I’ve recently discussed two of my most reliable longer-term sell signals: The AAII Bull/Bear Spread Extremes as well as the $NAAD simple trendline buy/sell indicator (click on either to see the previous charts and discussion). In the last update to the $NAAD indicator about a week ago, I pointed out that a sell signal was likely to be triggered soon, which it has as shown in the updated chart below.

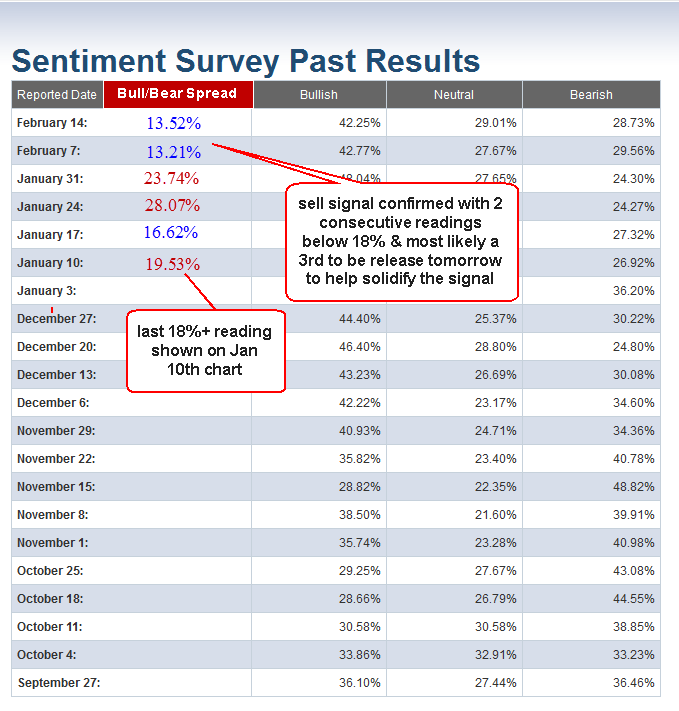

Regarding the pending AAII Bull/Bear Spread signal, we were waiting for the Bull/Bear Spread to moderate back below the 18%+ extreme level for at least two consecutive weeks, which as the chart below shows, happened last week with a spread of 13.52% vs. following a spread of 13.21% the previous week, both well below the 18%+ extreme level that has historically preceded significant stock market corrections. AAII is scheduled to release the most recent survey results tomorrow which will most likely fall below an 18 point spread once again but regardless, the signal has already been officially triggered.

Once again, the previous charts and discussion on these signals can be view by clicking on the blue hyper-links in the first paragraph above. Remember, there isn’t a single indicator or buy/sell signal with a 100% accuracy rate, not even close. However, the track record on each of these two for catching significant trend reversals is about as good as they come as a stand alone system. The fact that they have both recently triggered a new & relatively infrequent sell signal should, at the very least, be a caution sign to those investors or traders who are positioned heavily long or considering accumulating new long positions at this point.