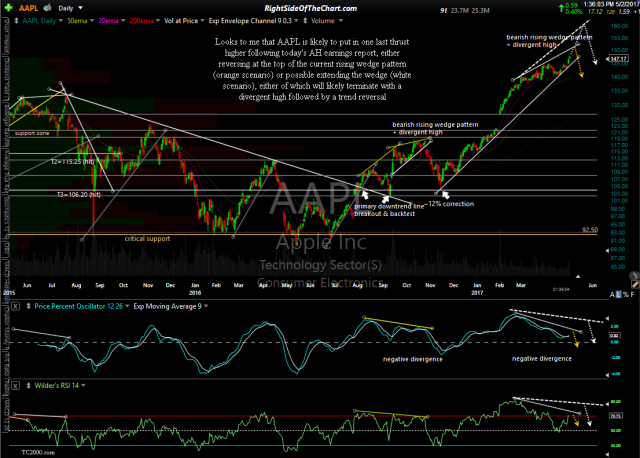

As per my comments & chart (below) from May 2nd, shortly before the AAPL (Apple Inc.) was schedule to report earnings, I had stated:

Looks to me that AAPL (Apple Inc) is likely to put in one last thrust higher following today’s AH earnings report, either reversing at the top of the current rising wedge pattern (orange scenario) or possible extending the wedge (white scenario), either of which will likely terminate with a divergent high followed by a trend reversal.

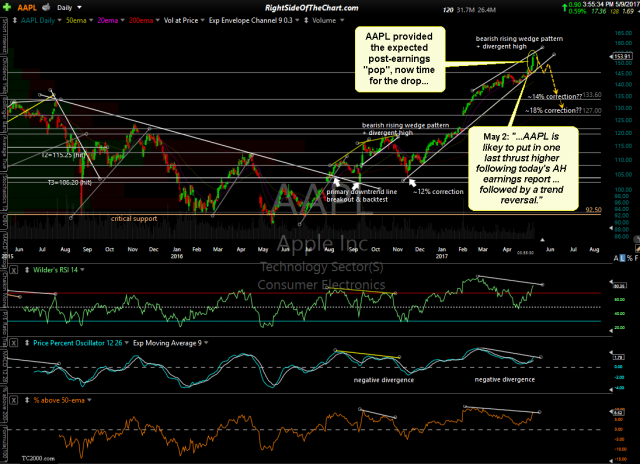

Now that we had the post-earnings ‘pop’, it appears that the time has come for the subsequent drop. Inserted below is the previous chart from that post followed by the updated chart, showing that AAPL has indeed rallied to the top of the rising wedge pattern, slightly expanding the wedge so far, with the negative divergences still very much intact. This post may prove to be premature, as I strive to post actionable analysis predicting the likely moves in a stock before it happens vs. after the fact & it should be noted that there are zero signs of a reversal or top in AAPL yet, not to mention the fact that there is still plenty of room for the stock to move higher while keeping the potential (still unconfirmed) divergence intact. Should AAPL continue to push higher, we’ll just have to see how the charts develop to determine if the case for a substantial reversal remains or begins to erode.

- AAPL daily May 2nd

- AAPL daily May 9th

With that being said, based on the technical posture of AAPL along with the fact that the both SPY & QQQ are currently sitting on the bottom of these 30-minute bearish rising wedge patterns, both with confirmed negative divergences & appearing ready to breakdown any day/minute now, it appears that a reversal in the world’s company & top component of both the Nasdaq 100 as well as the S&P 500 is imminent. Just how far that pullback will be, assuming that my analysis is correct, is hard to say although I think if Apple takes out the 145.50ish level with conviction, a move down to the 113.60 level & quite possibly the 127.00 level is certainly a possibly. If so, that would represent a drop of roughly 14% or 18%, respectively, from currently levels.

- QQQ 30-min April 9th

- SPY 30-minute April 9th