This list of ‘charts I’m watching today’ is long but far from comprehensive. Starting out with the broad markets, I’m still awaiting a break below 2865 for a minor sell signal on /ES and 7519 on /NQ as the divergences continue to build. 60-minute charts:

- ES 60-min April 5th

- NQ 60-min April 5th

On a closely-related note (due to the correlation between crude & the stock market), I’m awaiting an impulsive break below 61.55 on /CL for the next sell signal on crude oil. 60-minute chart:

CORN is starting to look sweet following the recent false breakdown/stop clearly move & divergent low while DBA still looks like a nice “one-size-fits-all” addition to diversify one’s portfolio by adding exposure to the increasingly bullish agricultural commodity arena.

- CORN daily April 4th close

- DBA daily April 4th close

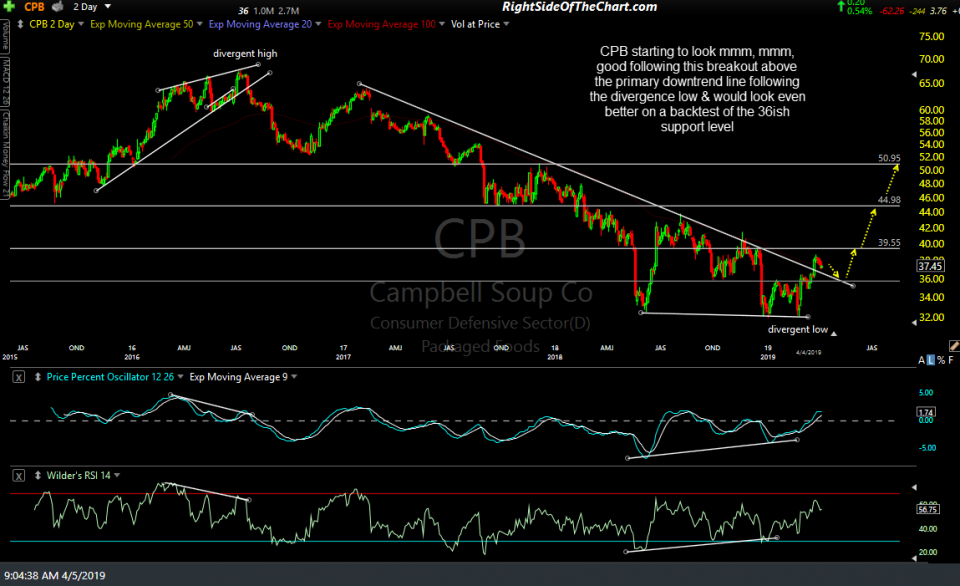

CPB (Campbell Soup Co.) is starting to look mmm, mmm good following this breakout above the primary downtrend line following the divergence low & would look even better on a backtest of the 36ish support level. CPB on watch as a potential Growth & Income Trade idea.

