ALK (Alaska Air Group Inc) was added as a Short Trade Setup back in early January, going on to trigger a short entry & then hitting the second profit target about a month later for a 17% gain. As noted both before & after T2 was hit, a “significant reaction“ was expected off that level & that is exactly what occurred. ALK has now come full circle by backtesting the the Ascending Broadening Wedge pattern that was the trigger for the short entry in early January. As such, ALK offers an objective add-on, new short entry or re-entry for those who booked profits at T2 with a new suggested stop of a daily close above 80.00

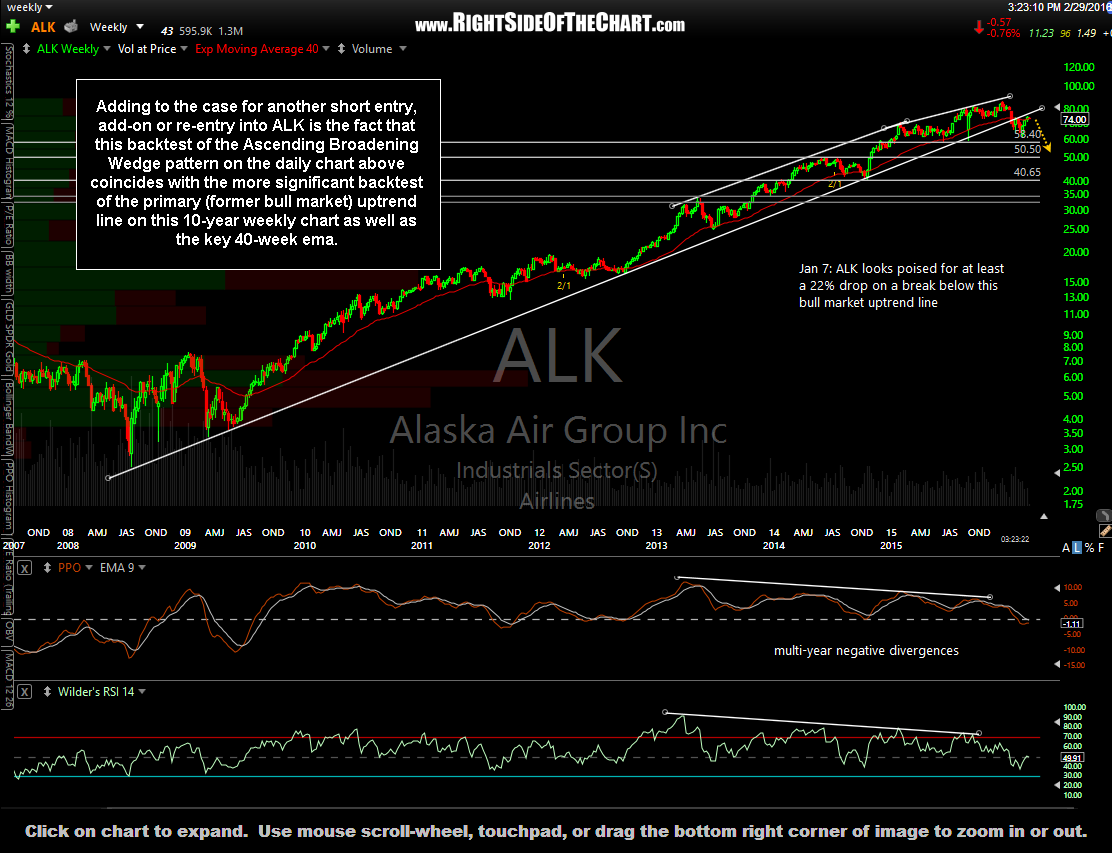

Adding to the case for another short entry, add-on or re-entry into ALK is the fact that this backtest of the Ascending Broadening Wedge pattern on the daily chart above coincides with the more significant backtest of the primary (former bull market) uptrend line on this 10-year weekly chart as well as the key 40-week ema. Previous notes & charts on the ALK trade can be referenced by clicking on the ALK symbol tag at the bottom of this post or under the Active Short Trades category. Also note that as Alaska Air offers an objective short entry at this time, this trade is categorized under all three short trade ideas categories: Short Trade Setups, Active Short Trades & Completed Short Trades (as ALK as already hit two of the 4 official price targets listed on the daily chart).

ALK is another good example of why multiple price targets are listed on the trade ideas on RSOTC as micro-managing the trades around these levels can produce returns far in excess of the gains measured simply from the original entry price to the final target. This is one of the key differences between active trading and passive investing (not to mention the accelerated gains from active trading).