Soybeans appear poised for a rally following the recent divergent low on the 60-minute chart of /ZB (soybean futures) below.

SOYB is the Soybean ETF which is may be added as an official trade as early as today after the market opens although a case for an objective long entry on this pullback to the intersecting downtrend line + 15.38 support level can certainly be made. I’ve included the daily chart of SOYB with some likely price targets below.

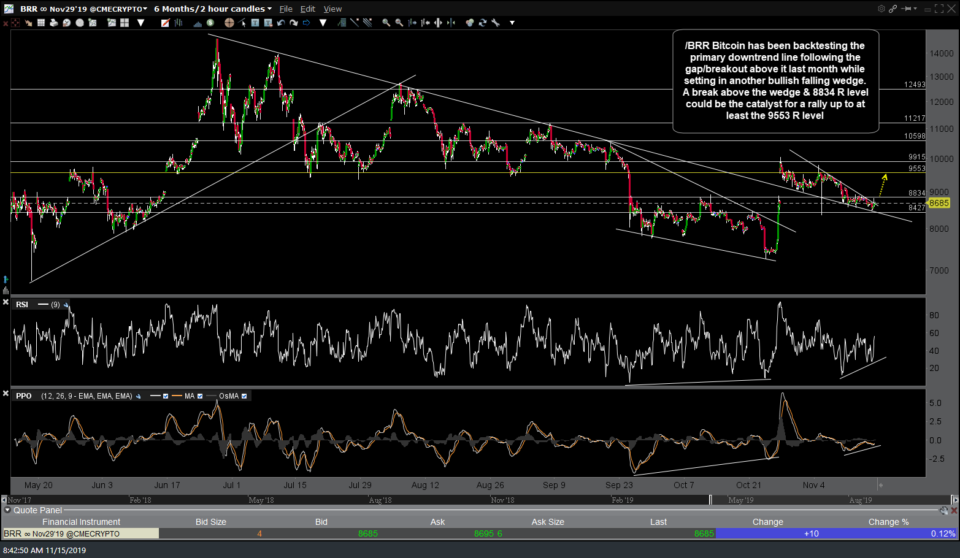

/BRR Bitcoin has been backtesting the primary downtrend line following the gap/breakout above it last month while setting in another bullish falling wedge. A break above the wedge & 8834 resistance level could be the catalyst for a rally up to at least the 9553 resistance level.

After closing out the recent GBTC long trade for a quick 27% profit on Oct 28th, it went on to make a near-perfect reversal off the 11.95 resistance level in which the max. final target was adjusted just below & has been backtesting the downtrend line + 1st target area (now support) since. As such, GBTC is also under consideration for another long entry as well, once again targeting just below the 11.95 resistance level.

/E7 euro futures appear poised to rally following the recent correction to the 1.1010 support & divergent low on the 60-minute chart below.

FXE (Euro ETN), which is also under consideration as an official trade idea, offers an objective long entry on this pullback to the 104.41 support for a swing trade up to & quite possibly beyond the 106 resistance level.