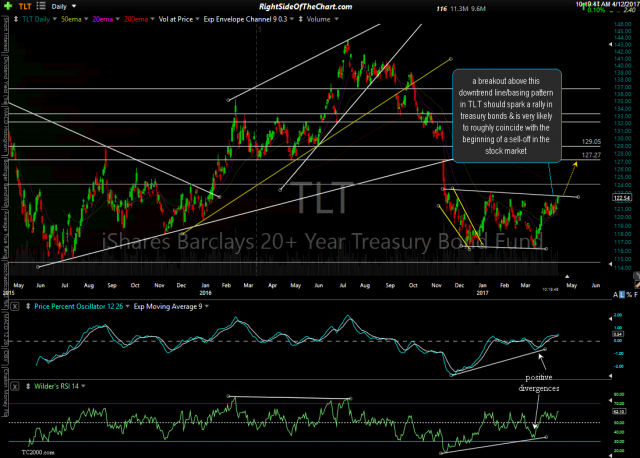

A breakout above this downtrend line/basing pattern in TLT (Long-term Treasury Bond ETF) should spark a rally in treasury bonds & is very likely to roughly coincide with the beginning of a sell-off in the stock market. Hard to say if that breakout in TLT will come very soon as TLT is somewhat stretched on the intraday time frames with potential negative divergence forming on the 60 & 120-minute charts. As such, maybe one final reaction off this downtrend line on that TLT basing pattern before a breakout & sustained rally? Hard to say but one constant almost always holds true in the financial markets & that is the flight-to-safety bid that treasury bonds catch during an impulsive selloff in the stock market.

- TLT daily April 12th

- TLT 120-min April 12th

- QQQ daily April 12th