There’s an old saying in trading/investing about how most gaps are back-filled at some point in time. The statistics on what percentage of gaps are filled range depending on the source but the author of this article from 2013 claims to have conducted a backtest spanning 24 years showing that over 91% of all gaps were eventually filled.

As I’m still positioned net short & even added more exposure yesterday when the only two broad stock indices that I’m short, IWM & QQQ were back-filled, I’d rather see those gaps back-filled sooner than later. Back-filling those gaps yesterday opens the door for the next leg down without any unfinished business (i.e.- leaving behind an unfilled gap).

Here’s a snap-shot of the major index tracking ETFs (1 minute charts as of yesterday’s close) with the yellow dashed lines showing Friday’s closing values (i.e.- the tops of yesterday’s gaps). Despite a virtually flat close, only 3 of the 11 sectors that comprise the S&P 500 closed positive yesterday & of those, the volume on all 3 was pathetically low, a sign of non-confirmation when stocks move higher on low/below average volume. Also worth noting is the fact that only one major US stock index, the thinly diversified (only 30 stocks) Dow Jones Industrial Average, was the only major US stock indices that failed to fully back-fill yesterday’s gaps although the Dow did manage to take home the dubious distinction of its worst losing streak since 2011.

- SPY 1 min March 27th close

- DIA 1-minute March 27th close

- QQQ 1 min March 27th close

- MDY 1 minute March 27th close

- IWM 1 min March 27th close

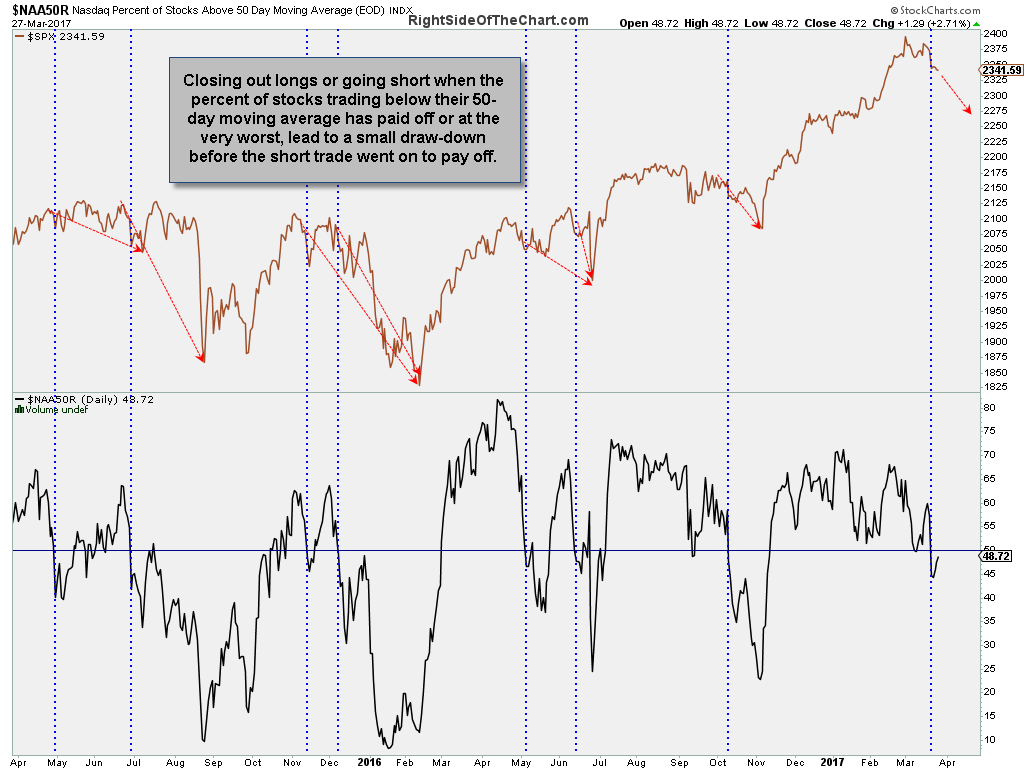

The recent trend has been one of deteriorating internals in the market, with fewer & fewer mega-cap stocks, namely the top components of the tech heavy Nasdaq 100, doing most of the heavy lifting while the majority of stocks move lower. That deterioration of market internals is also evidenced by the fact that the majority of stocks in the Nasdaq Composite were trading below their 50-day moving average as of yesterday’s close. As this chart of the $NAA50R (Nasdaq Percent of Stocks Trading Above Their 50-day Moving Average) shows, closing out long or going short when the $NAA50R has dropped below 50% has paid off either immediately or at the very worst, after a small draw-down before the short trade went on to pay off.

Today should be interesting. With yesterday’s gaps already back-filled, with the dip-buyers & nervous shorts continue to bid the market higher with more buying & short-covering was yesterday’s gap back-fills simply evidence that the downtrend that kicked-off with the March 1st highs is starting to gain some momentum by opting to immediately back-fill yesterday’s gaps in order to get that out of the way & open the door for the next leg down without leaving any unfinished business behind?