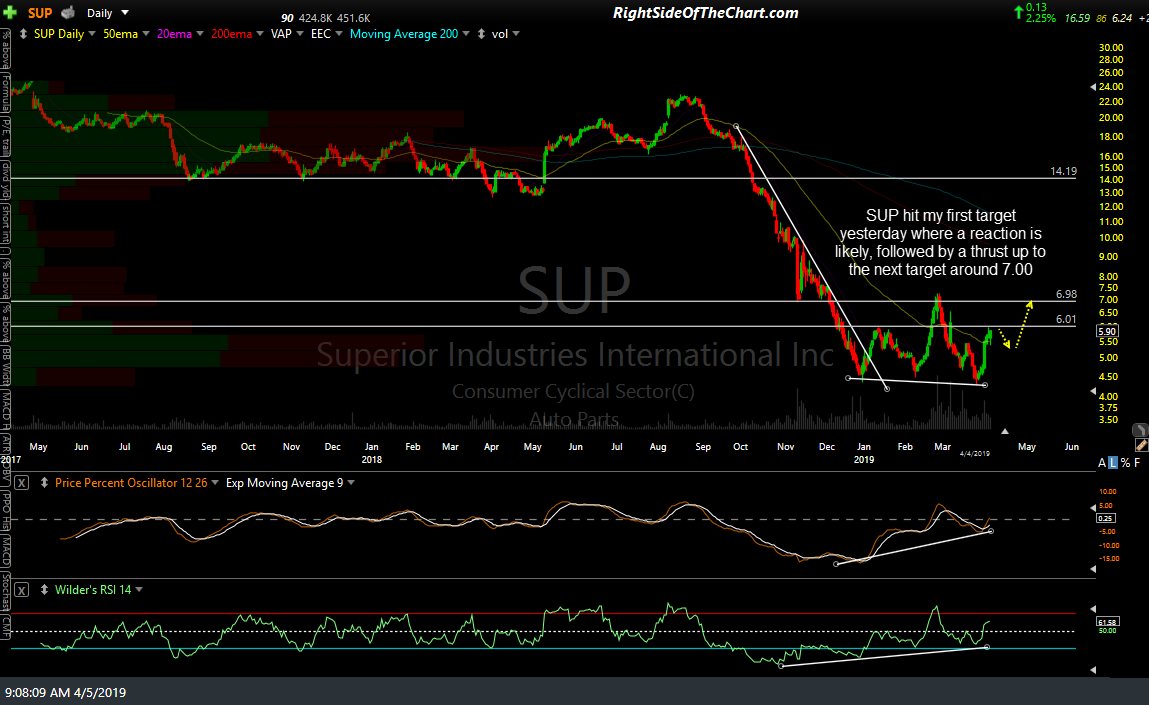

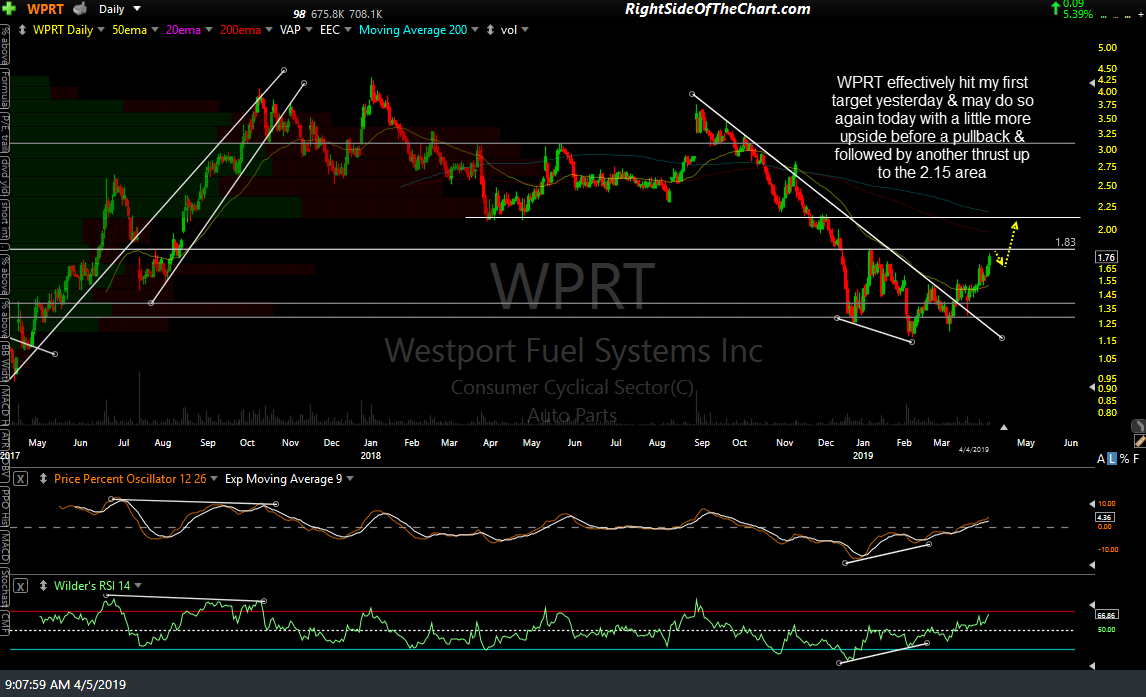

Five of the six auto parts stocks that have been recently highlighted as long-side trading opps have either hit their first target (resistance) yesterday or are close & will likely hit them today. As such, the odds for a reaction here soon is good, followed by another leg up to the next targets.

- SUP daily April 4th close

- WPRT daily April 5th

- TOWR daily April 5th

- CPS daily April 4th close

- ADNT daily April 4th close

- BWA daily April 4th close