There’s really not much to add that wasn’t covered in the mid-session market analysis video published early today but to sum it up:

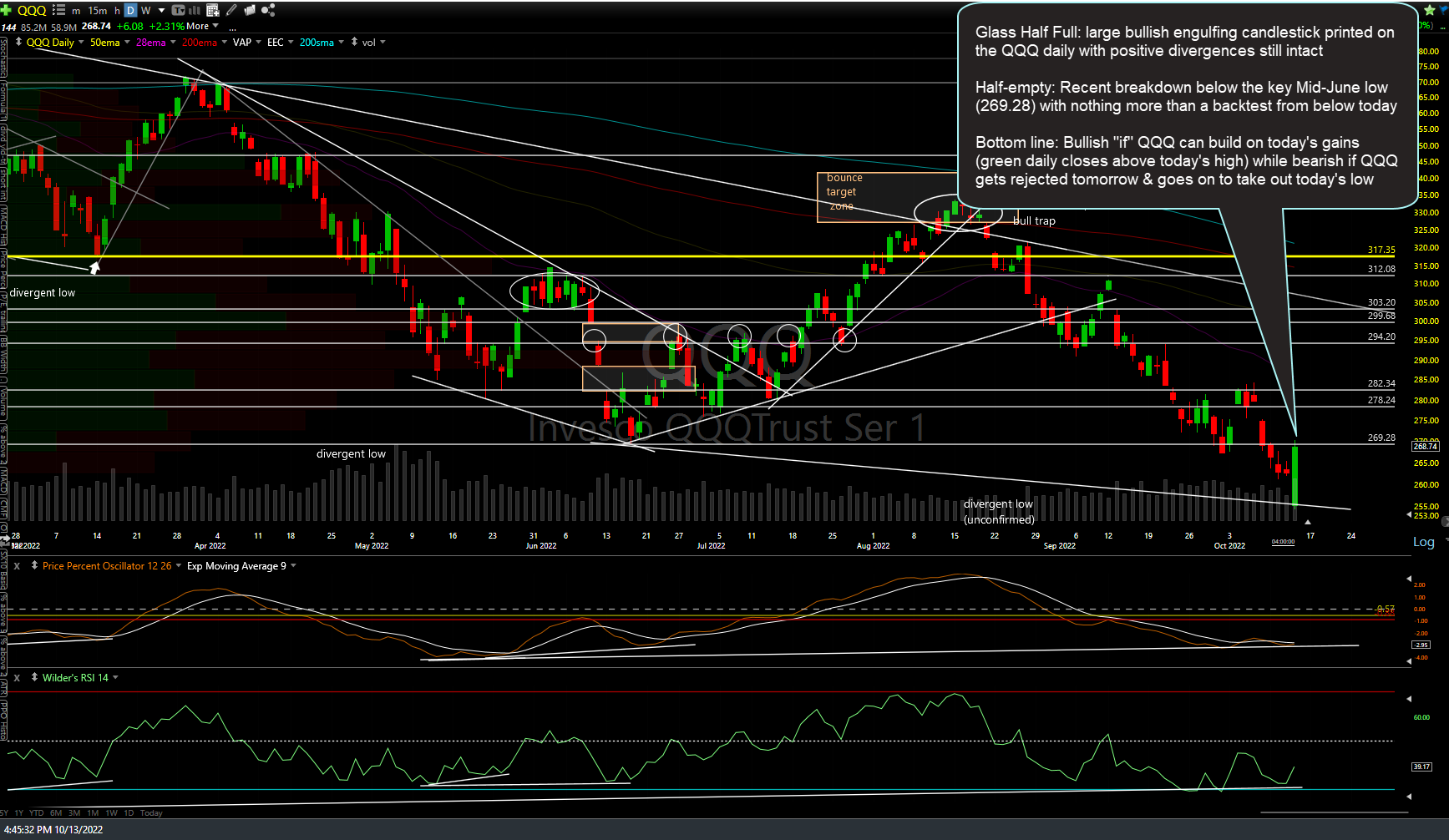

For the Glass Half Full (bullish) case: The major stock indexes printed large bullish engulfing candlesticks on the daily time frames today with positive divergences still intact. Bullish engulfing candlesticks often prove to be bottoming sticks, marking the end of a primary bearish trend & the start of a new uptrend. However, always best to wait to see confirmation via additional upside over the next couple of trading sessions (green closes above today’s highs… the ‘greener’ the close, the better).

Glass Half Empty (bearish): QQQ recently broke down below the key Mid-June low (269.28) with nothing more than a backtest from below today, essentially offering an objective short entry or add-on (on a bounce back to resistance) as most trend indicators remain clearly bearish at this time.

Bottom line: Bullish “if” QQQ & SPY can build on today’s gains (green daily closes above today’s high) while bearish if QQQ gets rejected tomorrow & goes on to take out today’s low. With several of the largest financial companies reporting earnings tomorrow before the opening bell, hopefully, the market will give us some clarity on which way it wants to go from here by tomorrow’s close before heading into the weekend. I will add that even if the market prints another solid green close tomorrow, it will remain in a fairly precarious technical posture, just above the 52-week/bear market low that was put in today & some of the largest gaps down during bear markets come on a Monday. As such, best to keep things relatively light heading into the weekend as one can always add to a long or short position next week.