QQQ remains in a near-term uptrend as it continues to work higher within the lower half of the price channel. The next sell signal may come on a break below the channel although QQQ is unlikely to make any big moves until Thurs or Fri after the big earnings reports from MSFT, AMZN & INTC.

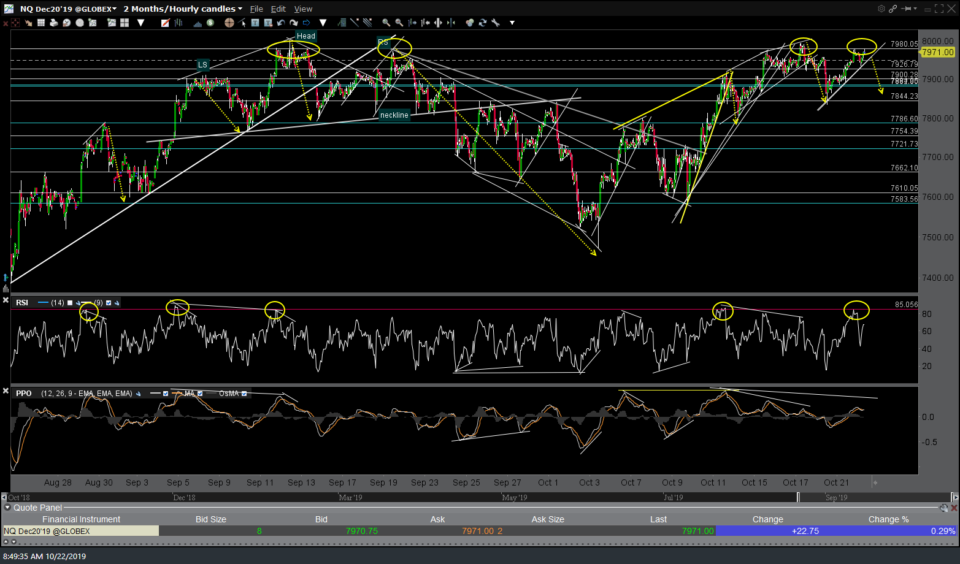

Although I don’t foresee any large moves, up or down, in the $NDX before those big earnings reports are out of the way, there are 9 reasons on the 60-minute chart of /NQ below why I favor a pullback in /NQ today even though QQQ is currently poised to gap higher at the open today. The 4 circles up top highlight the failures at the 7980 resistance levels where the 5 circles on the RSI below show the tags of the extreme oversold 85 level, all of which were also followed by pullbacks/corrections.

On a somewhat related note (as Treasury bonds tend to move inversely to the stock market), /ZB (30-yr T-bond futures) have broken out above minor downtrend line resistance following the recently highlighted divergent low on the 60-min chart with the next buy signal to come on a break above this second minor trendline.

Likewise, /ZN (10-yr T-bond futures) appears poised to rally on a break above both downtrend lines on this 60-minute chart.

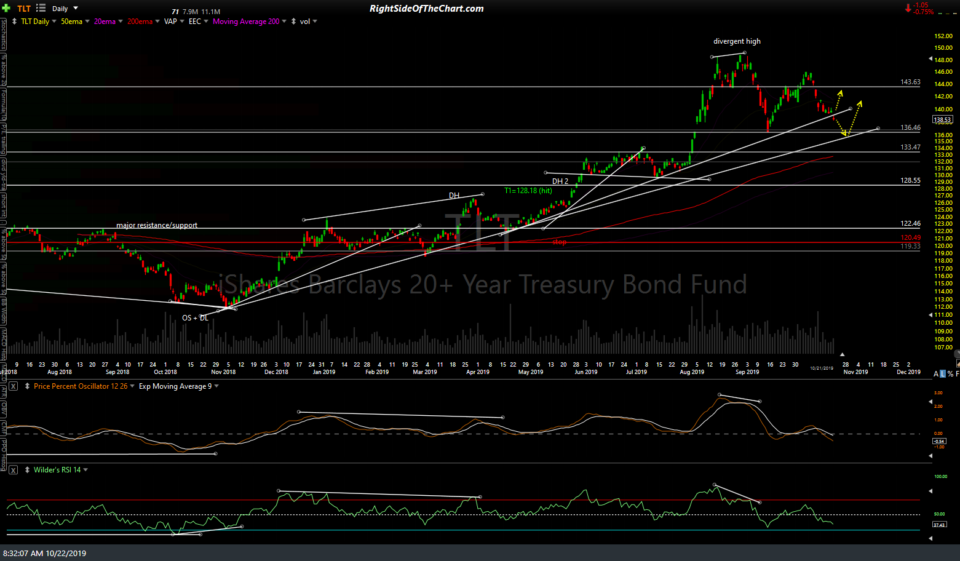

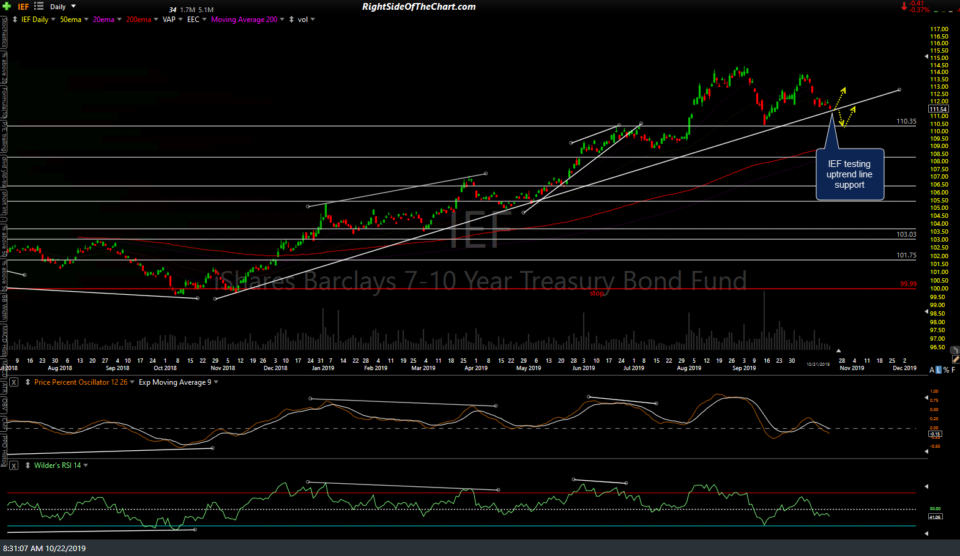

TLT (30-yr T-bond ETF) and IEF (10-yr T-Bond ETF) has also fallen to trendline support on these daily charts below with decent support not far below should those TL’s go.

- TLT daily Oct 22nd

- IEF daily Oct 22nd

LIT (Lithium ETF) is still on watch for a break above the minor & primary downtrend lines. LIT, as well as numerous individual lithium stocks that are setting up in potentially bullish technical postures, were recently highlighted in this video on Sept 20th.

FYI- I have a few more charts that I was going to post but I just lost power & my UPS battery backup will only run my trading PC & 4 monitors for a short while so I’m going to fire off this post now & will follow up with the others when my power is restored.