AEM (Agnico Eagle Mines Ltd.) was one of about a dozen individual gold & silver mining stocks that were added to the Live Charts page as trade ideas in late December. On Friday, AEM hit the final target, T2, for about a 40% gain from the original entry price and as such, will be removed from the Active Trades-Long and Long-term Trades-Active categories. As with all closed trades, all associated posts for this most recent trade on AEM will be moved to the Completed Trades category (and respective sub-categories) where they will be archived for future reference. On a related note, I spent some time reviewing the charts of gold (both $GOLD & GLD), GDX, as well as every single component of GDX and wanted to share my thoughts on both gold & the mining sector.

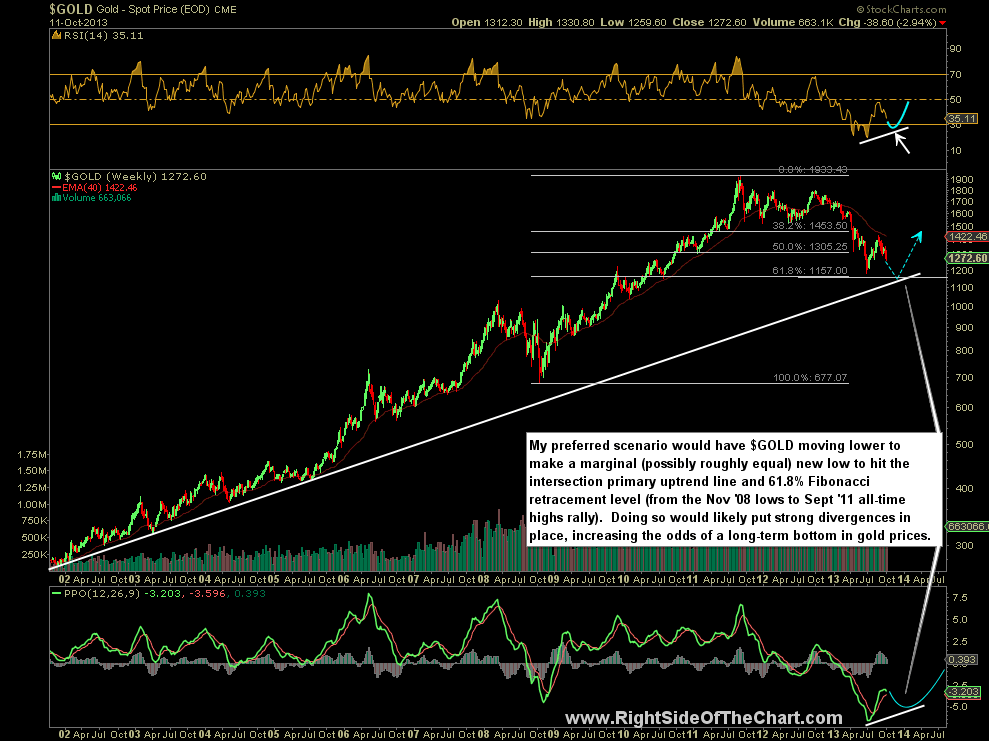

Heading into the end of 2013, in fact, all the way back in mid-October, I began outlining my preferred scenario that gold prices would likely continue to fall until reaching the long-term uptrend line outlined in the chart posted back on Oct 14th (below), at which point we would likely have strong positive divergences put in place on some of the key momentum indicators and price oscillators. That, along with several other factors such as the scope and duration of the bear market at that time, bearish sentiment measures, COT data, Fibonacci retracements, etc.. helped support the case that a lasting bottom would be likely be in place once gold reached that downside target.

In the Dec 17th post titled Gold Approaching Key Long-Term Support, I stated: With $GOLD nearing the downside target on my preferred scenario posted just over two months ago (the nearly 14 year long-term uptrend line & 61.8% Fibonacci retracement from the Sept 2011 peak), both GLD & GDX are among the more promising long-term trade ideas for 2014. Although my preferred scenario has a prices in GLD & GDX moving slightly lower, volume patterns on GDX are highly indicative of a selling climax and the miners could bottom at anytime now. As such, a scale in approach to GDX and/or select mining stocks over the next couple of months is my current preferred strategy. Exactly two weeks later, in the Time to Start Buying Gold post published on Dec 31st, it was pointed out that $GOLD was then within a hair of my downside target, the long-term uptrend line, and I reiterated my preference to use a scale-in strategy to accumulate the most attractive candidates in the mining sector using a shotgun approach (allocating capital amongst the most attractive individual names in the mining sector vs. only a few).

Fast-forward just over six weeks later and I posted taking profits on the bulk of my mining positions in the Feb 14th Reducing Exposure to the Gold Mining Sector post as many of the mining trades had recently hit an intermediate or final profit target. I realize that this may sound confusing or contradictory for some who have also been trading the miners or following the posts on these stocks as I had repeatedly stated that gold & the mining stocks were one of the more promising trade ideas for 2014 and were added as both typical swing trades as well as long-term trade ideas. If so, then why have so many of the mining stocks, such as AEM above, already been removed well before the first quarter of 2014 has ended? The reason is simply that the move off of the December lows in mining sector was unusually large and for the most part, unidirectional (straight up without hardly any pullbacks). As such, many of the dozen or so individual mining stock trades reached their final target within just a couple of months, most with percentage gains well into the mid-double digits.

When viewing the Long-Term Trade Ideas from the top menu, the following description for that category appears just below the symbol cloud: Long-term Trades are trade or investment ideas that have the potential for significant returns over a longer-term period, typically several months or more. This category of trade ideas might be useful for the longer-term swing trader or investor looking for investment ideas to supplement their existing portfolio and prefers a less active, more hands-off approach to investing. While several of the Long-Term Trade ideas in the mining sector, as well GLD & $GOLD (for those investing in physical gold), remain active at this time, a good percentage of the mining stock trades added in December have already hit their final target and are now considered completed.

Final targets are listed at the point were I believe the R/R (risk/reward ratio) no longer warrants remaining long. This does not mean that the trade will not continue to move higher, simply that I believe those funds can be redeployed more efficiently elsewhere, even if elsewhere is in “cash” at the time. Everyone has their own unique trading style and as such, long-term traders and investors may decide to continue to hold a position that has hit a final target while more active traders, like myself, might decide to micro-manage these long-term trade ideas by closing (or hedging) their positions when the charts indicate that a tradable pullback is likely (and typically re-entering on pullbacks to support). I also wanted to reiterate that I continue to believe that the chances are good that gold and silver, along with the mining stocks, are likely in the early stages of a new bull market and as such, many of those those long-term trade ideas that have not yet hit their final target will remain as active trades for now. BTW- The term “early stages” can mean early in time or scope, as pertaining to the overall expected gains of the full trend. The current SLV (Silver ETF) active long-term trade was added back on June 25th as both a typical long trade as well as a long-term trade idea. SLV bottomed and began a new bull market just 2 days later and went on to put in a series of higher lows (bullish) from Dec-Feb. GLD, which actually bottomed back on June 28th of last year, has also remained an active long-term trade since July of 2013. Updated charts on GLD & SLV to follow soon.