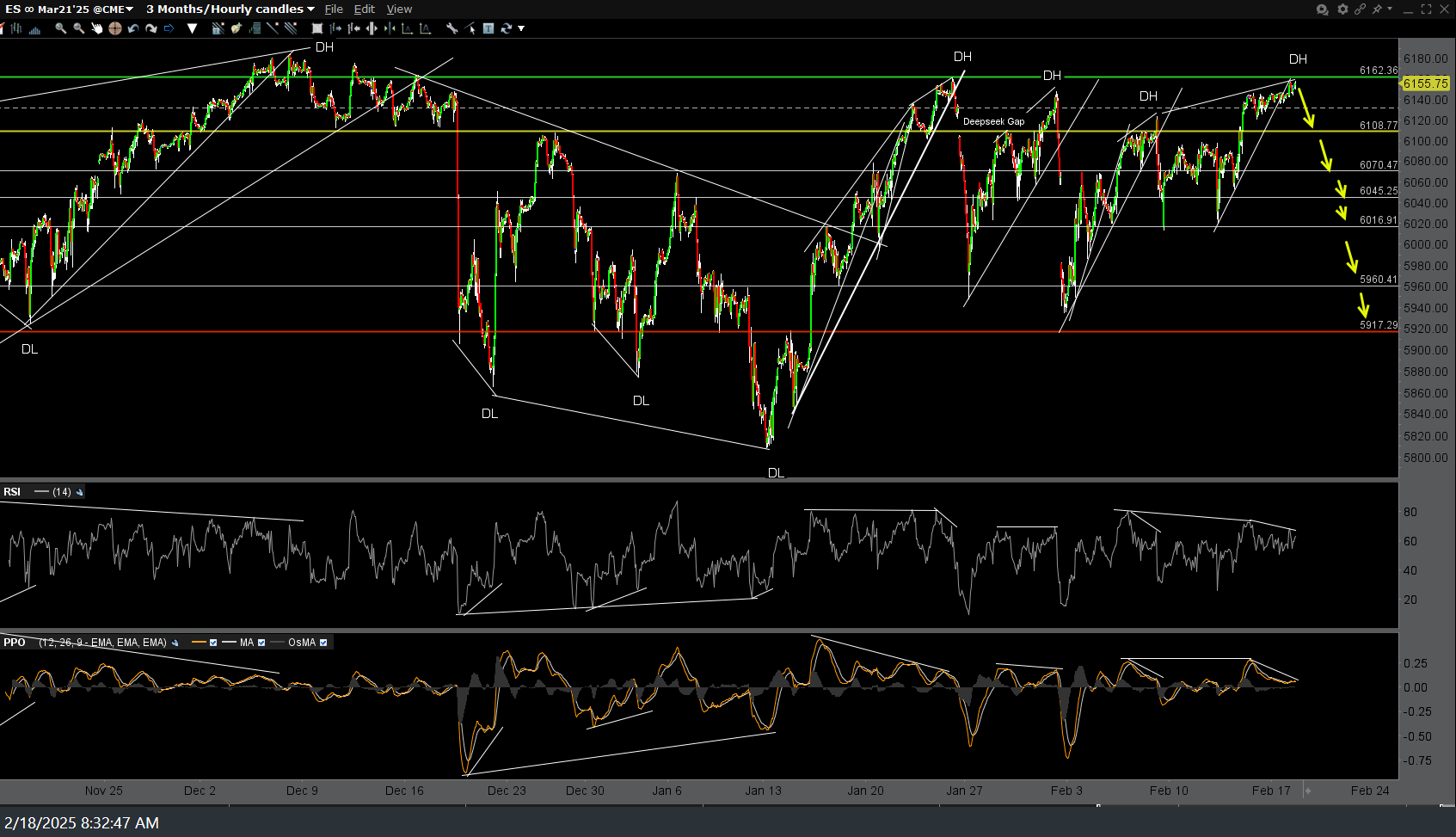

/ES (S&P 500 futures) 60-minute chart with key support & resistance levels for reference below.